Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 3, 2022, P Company acquired 70% interest in S Company for P4,200,000. Consideration includes issuance of shares with fair value of P3,500,000

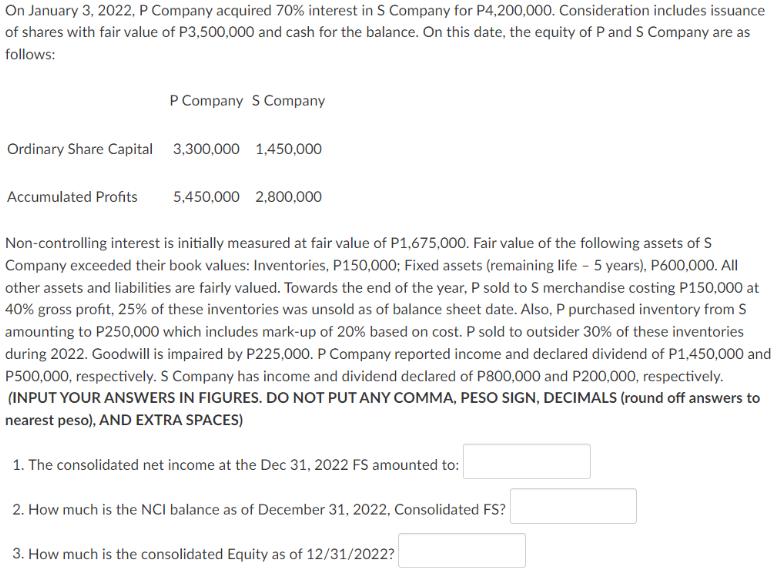

On January 3, 2022, P Company acquired 70% interest in S Company for P4,200,000. Consideration includes issuance of shares with fair value of P3,500,000 and cash for the balance. On this date, the equity of P and S Company are as follows: P Company S Company Ordinary Share Capital 3,300,000 1,450,000 Accumulated Profits 5,450,000 2,800,000 Non-controlling interest is initially measured at fair value of P1,675,000. Fair value of the following assets of S Company exceeded their book values: Inventories, P150,000; Fixed assets (remaining life - 5 years), P600,000. All other assets and liabilities are fairly valued. Towards the end of the year, P sold to S merchandise costing P150,000 at 40% gross profit, 25% of these inventories was unsold as of balance sheet date. Also, P purchased inventory from S amounting to P250,000 which includes mark-up of 20% based on cost. P sold to outsider 30% of these inventories during 2022. Goodwill is impaired by P225,000. P Company reported income and declared dividend of P1,450,000 and P500,000, respectively. S Company has income and dividend declared of P800,000 and P200,000, respectively. (INPUT YOUR ANSSWERS IN FIGURES. DO NOT PUT ANY COMMA, PESO SIGN, DECIMALS (round off answers to nearest peso), AND EXTRA SPACES) 1. The consolidated net income at the Dec 31, 2022 FS amounted to: 2. How much is the NCI balance as of December 31, 2022, Consolidated FS? 3. How much is the consolidated Equity as of 12/31/2022?

Step by Step Solution

★★★★★

3.35 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Answer According to the given Conditions Introduction iA noncontrolling interest also kn...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started