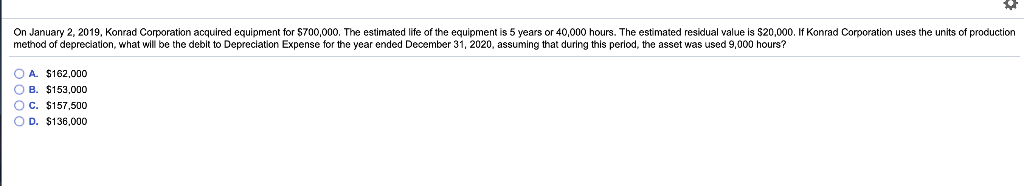

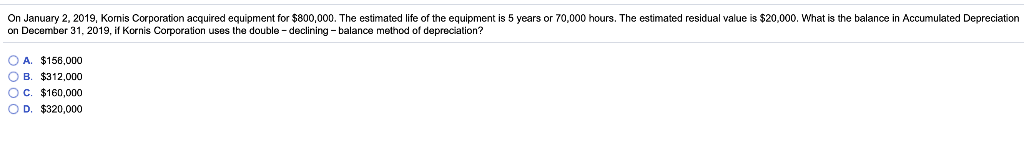

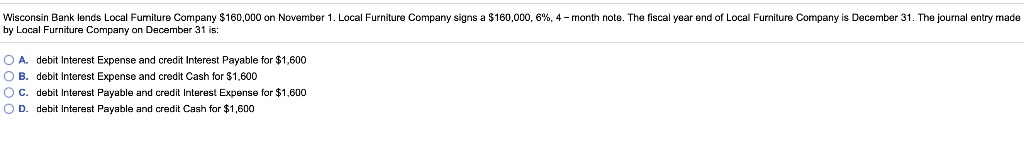

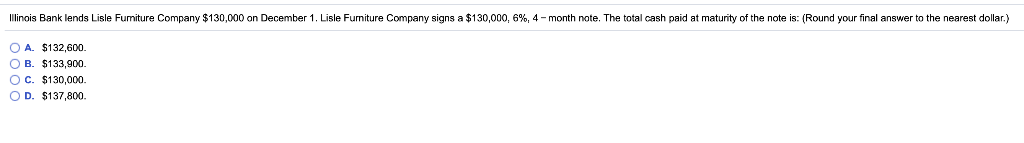

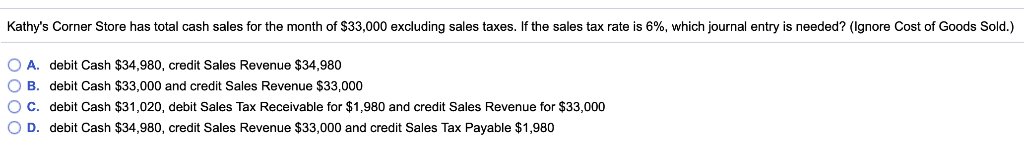

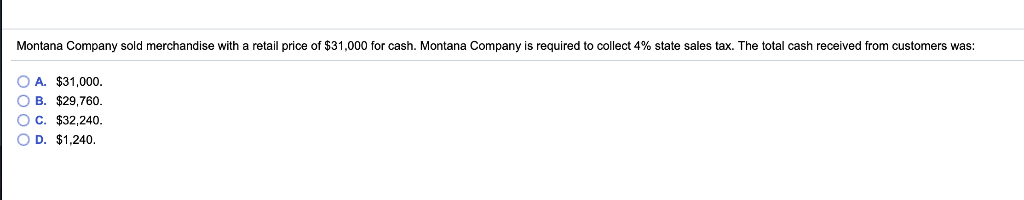

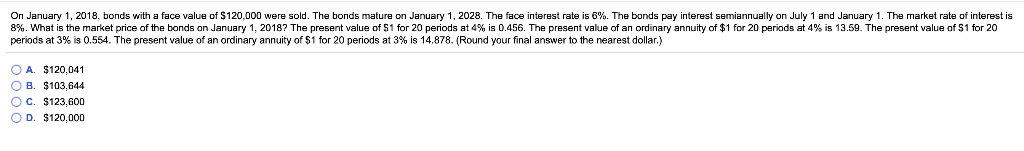

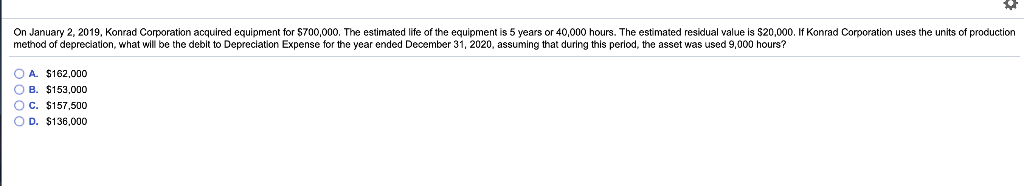

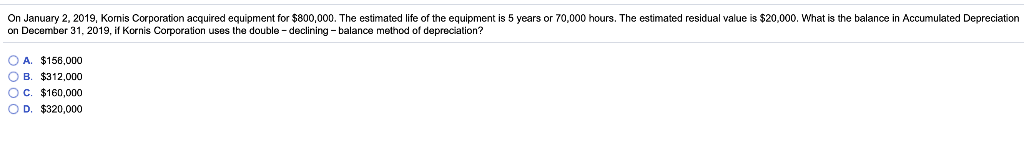

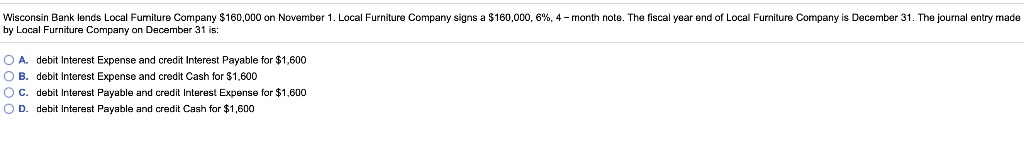

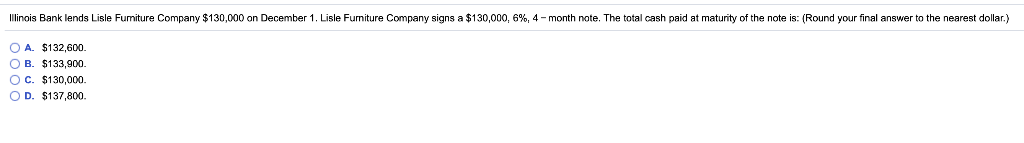

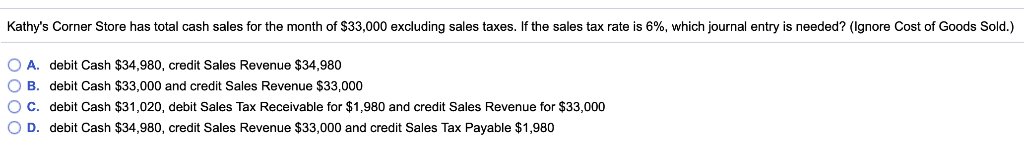

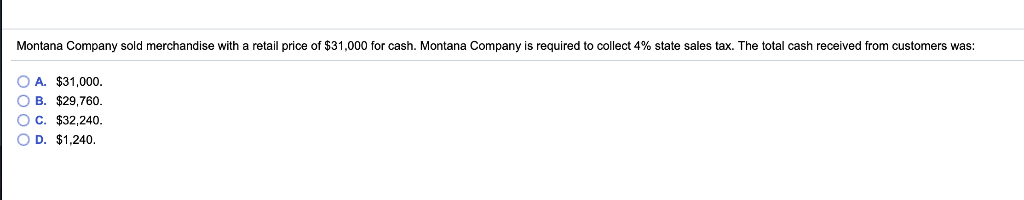

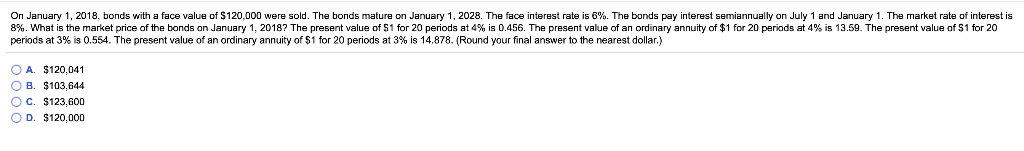

On January 2, 2019, Konrad Corporation acquired equipment for $700,000. The estimated life of the equipment is 5 years or 40,000 hours. The estimated residual value is S20,000. If Konrad Corporation uses the units of production method of depreciation, what will be the debit to Depreclation Expense for the year ended December 31, 2020, assuming that during this period, the asset was used 9,000 hours? OA $162.000 B. $153.000 C. $157.500 O D. $136,000 On January 2, 2019, Kornis Corporation acquired equipment for $800,000. The estimated life of the equipment is 5 years or 70,000 hours. The estimated residual value is $20,000. What is the balance in Accumulated Depreciation on December 31, 2019, if Kornis Corporation uses the double declining -balance method of depreciation? OA. $156,000 OB. $312.000 O c. $160,000 D. $320,000 Wisconsin Bank lends Local Fumiture Company $160,000 on November 1 Local Furniture Company signs a $160,000 6%, 4-month note. The fiscal year end of Local Furniture Company is December 31 The journal entry made by Local Furniture Company on December 31 is: O A. debit Interest Expense and credit Interest Payable for $1,600 O B. debit Interest