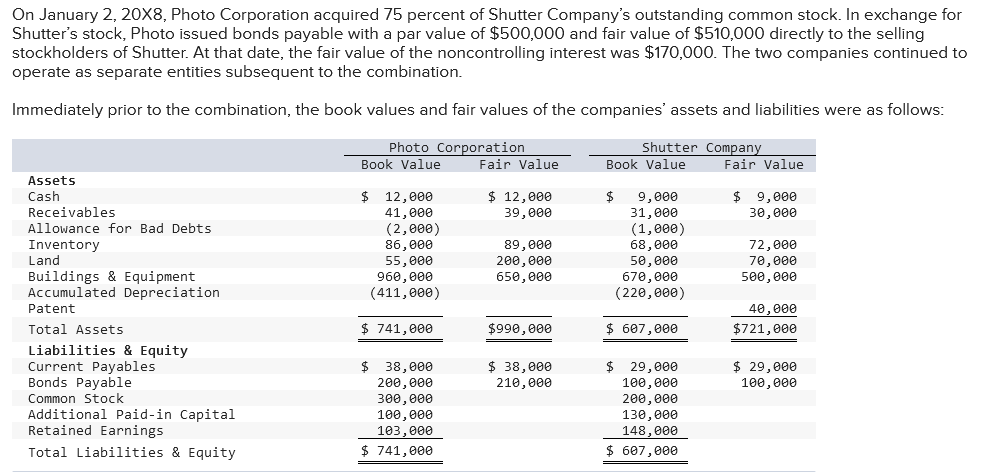

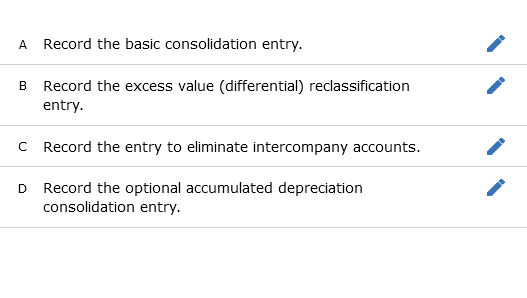

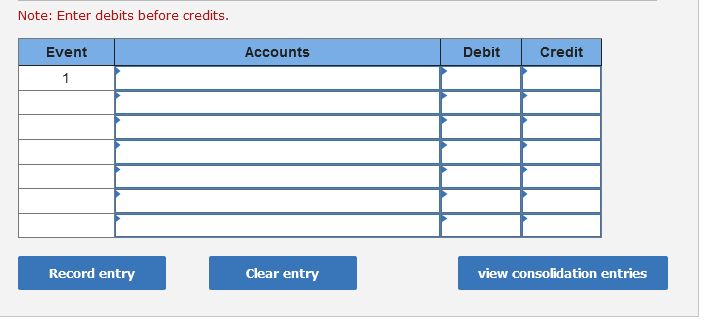

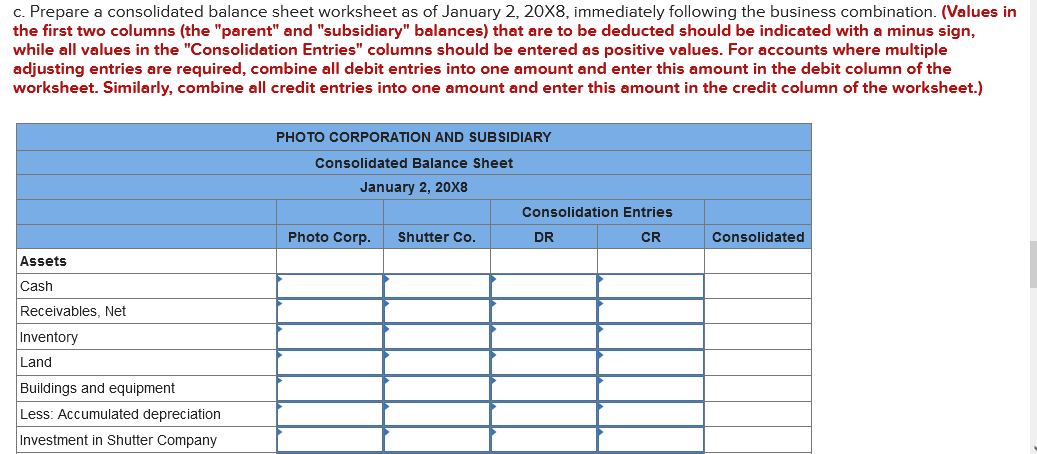

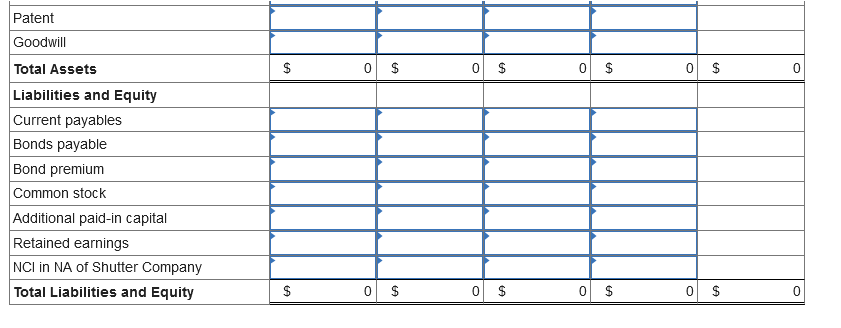

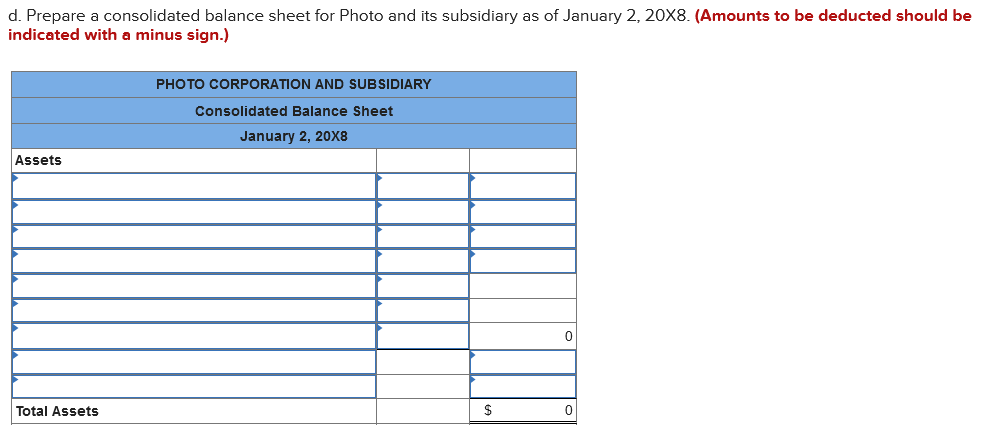

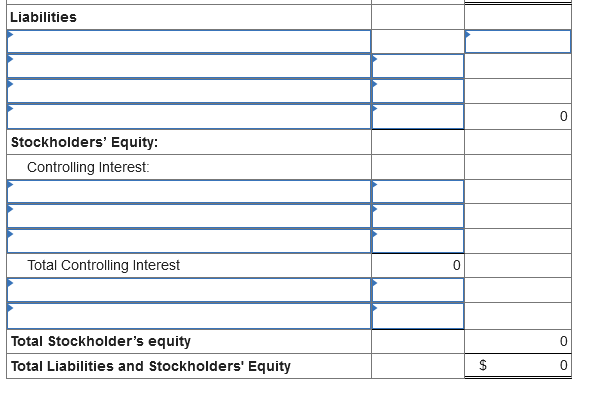

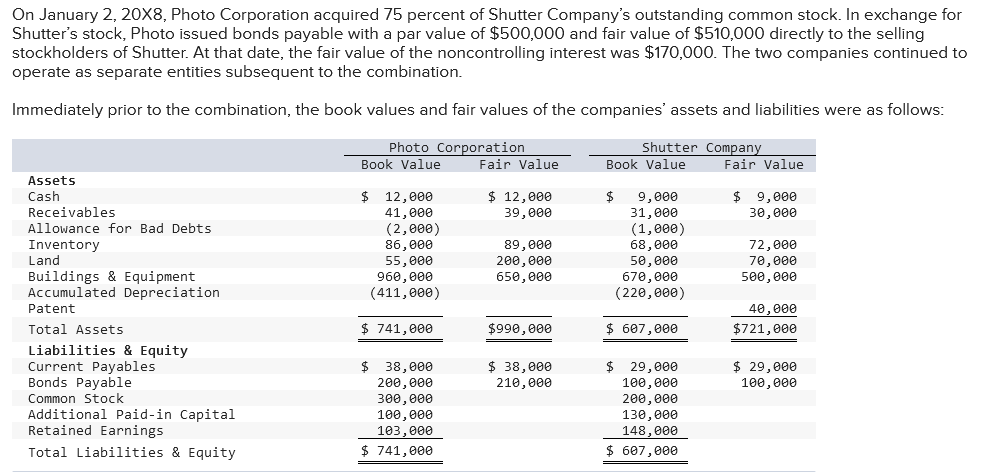

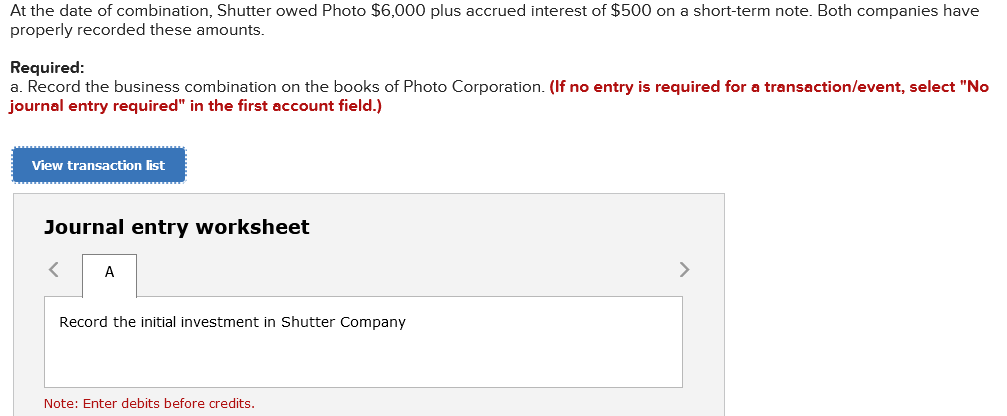

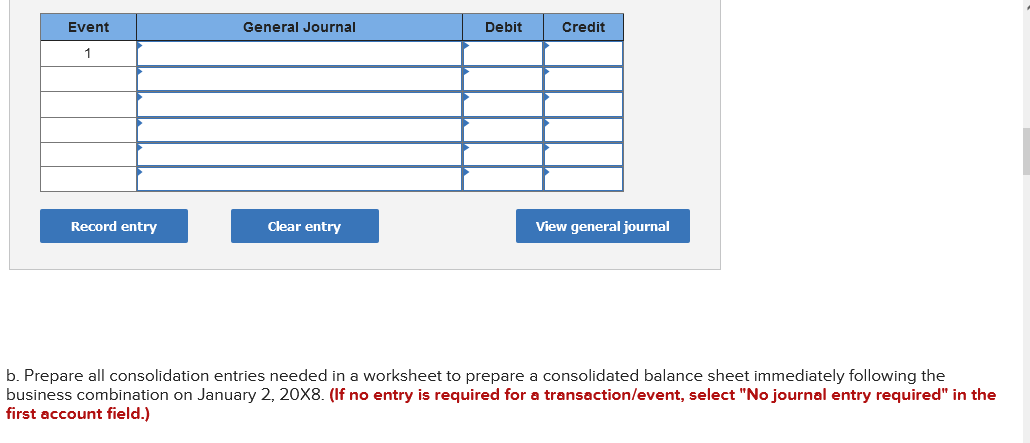

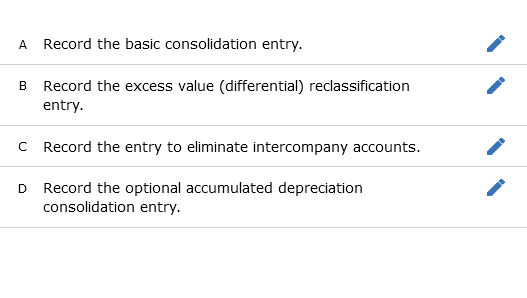

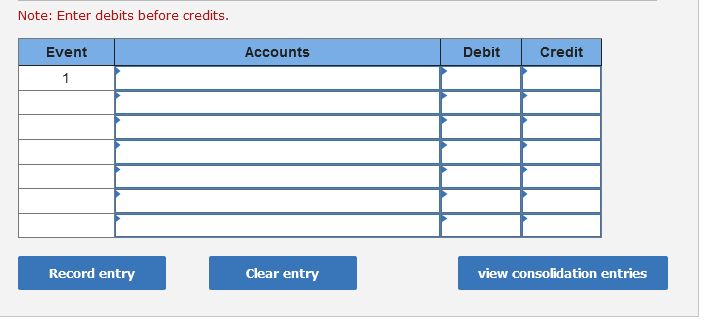

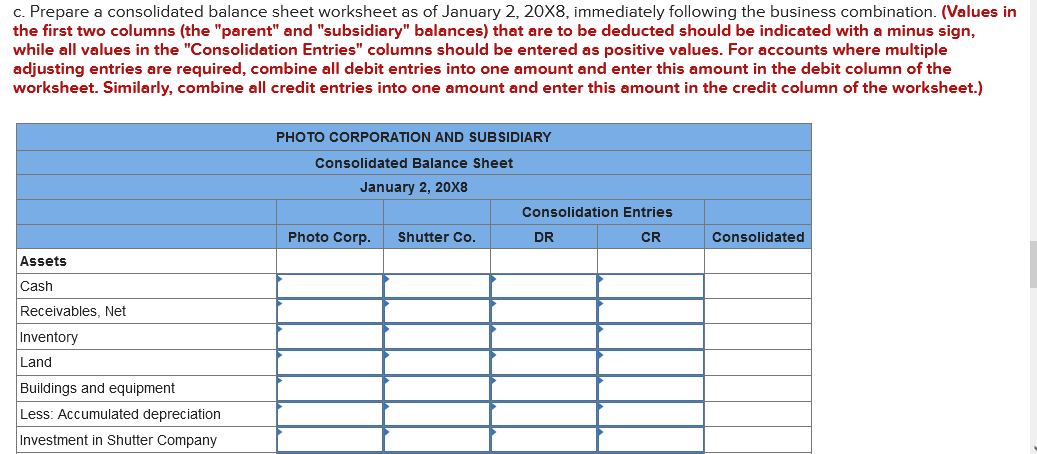

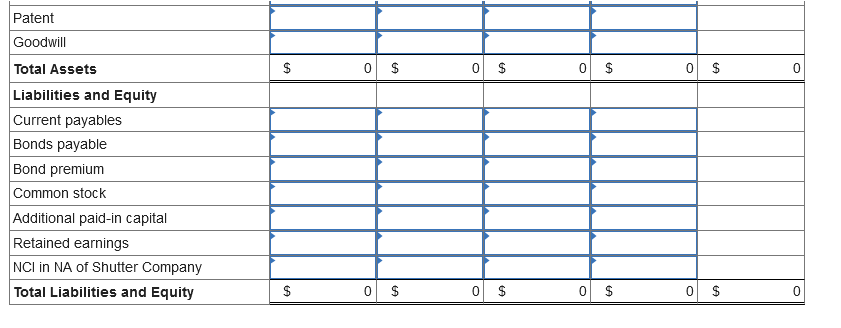

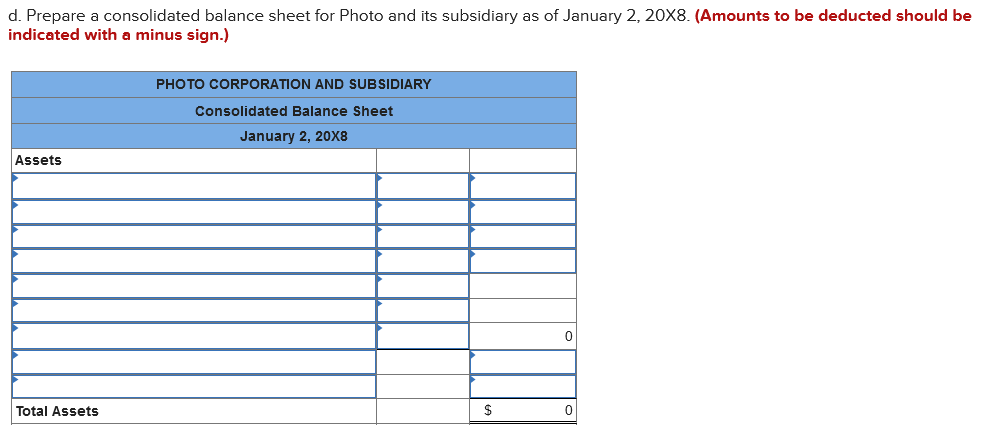

