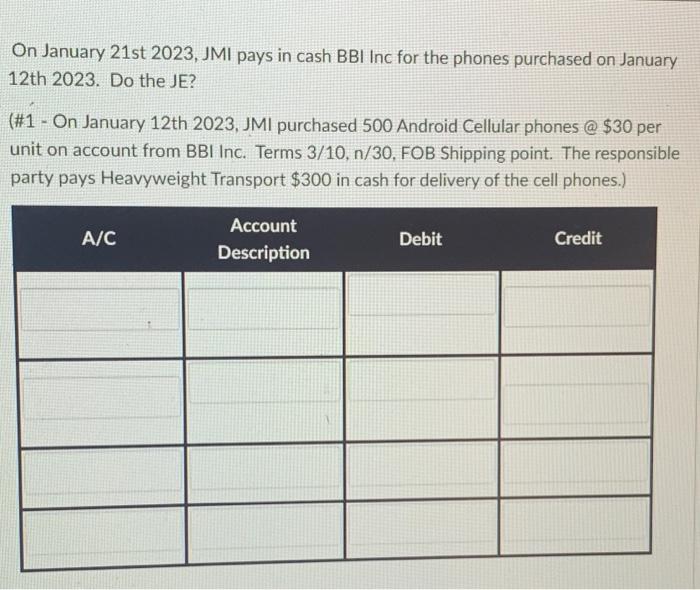

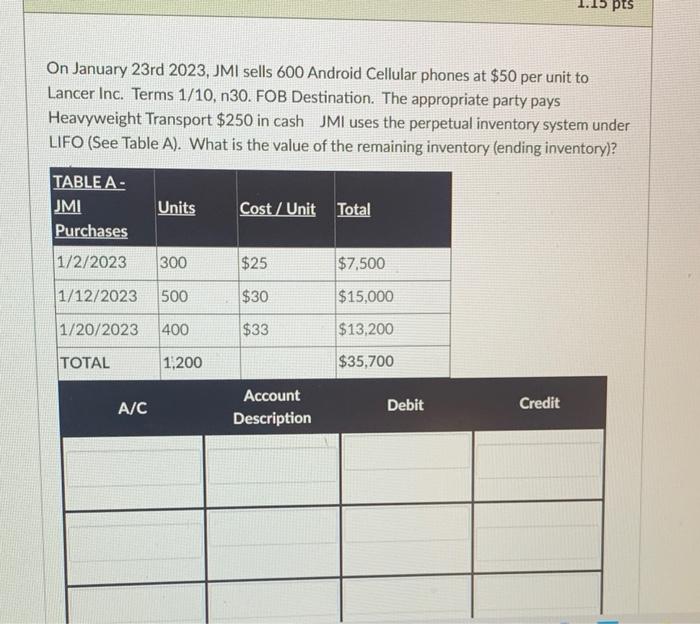

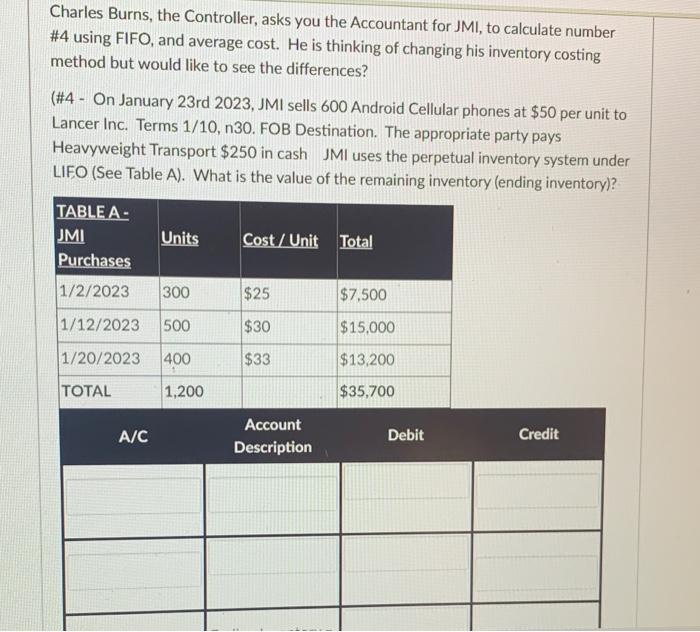

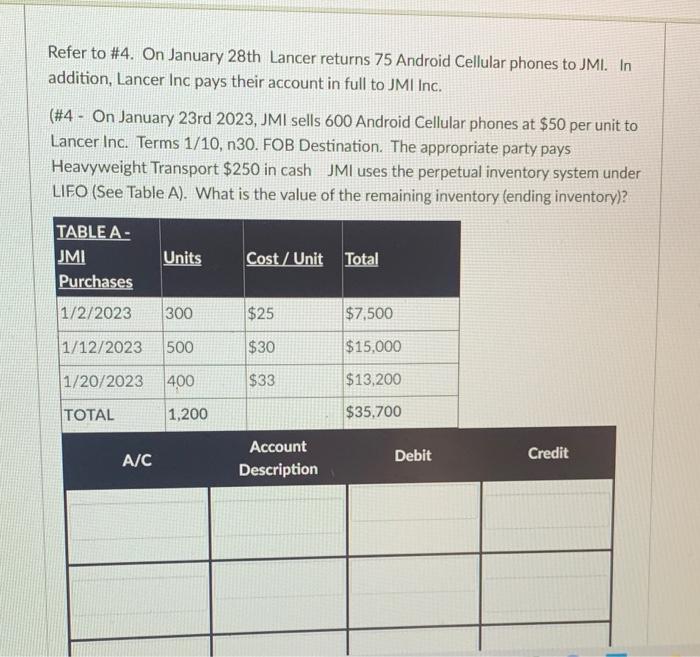

On January 21st 2023, JMI pays in cash BBI Inc for the phones purchased on January 12th 2023. Do the JE? (#1 - On January 12th 2023, JMI purchased 500 Android Cellular phones @ $30 per unit on account from BBI Inc. Terms 3/10, n/30, FOB Shipping point. The responsible party pays Heavyweight Transport $300 in cash for delivery of the cell phones.) A/C Account Description Debit Credit 1.15 pts On January 23rd 2023, JMI sells 600 Android Cellular phones at $50 per unit to Lancer Inc. Terms 1/10, n30. FOB Destination. The appropriate party pays Heavyweight Transport $250 in cash JMI uses the perpetual inventory system under LIFO (See Table A). What is the value of the remaining inventory (ending inventory)? TABLEA - JMI Purchases Units Cost / Unit Total 1/2/2023 300 $25 $7,500 1/12/2023 500 $30 $15,000 1/20/2023 400 $33 $13,200 TOTAL 1,200 $35,700 A/C Account Description Debit Credit Charles Burns, the Controller, asks you the Accountant for JMI, to calculate number #4 using FIFO, and average cost. He is thinking of changing his inventory costing method but would like to see the differences? (#4 - On January 23rd 2023, JMI sells 600 Android Cellular