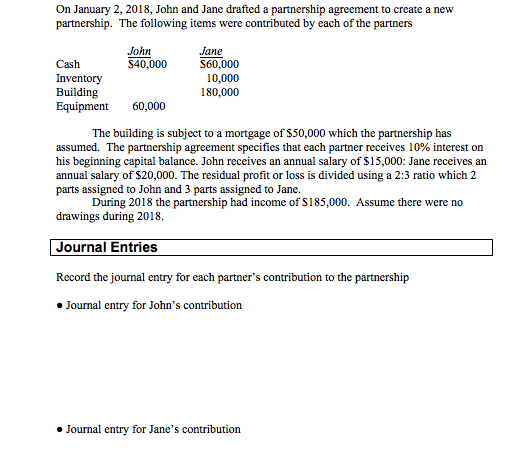

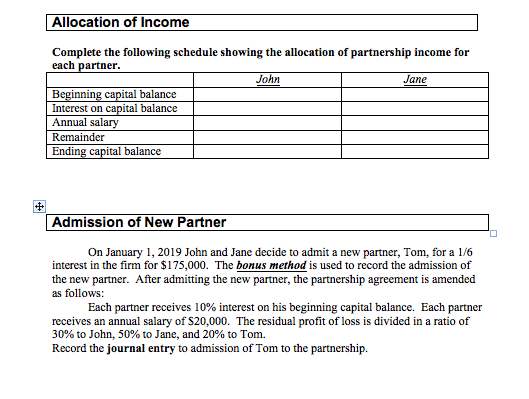

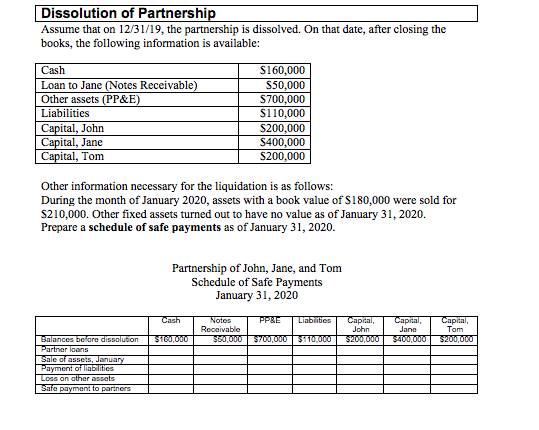

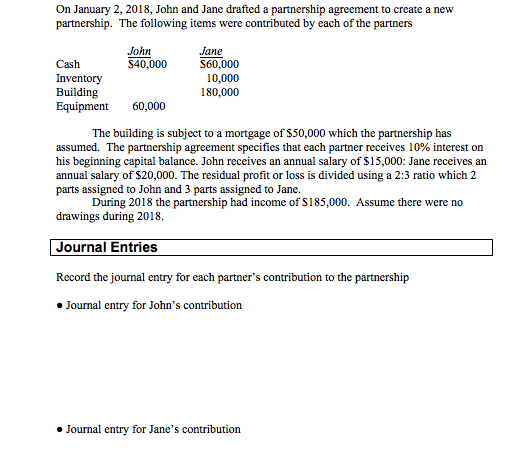

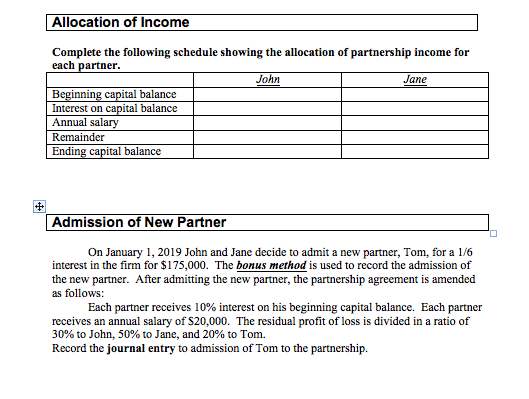

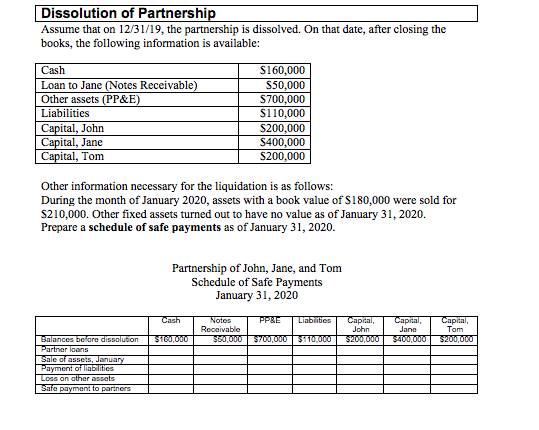

On January 2, 2018, John and Jane drafted a partnership agreement to create a new partnership. The following items were contributed by each of the partners John Jane Cash $40,000 560,000 Inventory 10,000 Building 180,000 Equipment 60,000 The building is subject to a mortgage of $50,000 which the partnership has assumed. The partnership agreement specifies that each partner receives 10% interest on his beginning capital balance. John receives an annual salary of $15,000: Jane receives an annual salary of $20,000. The residual profit or loss is divided using a 2:3 ratio which 2 parts assigned to John and 3 parts assigned to Jane. During 2018 the partnership had income of $185,000. Assume there were no drawings during 2018 Journal Entries Record the journal entry for each partner's contribution to the partnership Journal entry for John's contribution Journal entry for Jane's contribution Allocation of Income Complete the following schedule showing the allocation of partnership income for each partner. John Jane Beginning capital balance Interest on capital balance Annual salary Remainder Ending capital balance # Admission of New Partner On January 1, 2019 John and Jane decide to admit a new partner, Tom, for a 1/6 interest in the firm for $175,000. The bonus method is used to record the admission of the new partner. After admitting the new partner, the partnership agreement is amended as follows: Each partner receives 10% interest on his beginning capital balance. Each partner receives an annual salary of $20,000. The residual profit of loss is divided in a ratio of 30% to John, 50% to Jane, and 20% to Tom. Record the journal entry to admission of Tom to the partnership. Dissolution of Partnership Assume that on 12/31/19, the partnership is dissolved. On that date, after closing the books, the following information is available: Cash Loan to Jane (Notes Receivable) Other assets (PP&E) Liabilities Capital, John Capital, Jane Capital, Tom S160,000 S50,000 S700,000 S110,000 S200,000 S400,000 S200,000 Other information necessary for the liquidation is as follows: During the month of January 2020, assets with a book value of $180,000 were sold for S210,000. Other fixed assets turned out to have no value as of January 31, 2020. Prepare a schedule of safe payments as of January 31, 2020. Partnership of John, Jane, and Tom Schedule of Safe Payments January 31, 2020 Cash Notes PPBE Liabilities Receivable $50,000 $700,000 $110.000 Capital John $200.000 Capital Jane $400,000 Capital Tam S2000 $100,000 Balances before dissolution Partner loans Sale ofansels, January Payment of liabilities Loss on other assets Safe payment to partners