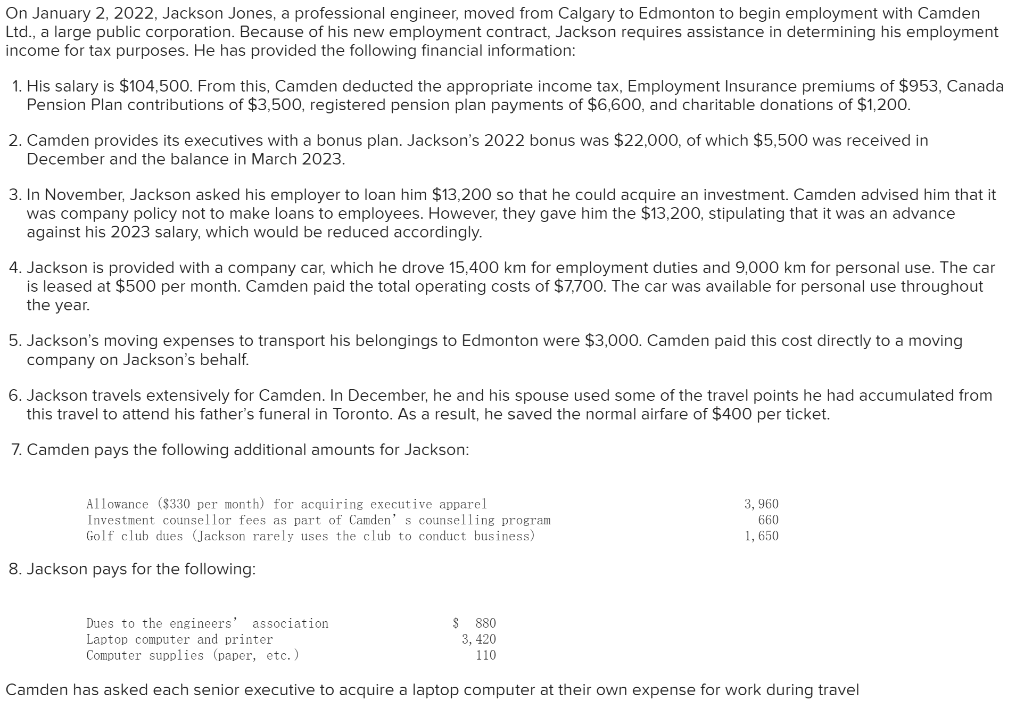

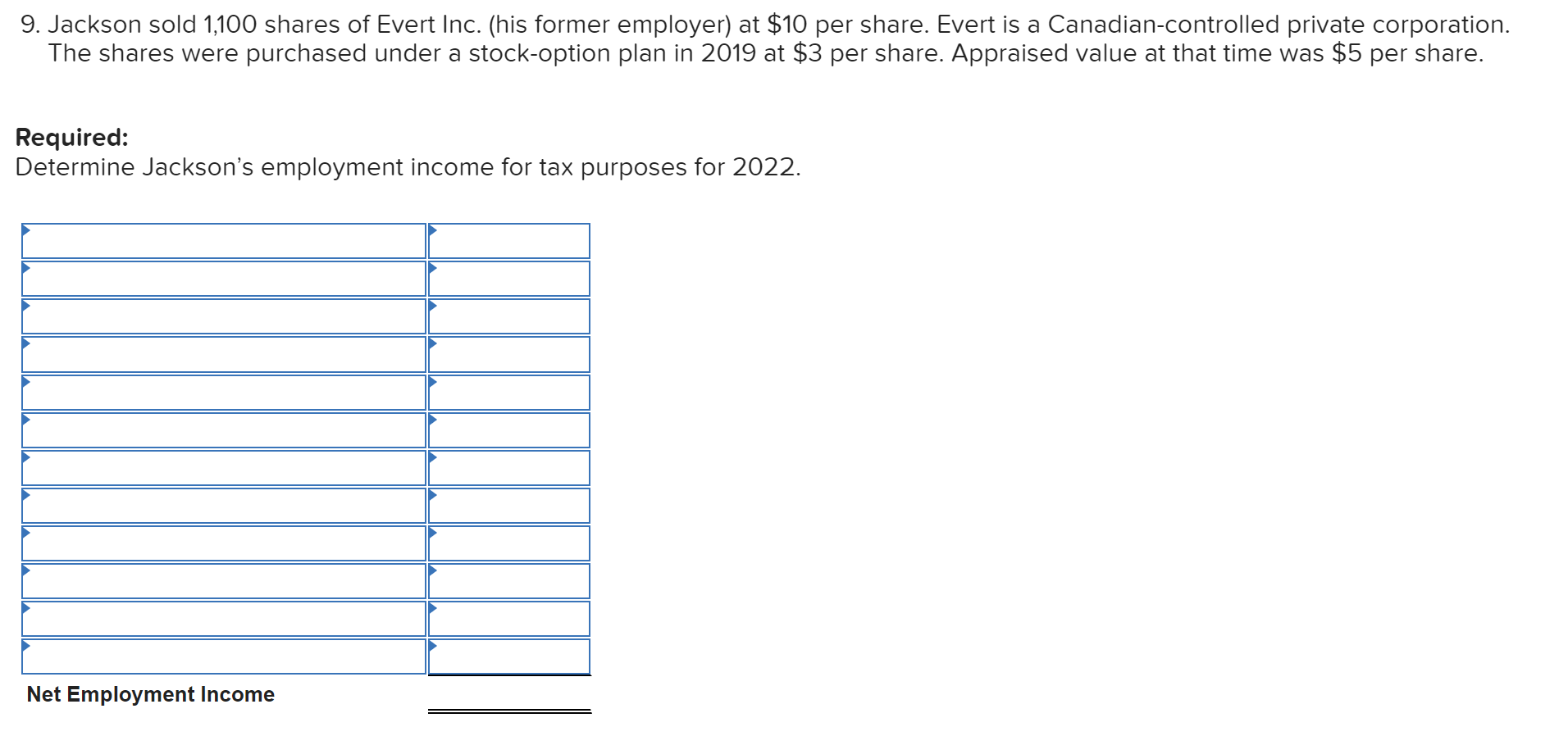

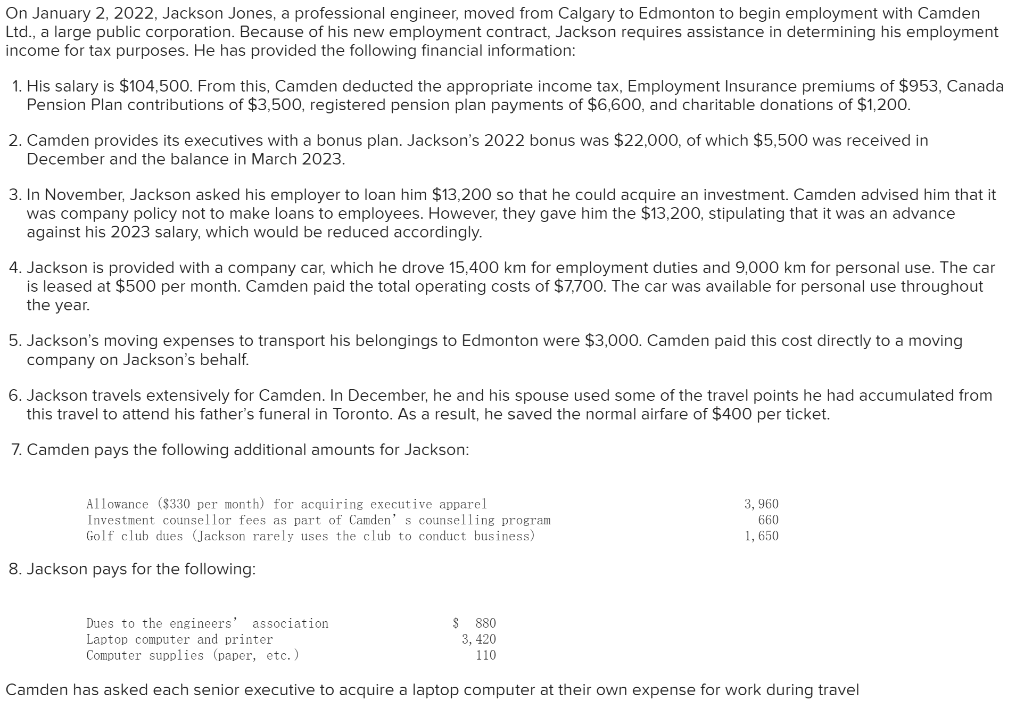

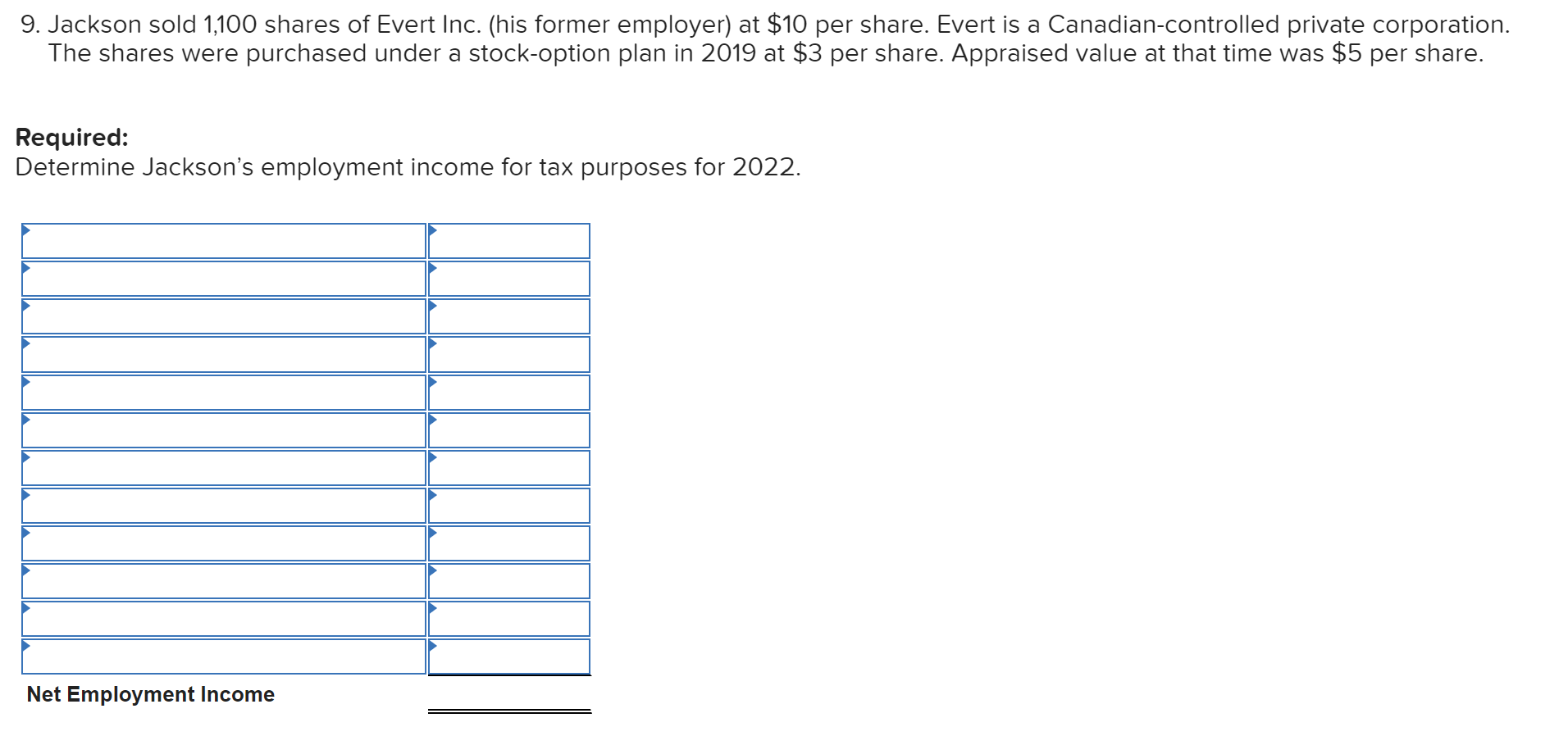

On January 2,2022 , Jackson Jones, a professional engineer, moved from Calgary to Edmonton to begin employment with Camden Ltd., a large public corporation. Because of his new employment contract, Jackson requires assistance in determining his employment income for tax purposes. He has provided the following financial information: 1. His salary is $104,500. From this, Camden deducted the appropriate income tax, Employment Insurance premiums of $953, Canada Pension Plan contributions of $3,500, registered pension plan payments of $6,600, and charitable donations of $1,200. 