Answered step by step

Verified Expert Solution

Question

1 Approved Answer

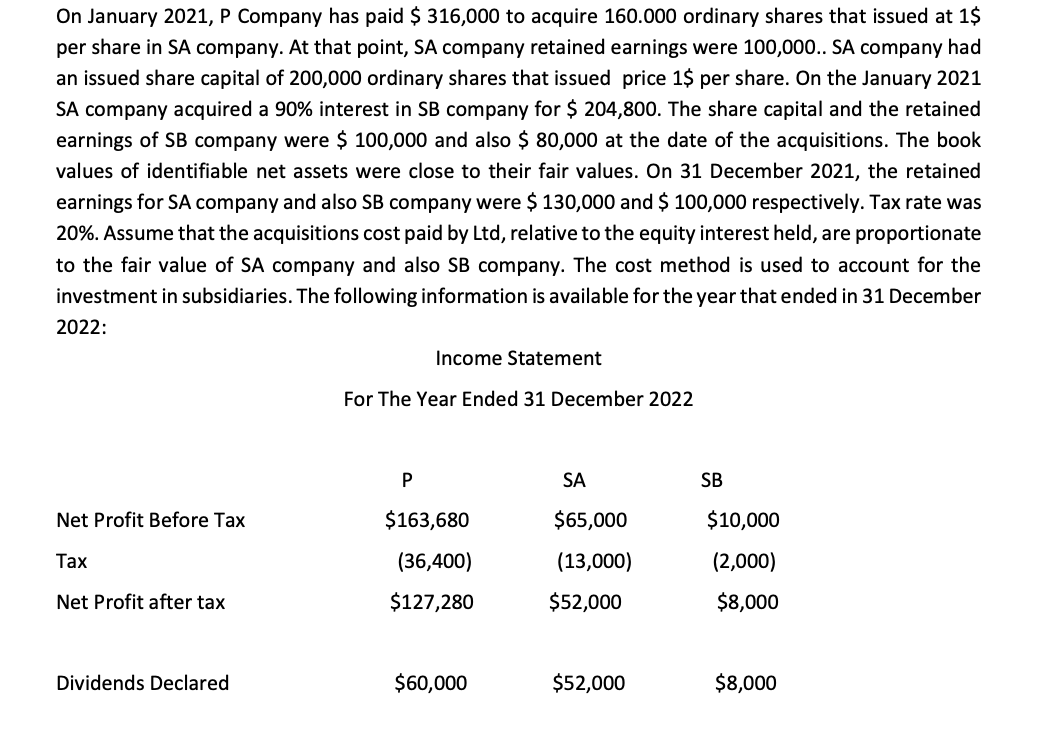

On January 2 0 2 1 , P Company has paid $ 3 1 6 , 0 0 0 to acquire 1 6 0 .

On January P Company has paid $ to acquire ordinary shares that issued at $

per share in SA company. At that point, SA company retained earnings were SA company had

an issued share capital of ordinary shares that issued price $ per share. On the January

SA company acquired a interest in SB company for $ The share capital and the retained

earnings of SB company were $ and also $ at the date of the acquisitions. The book

values of identifiable net assets were close to their fair values. On December the retained

earnings for SA company and also SB company were $ and $ respectively. Tax rate was

Assume that the acquisitions cost paid by Ltd relative to the equity interest held, are proportionate

to the fair value of SA company and also SB company. The cost method is used to account for the

investment in subsidiaries. The following information is available for the year that ended in December

:

Income Statement

For The Year Ended December

a Eliminate investment in SA and SB

b Allocate Profits to non controlling interest!

c Eliminate Dividends!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started