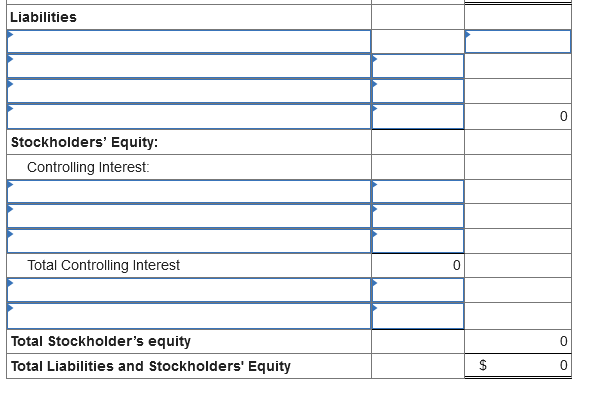

On January 2, 20X8, Photo Corporation acquired 75 percent of Shutter Company's outstanding common stock. In exchange for Shutter's stock, Photo issued bonds payable with a par value of $500,000 and fair value of $510,000 directly to the selling stockholders of Shutter. At that date, the fair value of the noncontrolling interest was $170,000. The two companies continued to operate as separate entities subsequent to the combination. Immediately prior to the combination, the book values and fair values of the companies' assets and liabilities were as follows: At the date of