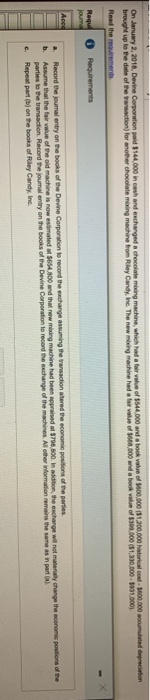

On January 2, 2018, Devine Corporation paid $144,000 in cash and exchanged a chocolate mising machine, which had a fair value of $544.000 and a book value of $800,000 1.200.000 historical contented depreciation brought up to the date of the transaction for another chocolate mixing machine from Rley Candy.ne. The new lng machine had a fair value of 1,000 and a book value of $300,000 (81,330,000 $80,000) Read the requirements Requ jound Requirements Acco b. Record the journal entry on the books of the Devine Corporation to record the exchange assuming the transaction stered the economic positions of the parties Assume that the fair value of the old machine is now estimated $654.800 and that now ming machine had been appraised $798,800. In addition, the exchange will not materially change the economic position of the parties to the transaction Record the journal entry on the books of the Devine Corporation to record the exchange of the machines. Al other information remains the same as in part) Repeal part on the books of Riey Candy, Inc. c. On January 2, 2018, Devine Corporation paid $144,000 in cash and exchanged a chocolate mising machine, which had a fair value of $544.000 and a book value of $800,000 1.200.000 historical contented depreciation brought up to the date of the transaction for another chocolate mixing machine from Rley Candy.ne. The new lng machine had a fair value of 1,000 and a book value of $300,000 (81,330,000 $80,000) Read the requirements Requ jound Requirements Acco b. Record the journal entry on the books of the Devine Corporation to record the exchange assuming the transaction stered the economic positions of the parties Assume that the fair value of the old machine is now estimated $654.800 and that now ming machine had been appraised $798,800. In addition, the exchange will not materially change the economic position of the parties to the transaction Record the journal entry on the books of the Devine Corporation to record the exchange of the machines. Al other information remains the same as in part) Repeal part on the books of Riey Candy, Inc. c