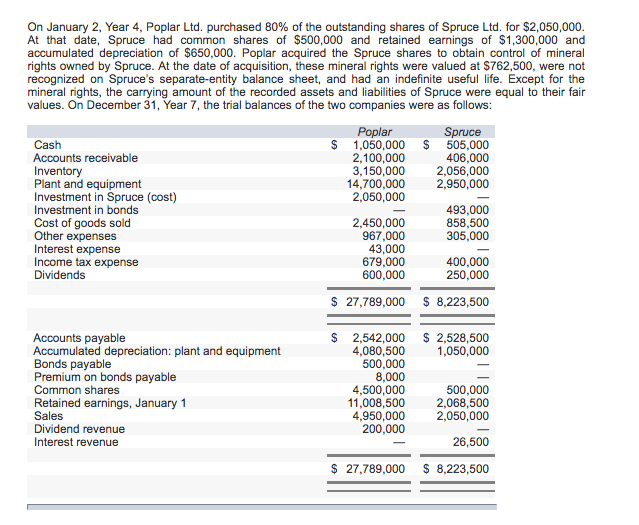

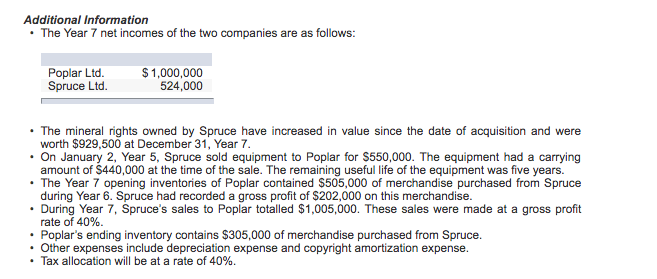

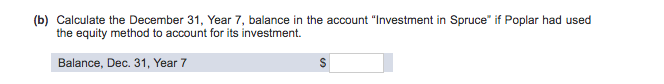

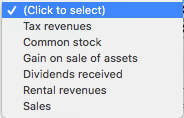

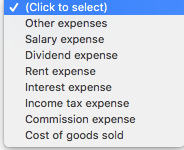

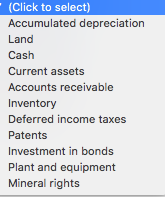

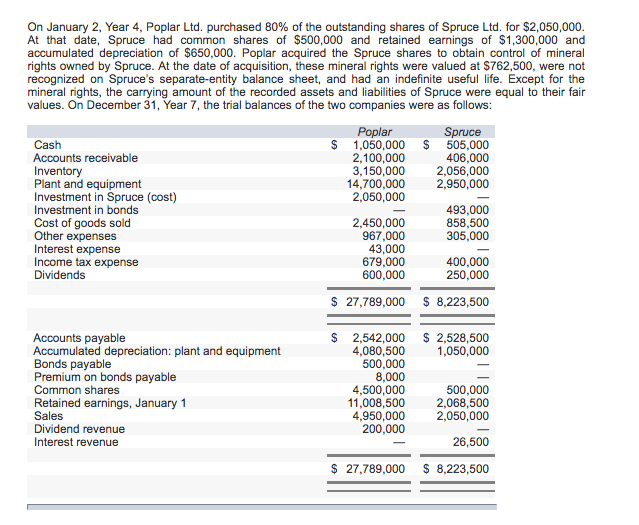

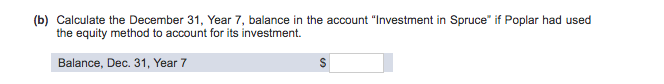

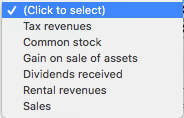

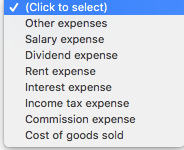

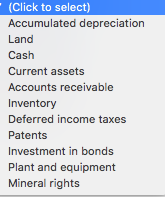

On January 2, Year 4, Poplar Ltd. purchased 80% of the outstanding shares of Spruce Ltd. for $2,050,000 At that date, Spruce had common shares of $500,000 and retained earnings of $1,300,000 and accumulated depreciation of $650,000. Poplar acquired the Spruce shares to obtain control of mineral rights owned by Spruce. At the date of acquisition, these mineral rights were valued at $762,500, were not recognized on Spruce's separate-entity balance sheet, and had an indefinite useful life. Except for the mineral rights, the carrying amount of the recorded assets and liabilities of Spruce were equal to their fair values. On December 31, Year 7, the trial balances of the two companies were as follows: Spruce Cash Accounts receivable $ 1,050,000 S 505,000 406,000 2,056,000 2,950,000 2,100,000 3,150,000 14.700,000 2,050,000 Plant and equipment Investment in Spruce (cost) Investment in bonds Cost of goods sold Other expenses Interest expense Income tax expense Dividends 493,000 858,500 305,000 2,450,000 967,000 43,000 679,000 600,000 400,000 250,000 $ 27,789,000 $ 8,223,500 Accounts payable Accumulated depreciation: plant and equipment Bonds payable Premium on bonds payable Common shares Retained earnings, January 1 Sales Dividend revenue Interest revenue $ 2,542,000 $ 2,528,500 1,050,000 4,080,500 500,000 8,000 4,500,000 11,008,500 4,950,000 200,000 500,000 2,068,500 2,050,000 26,500 $ 27,789,000 $ 8,223,500 On January 2, Year 4, Poplar Ltd. purchased 80% of the outstanding shares of Spruce Ltd. for $2,050,000 At that date, Spruce had common shares of $500,000 and retained earnings of $1,300,000 and accumulated depreciation of $650,000. Poplar acquired the Spruce shares to obtain control of mineral rights owned by Spruce. At the date of acquisition, these mineral rights were valued at $762,500, were not recognized on Spruce's separate-entity balance sheet, and had an indefinite useful life. Except for the mineral rights, the carrying amount of the recorded assets and liabilities of Spruce were equal to their fair values. On December 31, Year 7, the trial balances of the two companies were as follows: Spruce Cash Accounts receivable $ 1,050,000 S 505,000 406,000 2,056,000 2,950,000 2,100,000 3,150,000 14.700,000 2,050,000 Plant and equipment Investment in Spruce (cost) Investment in bonds Cost of goods sold Other expenses Interest expense Income tax expense Dividends 493,000 858,500 305,000 2,450,000 967,000 43,000 679,000 600,000 400,000 250,000 $ 27,789,000 $ 8,223,500 Accounts payable Accumulated depreciation: plant and equipment Bonds payable Premium on bonds payable Common shares Retained earnings, January 1 Sales Dividend revenue Interest revenue $ 2,542,000 $ 2,528,500 1,050,000 4,080,500 500,000 8,000 4,500,000 11,008,500 4,950,000 200,000 500,000 2,068,500 2,050,000 26,500 $ 27,789,000 $ 8,223,500