Expense and credit Cash for $1.600 O C. debit Interest Payable and credit Interest Expense for $1.600 O D. debit Interest Payable and credit Cash for $1,600 1 nois Bank lends Lisle Fu ure Company $130,00 on December 1 Lis e Fum ture Company signs a $ 30 0 0 0%, 4 month note. The total cash paid at maturity of he note s: Round your in an e to the nearest dollar. OA. OB. $132,600. $133.900. C. $130,000. OD. $137,800. Kathy's Corner Store has total cash sales for the month of $33,000 excluding sales taxes. If the sales tax rate is 6%, which ournal entry is needed? ignore Cost of Goods Sold .) O A. debit Cash $34,980, credit Sales Revenue $34,980 O B. debit Cash $33,000 and credit Sales Revenue $33,000 O C. debit Cash $31,020, debit Sales Tax Receivable for $1,980 and credit Sales Revenue for $33,000 O D. debit Cash $34,980, credit Sales Revenue $33,000 and credit Sales Tax Payable $1,980 Montana Company sold merchandise with a retail price of $31,000 for cash. Montana Company is required to collect 4% state sales tax. The total cash received from customers was: OA. $31,000. B. $29,760 O c. $32,240. O D. $1,240. On January 1, 2018 bonds with a face value of $120.000 were sold. The bonds mature on January 1, 2028. The face interest rate is 6%. The bonds pay interest semiannually on July 1 and January 1. The arket rate of interest is 8%. What is the market price of the bonds on January 1 2018? The present value of S1 for 20 periods at 4% s 0.456. The present value of an ordinary annuity of $1 for 20 periods at 4% is 13.59 The present value of S1 for 20 penods at 3% s 0 554. The present value of an ordinary annuity of $1 or 20 periods at 3% s 14.878 (Round your final answer the nearest dollar OA. $120,041 OB. $103,644 O C. $123,600 OD. $120,000