combination, Shutter owed Photo $6,000 plus accrued interest of $500 on a short-term note. Both companies have properly recorded these amounts. Required: a. Record the business combination on the books of Photo Corporation. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) b. Prepare all consolidation entries needed in a worksheet to prepare a consolidated balance sheet immediately following the business combination on January 2, 20X8. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) A Record the basic consolidation entry. B Record the excess value (differential) reclassification entry. C Record the entry to eliminate intercompany accounts. D Record the optional accumulated depreciation consolidation entry. Note: Enter debits before credits. c. Prepare a consolidated balance sheet worksheet as of January 2,208, immediately following the business combination. (Values in the first two columns (the "parent" and "subsidiary" balances) that are to be deducted should be indicated with a minus sign, while all values in the "Consolidation Entries" columns should be entered as positive values. For accounts where multiple adjusting entries are required, combine all debit entries into one amount and enter this amount in the debit column of the worksheet. Similarly, combine all credit entries into one amount and enter this amount in the credit column of the worksheet.) d. Prepare a consolidated balance sheet for Photo and its subsidiary as of January 2,208. (Amounts to be deducted should be indicated with a minus sign.) \begin{tabular}{|l|l|l|} \hline Liabilities & & \\ \hline & & \\ \hline & & \\ \hline Stockholders' Equity: & & \\ \hline Controlling Interest: & & \\ \hline & & \\ \hline & & \\ \hline Total Controlling Interest & & \\ \hline Total Stockholder's equity & & \\ \hline Totabilities and Stockholders' Equity & & \\ \hline \end{tabular}