Question

On January 1st, Terry's Board of Directors issued the management team 74,580 stock options for Terry's $1 par common stock. Terry's stock price on that

On January 1st, Terry's Board of Directors issued the management team 74,580 stock options for Terry's $1 par common stock. Terry's stock price on that day was $3.60/share. The Board set the strike price of the options at $5.20/share to encourage the management team to focus on improving the company's stock price. The average stock price during 2022 was $6.80/share. The options will vest 4 years from issuance and, according to the Black Scholes Model, have a fair value of $4.90 each on the date issued. Terry's management was pleased with the decision because this is the first time that the Board has offered them options as a form of compensation, although they were disappointed that the options could only be used to purchase stock, not redeemed for their fair value.

Later in the year, on February 15 when a market change significantly dropped stock prices, Terry's Board voted to repurchase 25,375 shares of common stock. The stock price on the day of the purchase was $8.00/share. Neither the stock options nor this purchase of treasury stock have been recorded.

Terry's management team has also asked you to determine the correct EPS numbers for the year. Up until the issuance of the options, the company had a simple capital structure. Now, though, the company will need to present both basic and diluted EPS on its Income Statement. In addition, they would like to know the effect of the stock options and additional dividend, if any, on the following ratios:

Debt-to-Equity

ROA

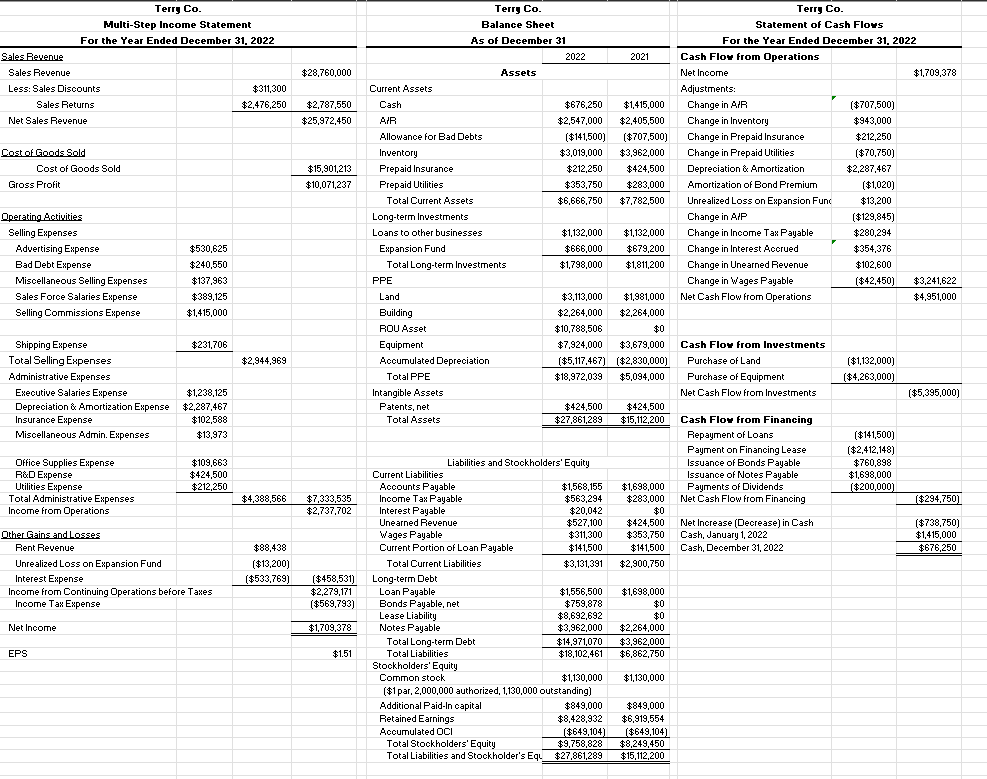

Please help me with the following question below and I also attached Financial Sheets Below as well:

1. Can show me step by step how to make the appropriate journal entries to correctly record the stock options and repurchase.

2. Can show me step by step how to make the appropriate journal entry to correctly record the tax effect of the stock options. Please note that for tax purposes, equity options are treated as long-term deferred tax assets (for the future tax breaks that they will provide). In making your tax calculations, assume that Terry's management will exercise the options as soon as they can (at the end of the year when they vest).

3. Also, how to make any necessary changes to the financial statements as well.

(Here is the financial Sheets )

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started