Answered step by step

Verified Expert Solution

Question

1 Approved Answer

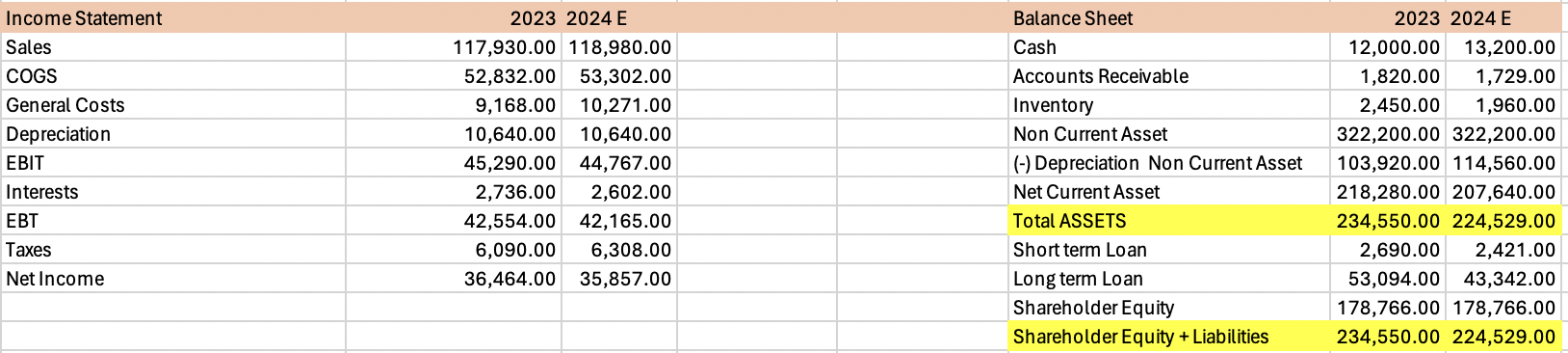

On January 2 , 2 0 2 4 , the BBQ Ltd share price closed at 6 0 . 5 0 euros. The number of

On January the BBQ Ltd share price closed at euros. The number of shares subscribed is million, which have a beta of and an expected constant dividend payout ratio of

As of January companies in the sector have average PER values of The riskfree rate is

equal to and the market risk premium amounts to Consider that both remain constant over time.

Based on this information, you are asked to answer the following questions:

a Determine as of January : the expected dividend yield, the expected economic return, the expected financial return and the expected internally sustainable growth.

b According to the value multiple model based on the PER and taking as theoretical value the average value of the sector, what is the intrinsic value of the BBQ Ltd share as of January

c It is proposed to use the discount model of the growing dividend at a constant rate. Suppose that the dividend per share expected for is reduced by half in and thereafter grows at a constant rate An opportunity cost of the dividend equal to twice the riskfree rate is considered appropriate. Carry out an analysis

of the possible values that g can take and indicate the range of values of g for which BBQ Ltd would be

undervalued or overvalued.

d Calculate the intrinsic value of BBQ Ltd using the discount model of cash flows for the shareholder and the

CAPM model. Suppose that from the year the cash flow for the shareholder grows perpetually at

per year. State and justify the decision to be taken given that the price of BBQ Ltd is on January

e Suppose you have BBQ Ltd shares to carry out a riskneutral strategy. The strategy is launched on January and is settled on December You have BLAZAR shares to design the strategy. These shares are traded on January at and have a beta of Your forecast is that two equally probable and mutually exclusive scenarios will occur on December In the first scenario, the price of BBQ Ltd shares will be while BLAZAR shares will be priced at In the second scenario, the price of BBQ Ltd shares will be and that of BIAZAR shares

will be Design the riskneutral strategy. Indicate how many BLAZAR shares you would use in the strategy

Calculate the profitability of the riskneutral strategy according to the scenarios provided and compare it with the

profitability you would obtain in an equilibrium situation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started