Answered step by step

Verified Expert Solution

Question

1 Approved Answer

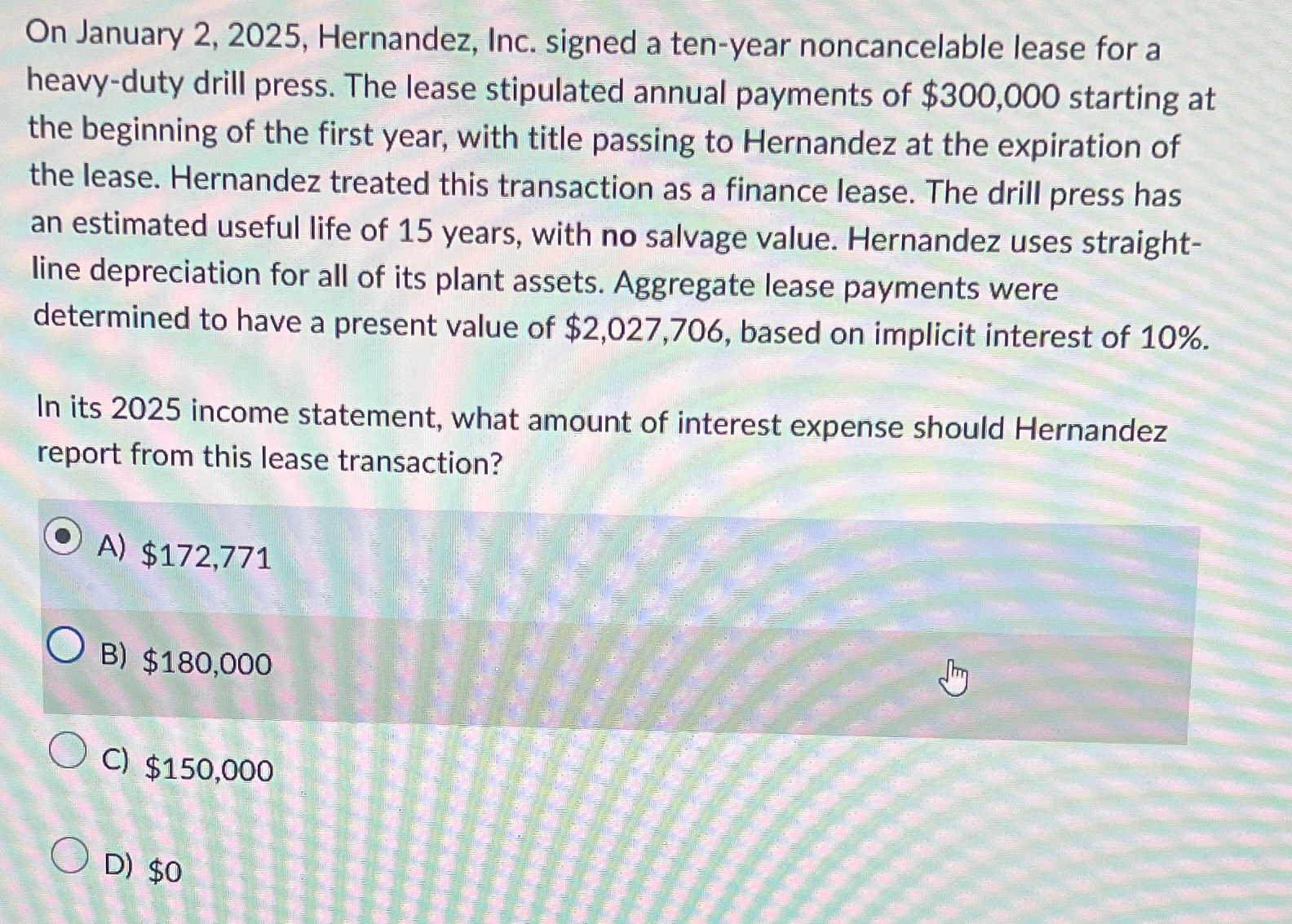

On January 2 , 2 0 2 5 , Hernandez, Inc. signed a ten - year noncancelable lease for a heavy - duty drill press.

On January Hernandez, Inc. signed a tenyear noncancelable lease for a heavyduty drill press. The lease stipulated annual payments of $ starting at the beginning of the first year, with title passing to Hernandez at the expiration of the lease. Hernandez treated this transaction as a finance lease. The drill press has an estimated useful life of years, with no salvage value. Hernandez uses straightline depreciation for all of its plant assets. Aggregate lease payments were determined to have a present value of $ based on implicit interest of

In its income statement, what amount of interest expense should Hernandez report from this lease transaction?

A $

B $

C $

D $

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started