Answered step by step

Verified Expert Solution

Question

1 Approved Answer

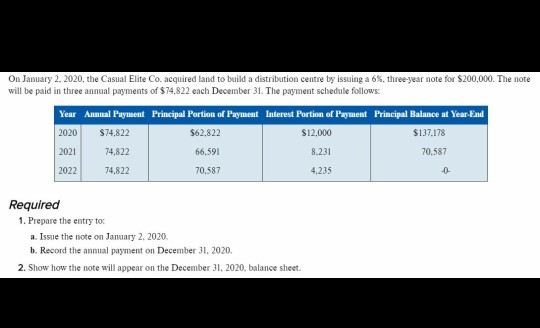

On January 2, 2020, the Casual Elite Co. acquired land to build a distribution centre by issuing a 6%, three-year note for $200,000. The note

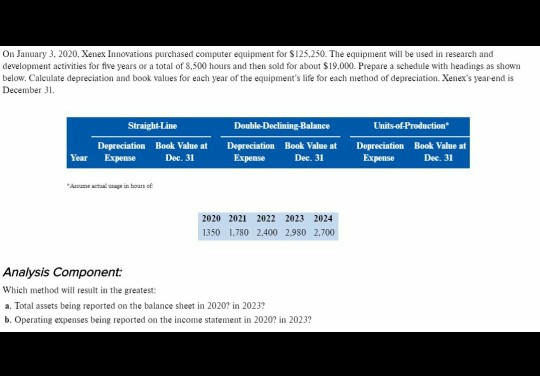

On January 2, 2020, the Casual Elite Co. acquired land to build a distribution centre by issuing a 6%, three-year note for $200,000. The note will be paid in three annual payments of $74.822 each December 31. The payment schedule follows Year Annual Payment Principal Portion of Payment Interest Portion of Payment Principal Balance at Year End 2020 $74,822 $62,822 $12,000 $137.178 2021 74,822 66,591 8.231 70.587 2022 74,822 70,587 4.235 -0- Required 1. Prepare the entry to a. Issue the note on January 2, 2020 b. Record the annual payment on December 31, 2020. 2. Show how the note will appear on the December 31, 2020. balance sheet. On January 3, 2020, Xenex Innovations purchased computer equipment for $125,250. The equipment will be used in research and development activities for five years or a total of 8,500 hours and then sold for about $19,000. Prepare a schedule with headings as shown below. Calculate depreciation and book values for each year of the equipment's life for each method of depreciation. Xenex's year-end is December 31. Straight-Line Depreciation Book Value at Year Expense Dec. 31 Double Declining-Balance Depreciation Book Value at Expense Dec. 31 Units-of-Production Depreciation Book Value at Expense Dec. 31 *Asanse taalge in bono. 2020 2021 2022 2023 2024 1350 1.780 2.400 2980 2.700 Analysis Component: Which method will result in the greatest: a. Total assets being reported on the balance sheet in 2020? in 2023? b. Operating expenses being reported on the income statement in 2020? in 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started