Answered step by step

Verified Expert Solution

Question

1 Approved Answer

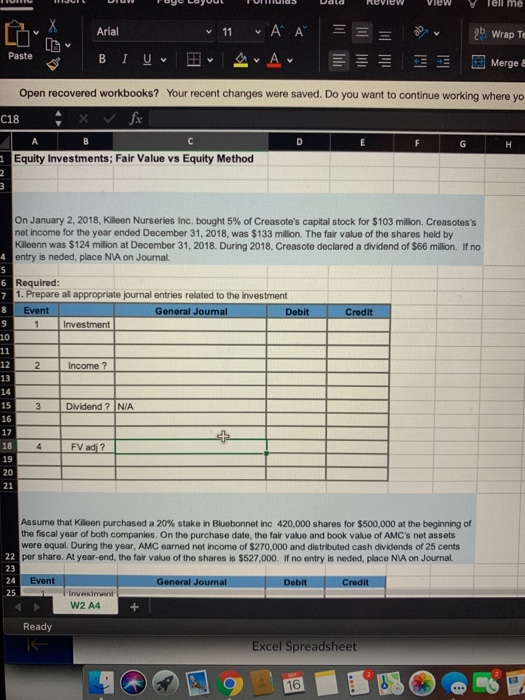

On January 2, 200018 Killeen nurseries Inc. bought 5% of the creosote's capital stock for a 103 million. A Creasote's net income for the year

On January 2, 200018 Killeen nurseries Inc. bought 5% of the creosote's capital stock for a 103 million. A Creasote's net income for the year ended December 31, 2018 was 133,000,000. The fair value of the shares held by Killeen was 124 million at December 31, 2018. Creasote declared Declared a dividend of 66 million if not need to place an N/A on journal

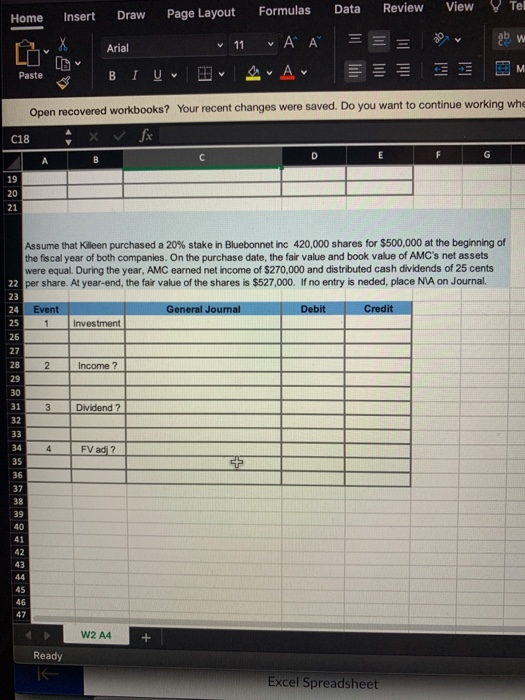

View Tell me Paste Arial ~ 11 A ab Wrap Te BLUE Av Merge & Open recovered workbooks? Your recent changes were saved. Do you want to continue working where yo C18 fx D 1 Equity Investments; Fair Value vs Equity Method F G H 2 On January 2, 2018, Killeen Nurseries Inc, bought 5% of Creasote's capital stock for $103 million. Creasotes's net income for the year ended December 31, 2018, was $133 million. The fair value of the shares held by Kileenn was $124 million at December 31, 2018. During 2018, Creasote declared a dividend of $66 million. If no 4 entry is neded, place N on Journal 5 6 Required: 7 1. Prepare al appropriate journal entries related to the investment 8 Event General Journal Debit Credit 9 Investment 10 1 11 2 Income? 12 13 14 3 Dividend ? N/A 15 16 17 18 19 20 21 4 FV adi 2 Assume that Killeen purchased a 20% stake in Bluebonnet inc 420,000 shares for $500,000 at the beginning of the fiscal year of both companies. On the purchase date, the fair value and book value of AMC's net assets were equal. During the year, AMC earned net income of $270,000 and distributed cash dividends of 25 cents 22 per share. At year-end, the fair value of the shares is $627,000. If no entry is neded, place NIA on Journal 23 24 Event General Journal Debit Credit 25 Investment W2 A4 + Ready Excel Spreadsheet 16 Review Formulas Data View Tel Home Insert Draw Page Layout A ab W Arial v 11 II III hul . a. A v Paste BIU Open recovered workbooks? Your recent changes were saved. Do you want to continue working whe C18 D A G C B 19 20 21 1 Assume that Killeen purchased a 20% stake in Bluebonnet inc 420,000 shares for $500,000 at the beginning of the fiscal year of both companies. On the purchase date, the fair value and book value of AMC's net assets were equal. During the year, AMC earned net income of $270,000 and distributed cash dividends of 25 cents 22 per share. At year-end, the fair value of the shares is $527,000. If no entry is neded, place NIA on Journal. 23 24 Event General Journal Debit Credit 25 Investment 26 27 28 2 Income? 29 30 31 3 Dividend ? 32 33 34 FVad 2 35 36 4 37 38 39 40 41 42 43 44 45 46 47 W2 A4 + Ready Excel Spreadsheet Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started