2. Camden provides its executives with a bonus plan. Jackson's 2022 bonus was $22,000, of which $5,500 was received in December and the balance in March 2023. 3. In November, Jackson asked his employer to loan him $13,200 so that he could acquire an investment. Camden advised him that it was company policy not to make loans to employees. However, they gave him the $13,200, stipulating that it was an advance against his 2023 salary, which would be reduced accordingly. 4. Jackson is provided with a company car, which he drove 15,400km for employment duties and 9,000km for personal use. The car is leased at $500 per month. Camden paid the total operating costs of $7,700. The car was available for personal use throughout the year. 5. Jackson's moving expenses to transport his belongings to Edmonton were $3,000. Camden paid this cost directly to a moving company on Jackson's behalf. 6. Jackson travels extensively for Camden. In December, he and his spouse used some of the travel points he had accumulated from this travel to attend his father's funeral in Toronto. As a result, he saved the normal airfare of $400 per ticket. 7. Camden pays the following additional amounts for Jackson: 8. Jackson pays for the following: 9. Jackson sold 1,100 shares of Evert Inc. (his former employer) at $10 per share. Evert is a Canadian-controlled private corporation. The shares were purchased under a stock-option plan in 2019 at $3 per share. Appraised value at that time was \$5 per share. Required: Determine Jackson's employment income for tax purposes for 2022