Answered step by step

Verified Expert Solution

Question

1 Approved Answer

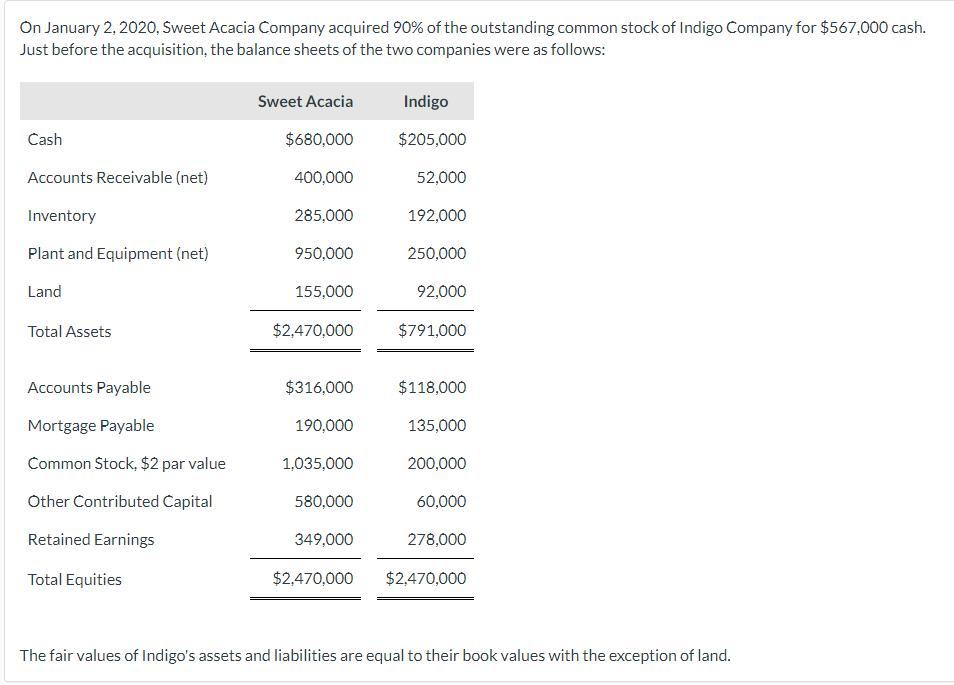

On January 2, 2020, Sweet Acacia Company acquired 90% of the outstanding common stock of Indigo Company for $567,000 cash. Just before the acquisition,

On January 2, 2020, Sweet Acacia Company acquired 90% of the outstanding common stock of Indigo Company for $567,000 cash. Just before the acquisition, the balance sheets of the two companies were as follows: Cash Accounts Receivable (net) Inventory Plant and Equipment (net) Land Total Assets Accounts Payable Mortgage Payable Common Stock, $2 par value Other Contributed Capital Retained Earnings Total Equities Sweet Acacia $680,000 400,000 285,000 950,000 155,000 $2,470,000 $316,000 190,000 1,035,000 580,000 349,000 $2,470,000 Indigo $205,000 52,000 192,000 250,000 92,000 $791,000 $118,000 135,000 200,000 60,000 278,000 $2,470,000 The fair values of Indigo's assets and liabilities are equal to their book values with the exception of land. Prepare Consolidated Balance Sheet January 2, 2020

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To record the acquisition of Indigo Company by Sweet Acacia Company on January 2 2020 we need to det...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started