Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 2, 2018, Hardy Furniture purchased display shelving for $8,000 cash, expecting the shelving to remain in service for five years. Hardy depreciated the

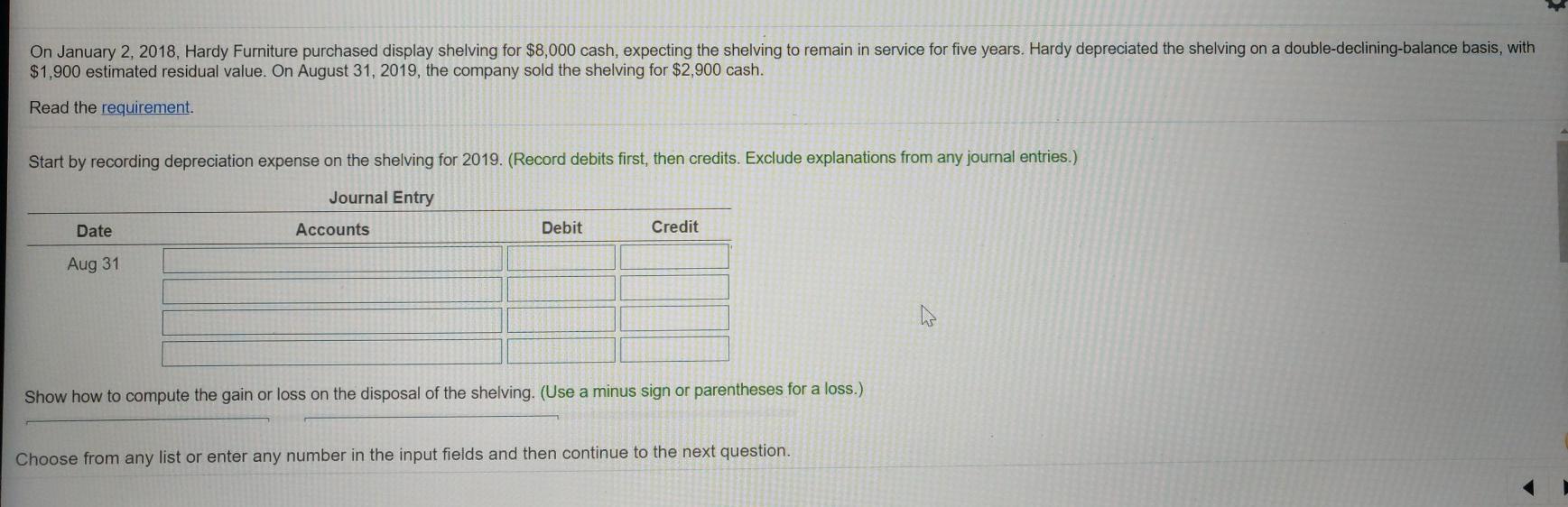

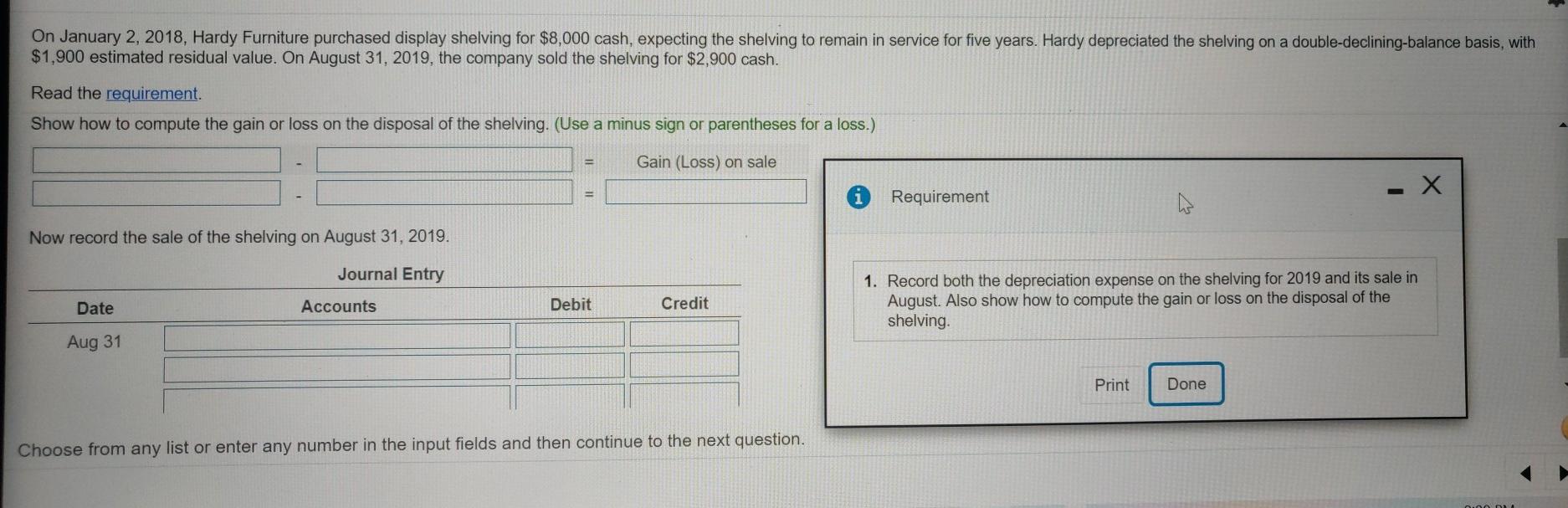

On January 2, 2018, Hardy Furniture purchased display shelving for $8,000 cash, expecting the shelving to remain in service for five years. Hardy depreciated the shelving on a double-declining balance basis, with $1,900 estimated residual value. On August 31, 2019, the company sold the shelving for $2,900 cash. Read the requirement. Start by recording depreciation expense on the shelving for 2019. (Record debits first, then credits. Exclude explanations from any journal entries.) Journal Entry Date Accounts Debit Credit Aug 31 h Show how to compute the gain or loss on the disposal of the shelving. (Use a minus sign or parentheses for a loss.) Choose from any list or enter any number in the input fields and then continue to the next question. On January 2, 2018, Hardy Furniture purchased display shelving for $8,000 cash, expecting the shelving to remain in service for five years. Hardy depreciated the shelving on a double-declining-balance basis, with $1,900 estimated residual value. On August 31, 2019, the company sold the shelving for $2,900 cash. Read the requirement. Show how to compute the gain or loss on the disposal of the shelving. (Use a minus sign or parentheses for a loss.) Gain (Loss) on sale - X Requirement Now record the sale of the shelving on August 31, 2019. Journal Entry Date Accounts Debit Credit 1. Record both the depreciation expense on the shelving for 2019 and its sale in August. Also show how to compute the gain or loss on the disposal of the shelving Aug 31 Print Done Choose from any list or enter any number in the input fields and then continue to the next

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started