phones at $50 per unit to Lancer Inc. Terms 1/10,n30. FOB Destination. The appropriate party pays Heavyweight Transport $250 in cash JMI uses the perpetual inventory system under LIFO (See Table A). What is the value of the remaining inventory (ending inventory)? Units Cost/Unit Total TABLE A- JMI Purchases 1/2/2023 300 $25 $7,500 1/12/2023 500 $30 $15,000 1/20/2023 400 $33 $13,200 TOTAL 1,200 $35,700 A/C Account Description Debit Credit Refer to #4. On January 28th Lancer returns 75 Android Cellular phones to JMI. In addition, Lancer Inc pays their account in full to JMI Inc. (#4 - On January 23rd 2023, JMI sells 600 Android Cellular phones at $50 per unit to Lancer Inc. Terms 1/10, n30. FOB Destination. The appropriate party pays Heavyweight Transport $250 in cash JMI uses the perpetual inventory system under LIFO (See Table A). What is the value of the remaining inventory (ending inventory)? TABLE A- JMI Purchases Units Cost/Unit Total 1/2/2023 300 $25 $7,500 1/12/2023 500 $30 $15,000 $33 $13,200 1/20/2023 400 TOTAL 1,200 $35.700 A/C Account Description Debit Credit On February 1st, 2023, JMI Beginning Inventory is $16,500. Purchases were made on 2/13/23 for $15,000, on 2/17/23 for $8,000, and on 2/24/23 for $12,500. If ending inventory on 2/28/23 is $22,000, what is JMI Cost of Good sold for February 2023