Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January, 2017, Xenex Innovations purchased computer equipment for $125,900. The equipment will be used in research and development activities for 5 years or a

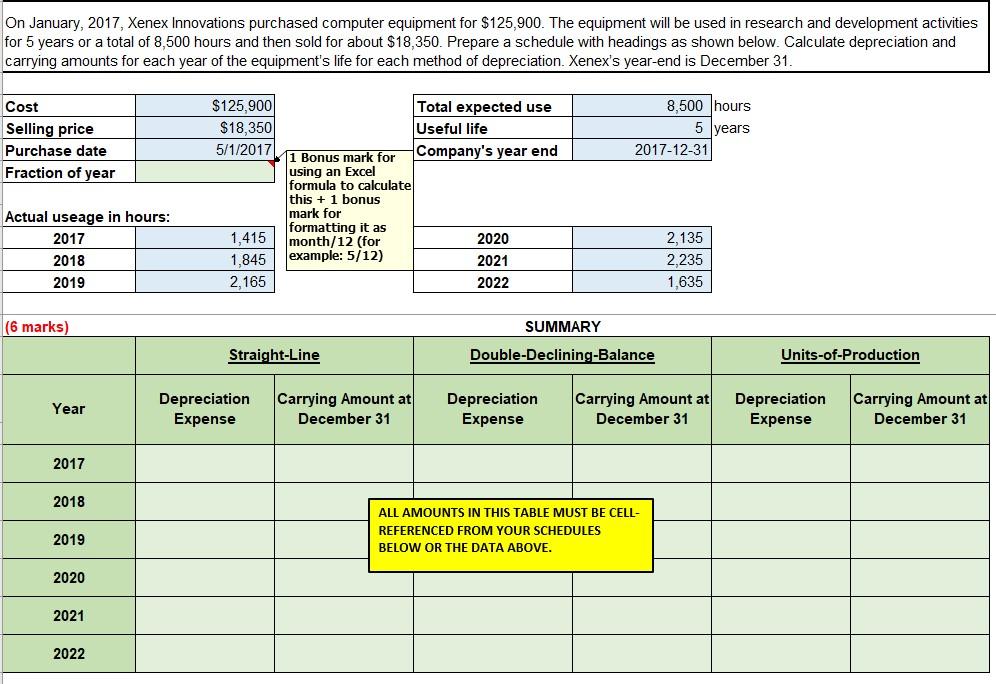

On January, 2017, Xenex Innovations purchased computer equipment for $125,900. The equipment will be used in research and development activities for 5 years or a total of 8,500 hours and then sold for about $18,350. Prepare a schedule with headings as shown below. Calculate depreciation and carrying amounts for each year of the equipment's life for each method of depreciation. Xenex's year-end is December 31. Cost Selling price Purchase date Fraction of year 8,500 hours 5 years 2017-12-31 $125,900 Total expected use $18,350 Useful life 5/1/2017 11 Bonus mark for Company's year end using an Excel formula to calculate this + 1 bonus mark for formatting it as 1,415 month/12 (for 2020 1,845 example: 5/12) 2021 2,165 2022 Actual useage in hours: 2017 2018 2019 2,135 2.235 1,635 (6 marks) SUMMARY Straight-Line Double-Declining-Balance Units-of-Production Year Depreciation Expense Carrying Amount at December 31 Depreciation Expense Carrying Amount at December 31 Depreciation Expense Carrying Amount at December 31 2017 2018 ALL AMOUNTS IN THIS TABLE MUST BE CELL- REFERENCED FROM YOUR SCHEDULES BELOW OR THE DATA ABOVE. 2019 2020 2021 2022

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started