Question

On January 2, 2016, Mullen, Inc. acquired Hudson & Sons as a wholly-owned subsidiary, paying an excess of $500,000 over the book value of Hudson's

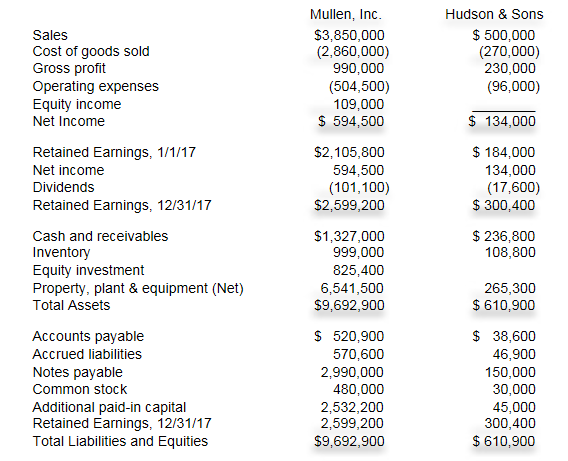

On January 2, 2016, Mullen, Inc. acquired Hudson & Sons as a wholly-owned subsidiary, paying an excess of $500,000 over the book value of Hudson's net assets. One-half of the excess was attributable to equipment with a 10-year life, leaving the remainder as goodwill. The parent uses the equity method of pre-consolidation Equity investment bookkeeping. The 2017 financial statements for the two companies are presented below

Required : At what amount will the following accounts appear on the consolidated financial statements for 2017?

a. Equity Income b. Operating Expenses c. Equity Investment d. Goodwill account e. Additional-Paid-in-Capital f. Retained Earnings g. Property, Plant, and Equipment line item h. Equity Income

Mullen, Inc Hudson & Sons $3,850,000 (2,860,000) 990,000 (504,500) 109,000 594,500 500,000 (270,000) 230,000 Sales Cost of goods sold Gross profit Operating expenses Equity income Net Income (96,000) 134,000 $2,105,800 184,000 134,000 (17,600) $300,400 Retained Earnings, 1/1/17 Net income 594,500 (101,100) S2,599,200 Dividends Retained Earnings, 12/31/17 $ 236,800 108,800 Cash and receivables $1,327,000 999,000 825,400 6,541,500 $9,692,900 Inventory Equity investment Property, plant & equipment (Net) 265,300 $610,900 Total Assets Accounts payable 520,900 38,600 Accrued liabilities 570,600 2,990,000 480,000 46,900 Notes payable 150,000 Common stock 30,000 45,000 300,400 Additional paid-in capital Retained Earnings, 12/31/17 2,532,200 2,599,200Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started