Answered step by step

Verified Expert Solution

Question

1 Approved Answer

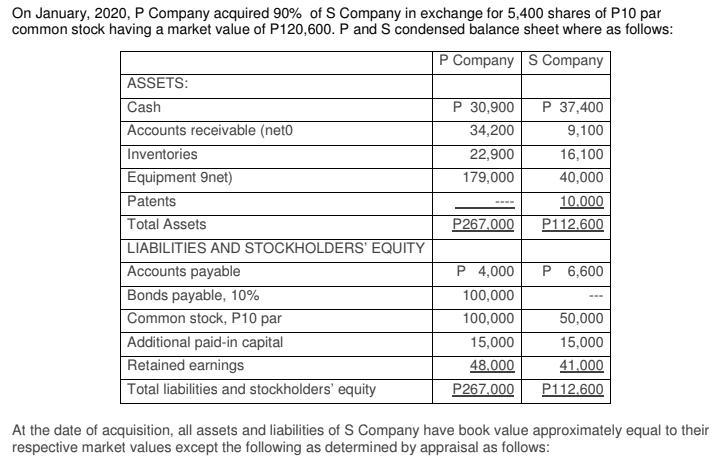

On January, 2020, P Company acquired 90% of S Company in exchange for 5,400 shares of P10 par common stock having a market value

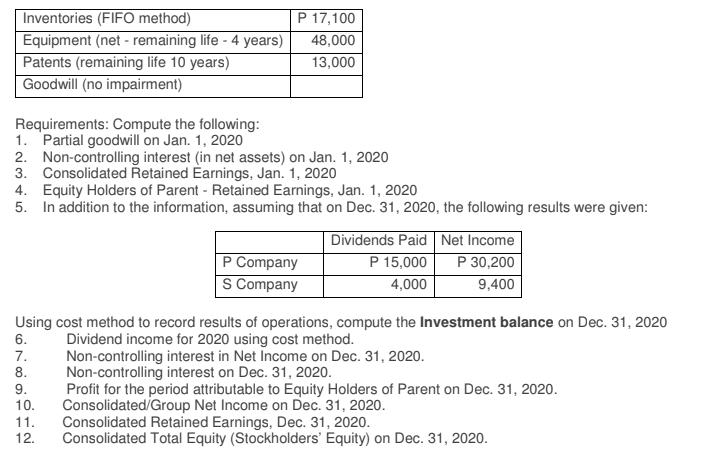

On January, 2020, P Company acquired 90% of S Company in exchange for 5,400 shares of P10 par common stock having a market value of P120,600. P and S condensed balance sheet where as follows: P Company S Company ASSETS: Cash Accounts receivable (net0 Inventories Equipment 9net) Patents Total Assets LIABILITIES AND STOCKHOLDERS' EQUITY Accounts payable Bonds payable, 10% Common stock, P10 par Additional paid-in capital Retained earnings Total liabilities and stockholders' equity P 30,900 34,200 22,900 179,000 wwww. P267.000 P 4,000 100,000 100,000 15,000 48.000 P267.000 P 37,400 9,100 16,100 40,000 10.000 P112.600 P 6,600 --- 50,000 15,000 41.000 P112.600 At the date of acquisition, all assets and liabilities of S Company have book value approximately equal to their respective market values except the following as determined by appraisal as follows: Inventories (FIFO method) Equipment (net - remaining life - 4 years) Patents (remaining life 10 years) Goodwill (no impairment) Requirements: Compute the following: 1. Partial goodwill on Jan. 1, 2020 2. Non-controlling interest (in net assets) on Jan. 1, 2020 3. Consolidated Retained Earnings, Jan. 1, 2020 4. Equity Holders of Parent - Retained Earnings, Jan. 1, 2020 5. In addition to the information, assuming that on Dec. 31, 2020, the following results were given: 6. 7. 8. P 17,100 48,000 13,000 9. 10. Using cost method to record results of operations, compute the Investment balance on Dec. 31, 2020 Dividend income for 2020 using cost method. Non-controlling interest in Net Income on Dec. 31, 2020. Non-controlling interest on Dec. 31, 2020. Profit for the period attributable to Equity Holders of Parent on Dec. 31, 2020. Consolidated/Group Net Income on Dec. 31, 2020. 11. 12. P Company S Company Dividends Paid Net Income P 15,000 P 30,200 4,000 9,400 Consolidated Retained Earnings, Dec. 31, 2020. Consolidated Total Equity (Stockholders' Equity) on Dec. 31, 2020.

Step by Step Solution

★★★★★

3.46 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

To compute the requested values lets go through each requirement step by step 1 Partial goodwill on Jan 1 2020 Partial goodwill is calculated as the excess of the fair value of the consideration trans...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started