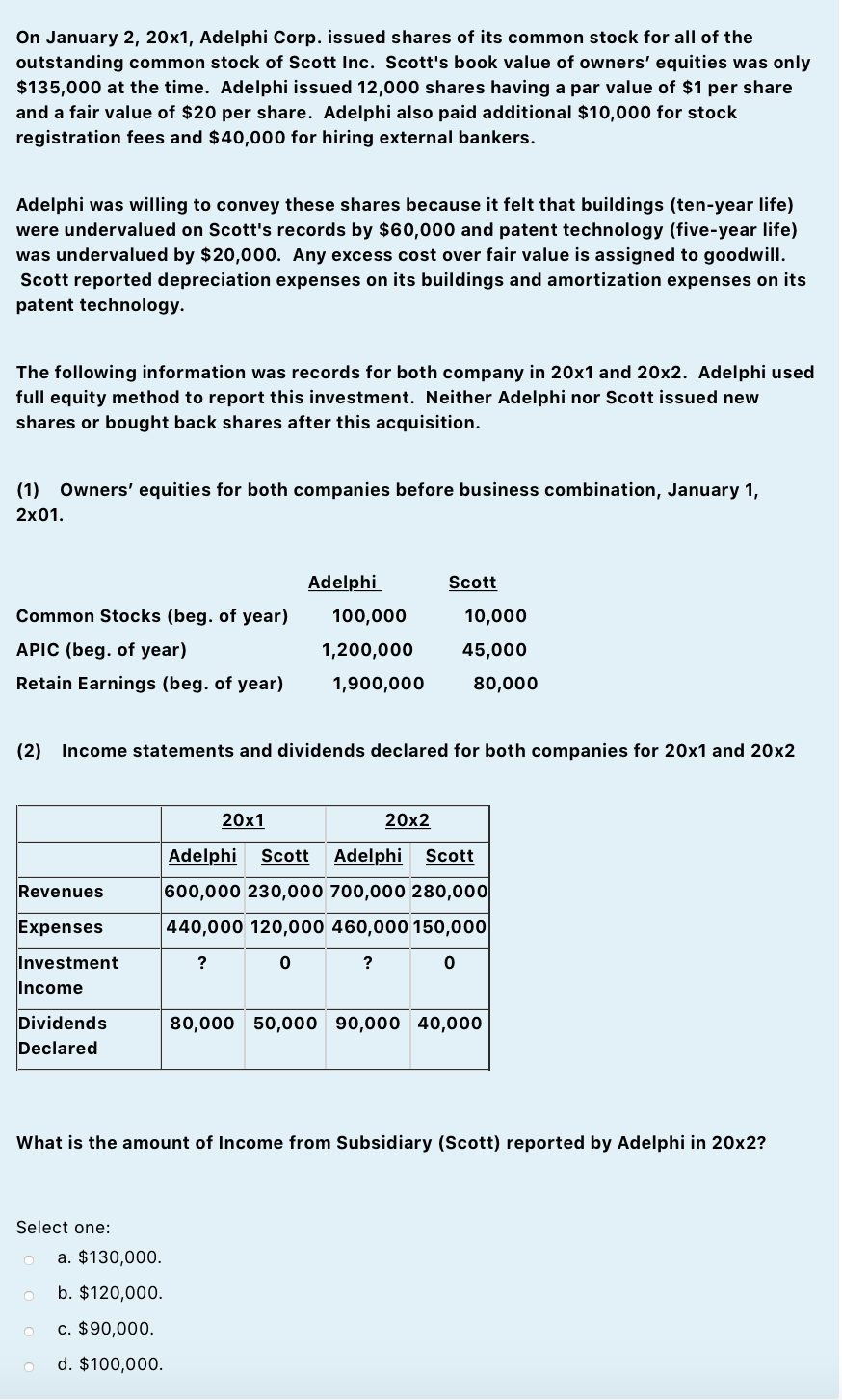

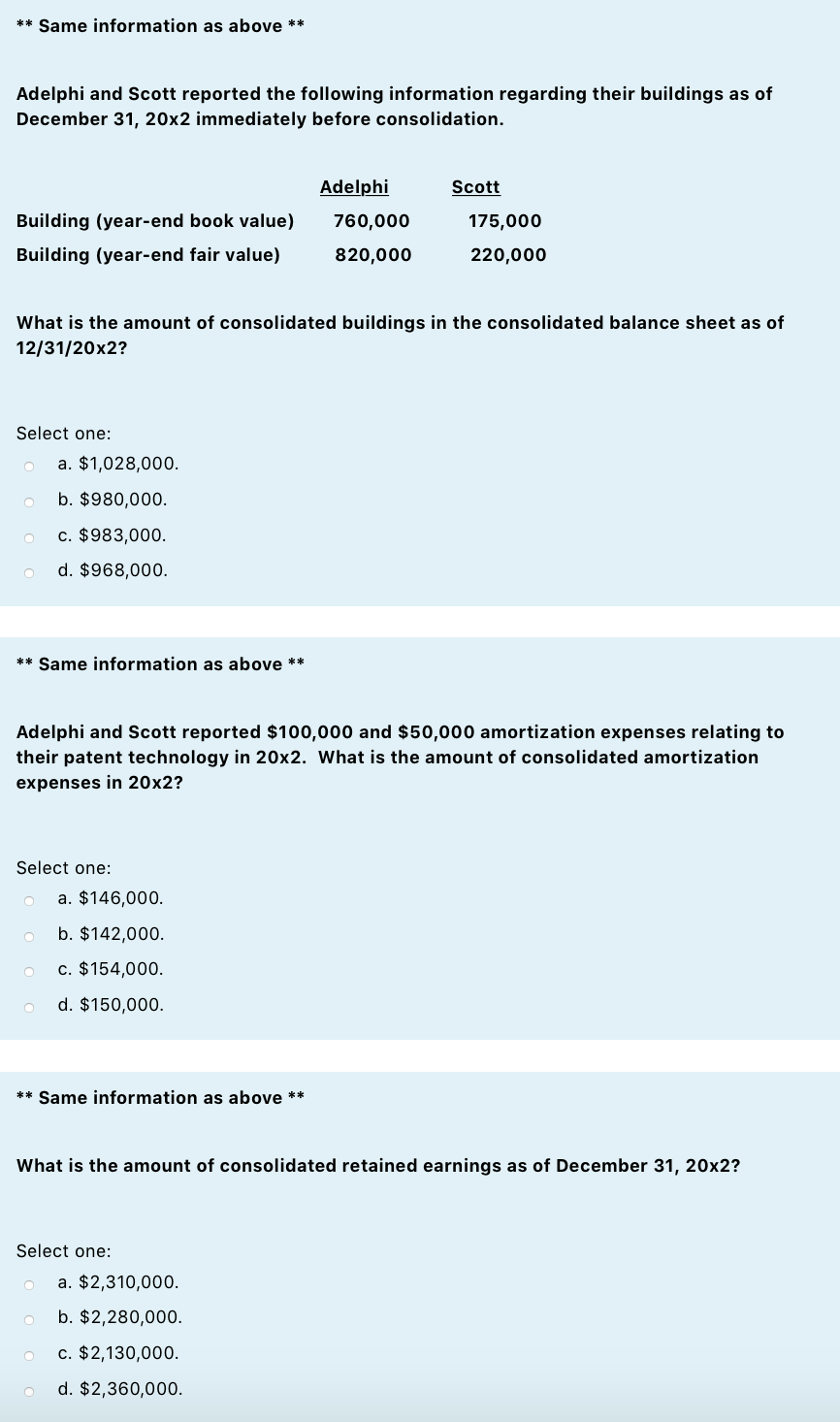

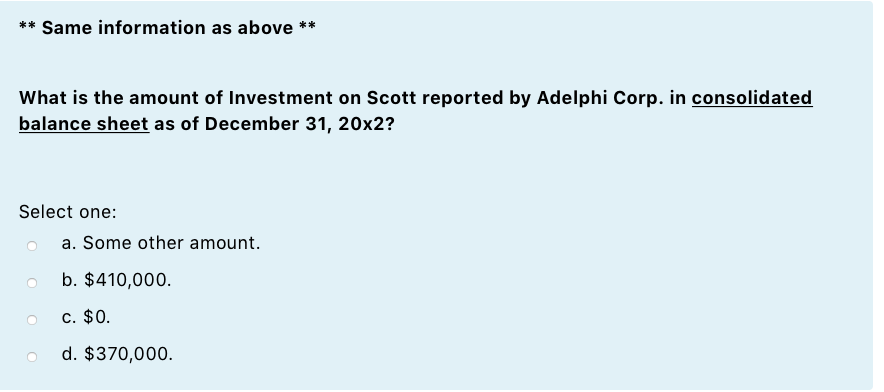

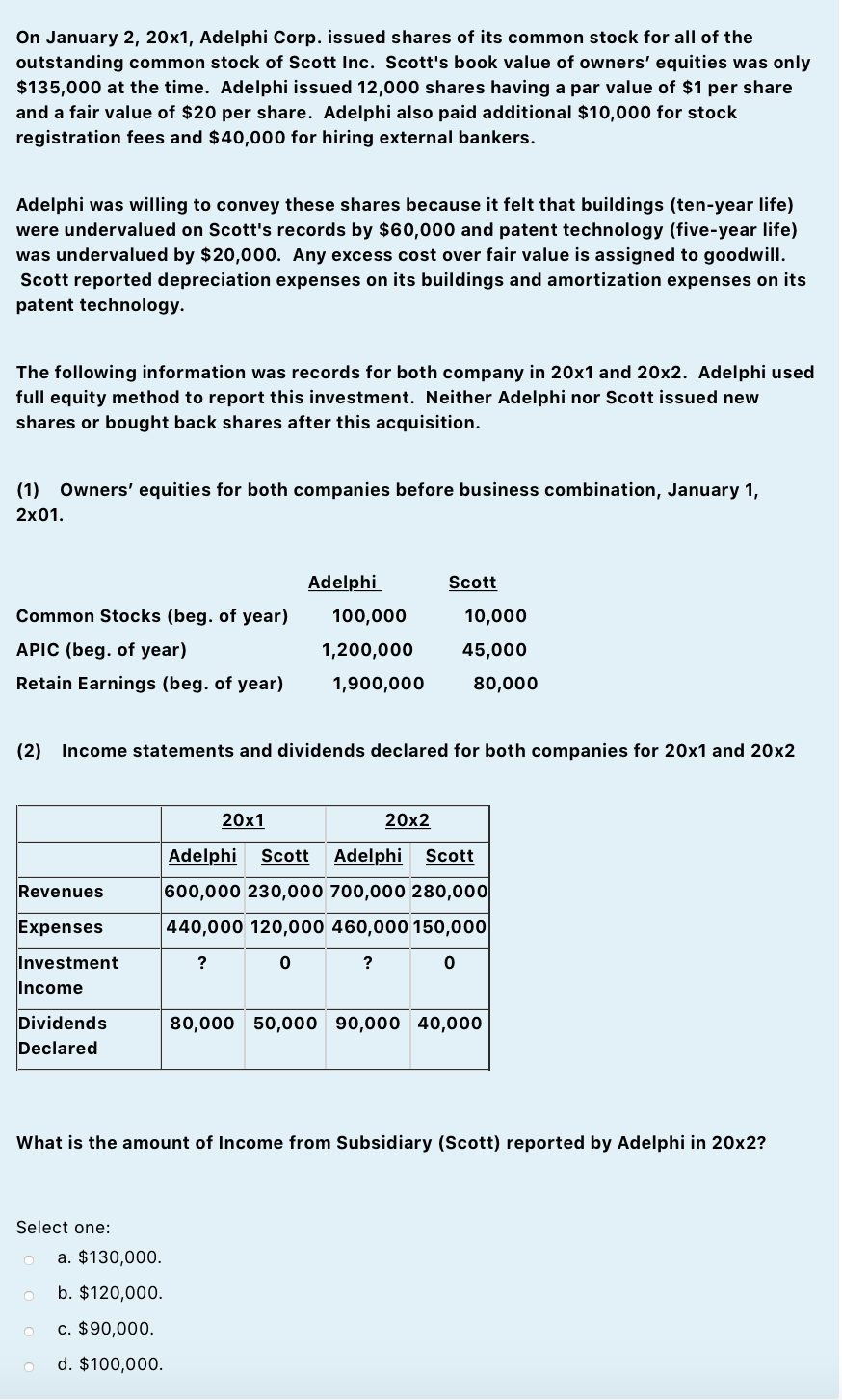

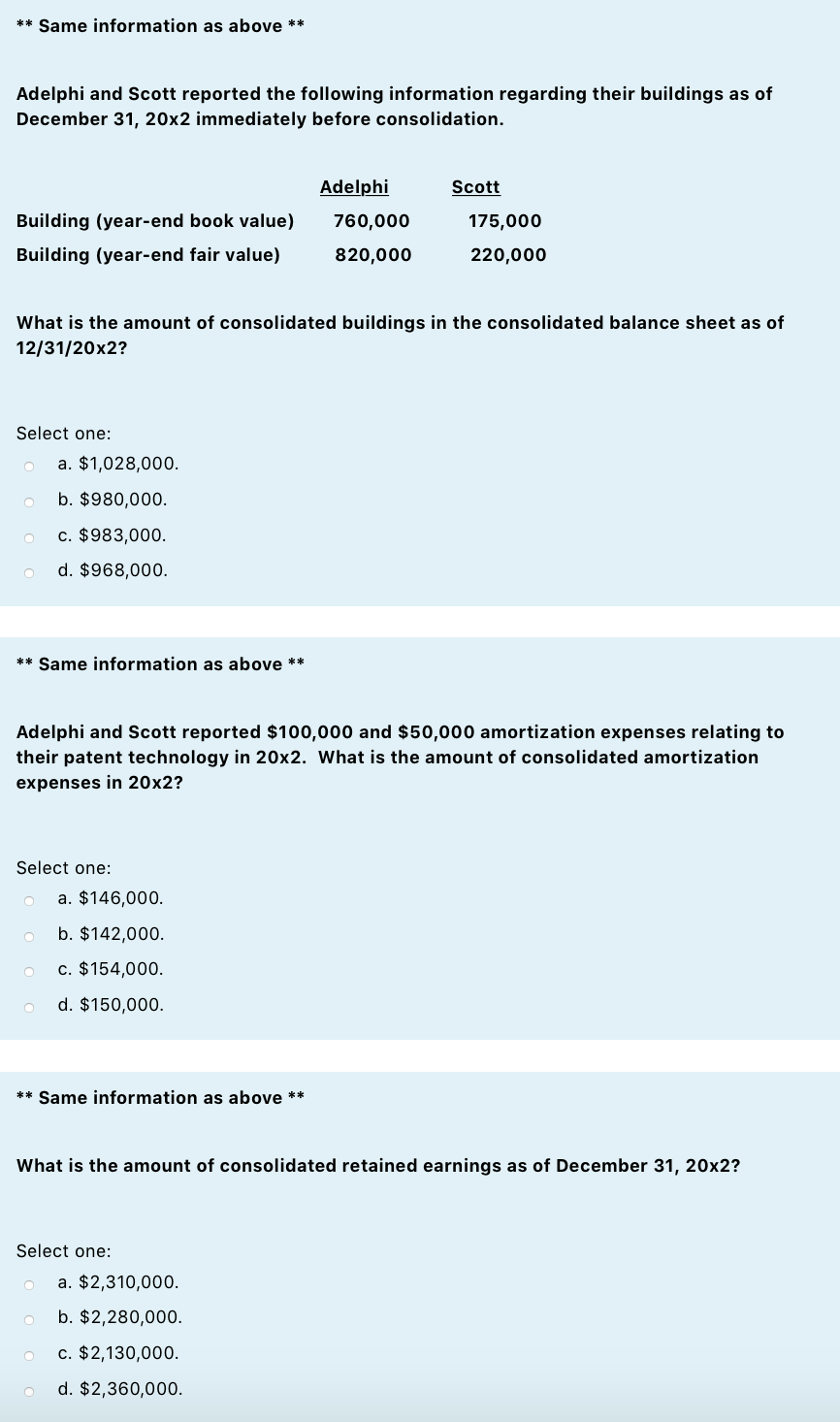

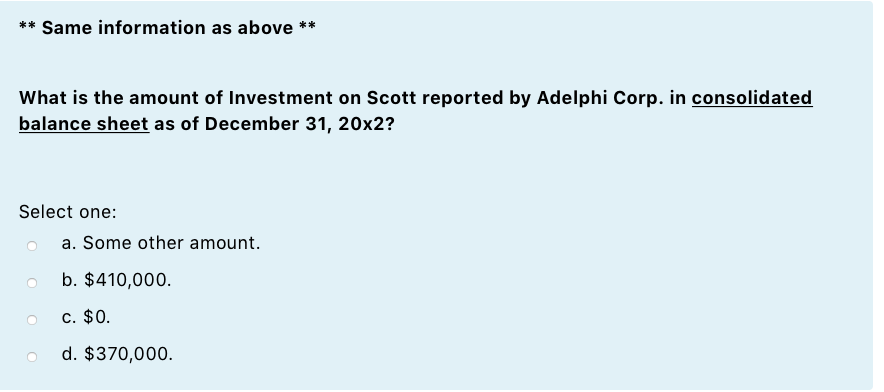

On January 2, 20x1, Adelphi Corp. issued shares of its common stock for all of the outstanding common stock of Scott Inc. Scott's book value of owners' equities was only $135,000 at the time. Adelphi issued 12,000 shares having a par value of $1 per share and a fair value of $20 per share. Adelphi also paid additional $10,000 for stock registration