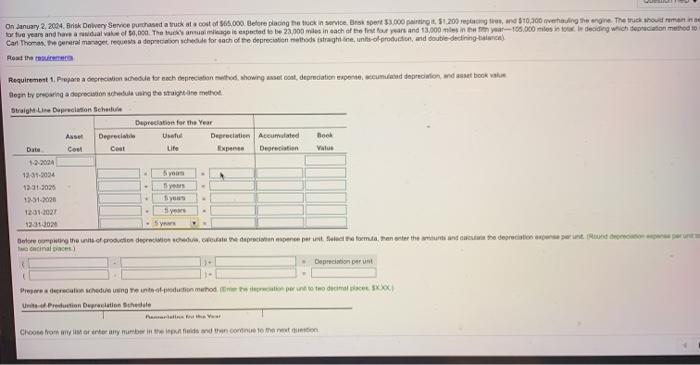

On January 2, 2004. Brisk Delivery Service purchased a truck at a cost of 565.000 Before placing the truck in a row $3.000 partit, 1.200 replong tres, and $10.300 euing the engine. The truck should remains tortue years and how a dal value of 10,000. Tha ang is expected to be 23.000 miles in each of the four years and 13,000 miles in the 105.000 miles in to deciding which depreciation method to Can Thomas the general managers a depreciation redule for each of the depreciation methods straighine,unto-oproduction, and double declining Rost the me Requirement 1. Prepare a decreacion schedulin tor nach depreciation method, own set coat, depreciation experto ecumdated depreciation, and asset book van Sogn tyroring a depreciation scheduling the rain hot Straight Line Dupruction Schedule Depreciation for the Year Aset Depreciabile Uwe Depreciation Accumulated tech Cout CE Lite Expen Depreciation Value 1.2.2004 19-11.2004 Date . - - 12 31 302 12-01-026 Sys 12312021 120102 - 5 Before coming the production de leden een perfect form. renter the end of the depreciation retour inal) Depreciation perust Perchedule ngentot method to XX Production Depreciation Schedule in the Choose from any Mortony mub in the come to the On January 2, 2004. Brisk Delivery Service purchased a truck at a cost of 565.000 Before placing the truck in a row $3.000 partit, 1.200 replong tres, and $10.300 euing the engine. The truck should remains tortue years and how a dal value of 10,000. Tha ang is expected to be 23.000 miles in each of the four years and 13,000 miles in the 105.000 miles in to deciding which depreciation method to Can Thomas the general managers a depreciation redule for each of the depreciation methods straighine,unto-oproduction, and double declining Rost the me Requirement 1. Prepare a decreacion schedulin tor nach depreciation method, own set coat, depreciation experto ecumdated depreciation, and asset book van Sogn tyroring a depreciation scheduling the rain hot Straight Line Dupruction Schedule Depreciation for the Year Aset Depreciabile Uwe Depreciation Accumulated tech Cout CE Lite Expen Depreciation Value 1.2.2004 19-11.2004 Date . - - 12 31 302 12-01-026 Sys 12312021 120102 - 5 Before coming the production de leden een perfect form. renter the end of the depreciation retour inal) Depreciation perust Perchedule ngentot method to XX Production Depreciation Schedule in the Choose from any Mortony mub in the come to the