Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 2, Big Apple Inc. purchased 4,800 of the 21,600 outstanding shares of common stock of Mack Corp. for $120,000 cash. Big Apple

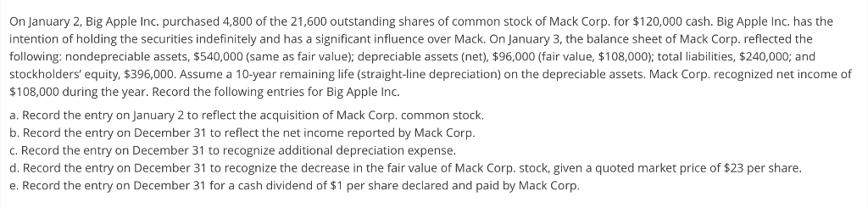

On January 2, Big Apple Inc. purchased 4,800 of the 21,600 outstanding shares of common stock of Mack Corp. for $120,000 cash. Big Apple Inc. has the intention of holding the securities indefinitely and has a significant influence over Mack. On January 3, the balance sheet of Mack Corp. reflected the following: nondepreciable assets, $540,000 (same as fair value); depreciable assets (net), $96,000 (fair value, $108,000); total liabilities, $240,000; and stockholders' equity, $396,000. Assume a 10-year remaining life (straight-line depreciation) on the depreciable assets. Mack Corp. recognized net income of $108,000 during the year. Record the following entries for Big Apple Inc. a. Record the entry on January 2 to reflect the acquisition of Mack Corp. common stock. b. Record the entry on December 31 to reflect the net income reported by Mack Corp. c. Record the entry on December 31 to recognize additional depreciation expense. d. Record the entry on December 31 to recognize the decrease in the fair value of Mack Corp. stock, given a quoted market price of $23 per share. e. Record the entry on December 31 for a cash dividend of $1 per share declared and paid by Mack Corp. f. Indicate the ending balance in the Investment in Mack Stock account as of December 31. Dec. 31 balance: $ 0

Step by Step Solution

★★★★★

3.40 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

a January 2 Acquisition of Mack Corp Common Stock Account Debit Credit Investment in Mack Corp Stock ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started