fees and $40,000 for hiring external bankers. Adelphi was willing to convey these shares because it felt that buildings (ten-year life) were undervalued on Scott's records by $60,000 and patent technology (five-year life) was undervalued by $20,000. Any excess cost over fair value is assigned to goodwill. Scott reported depreciation expenses on its buildings and amortization expenses on its patent technology. The following information was records for both company in 20x1 and 20x2. Adelphi used full equity method to report this investment. Neither Adelphi nor Scott issued new shares or bought back shares after this acquisition. (1) Owners' equities for both companies before business combination, January 1, 2x01. Adelphi Scott Common Stocks (beg. of year) APIC (beg. of year) Retain Earnings (beg. of year) 100,000 1,200,000 1,900,000 10,000 45,000 80,000 (2) Income statements and dividends declared for both companies for 20x1 and 20x2 20x2 20x1 Adelphi Scott Adelphi Scott Revenues 600,000 230,000 700,000 280,000 440,000 120,000 460,000 150,000 Expenses ? 0 ? 0 Investment Income Dividends Declared 80,000 50,000 90,000 40,000 What is the amount of Income from Subsidiary (Scott) reported by Adelphi in 20x2? Select one: a. $130,000. b. $120,000. c. $90,000 d. $100,000. ** Same information as above ** Adelphi and Scott reported the following information regarding their buildings as of December 31, 20x2 immediately before consolidation. Scott Building (year-end book value) Building (year-end fair value) Adelphi 760,000 820,000 175,000 220,000 What is the amount of consolidated buildings in the consolidated balance sheet as of 12/31/20x2? Select one: a. $1,028,000. b. $980,000. c. $983,000. d. $968,000 ** Same information as above ** Adelphi and Scott reported $100,000 and $50,000 amortization expenses relating to their patent technology in 20x2. What is the amount of consolidated amortization expenses in 20x2? Select one: a. $146,000. b. $142,000. c. $154,000. d. $150,000. ** Same information as above ** What is the amount of consolidated retained earnings as of December 31, 20x2? Select one: a. $2,310,000. b. $2,280,000. c. $2,130,000. d. $2,360,000. ** ** Same information as above What is the amount of Investment on Scott reported by Adelphi Corp. in consolidated balance sheet as of December 31, 20x2? Select one: a. Some other amount. b. $410,000. c. $0. d. $370,000