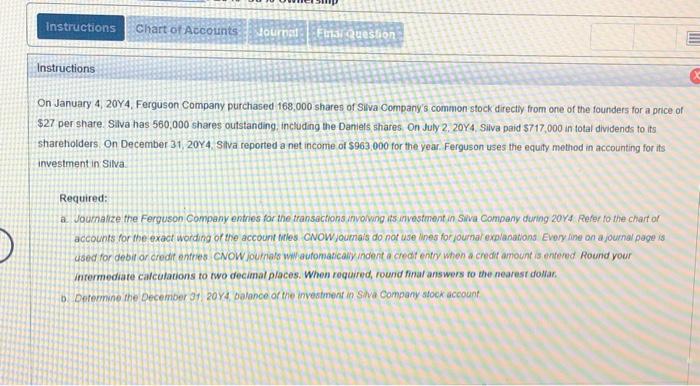

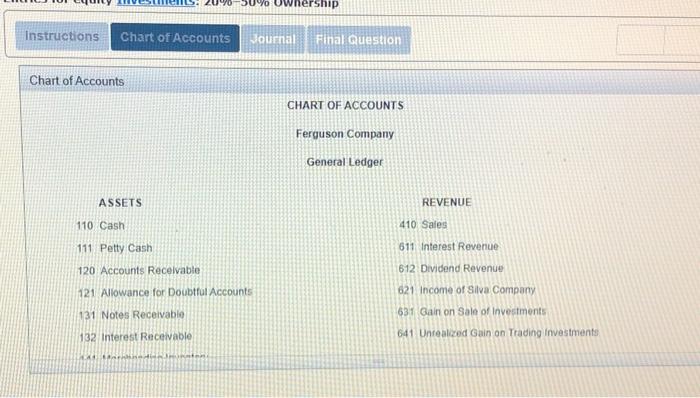

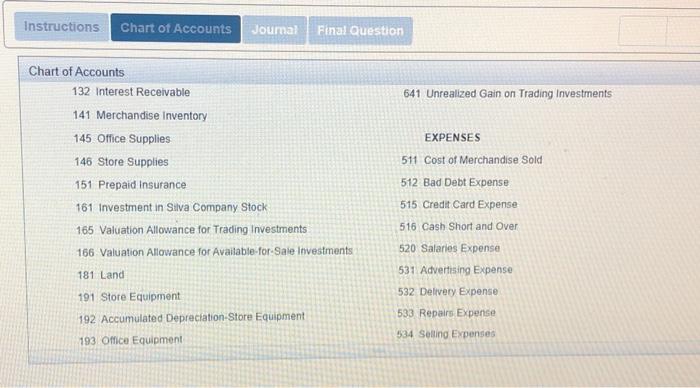

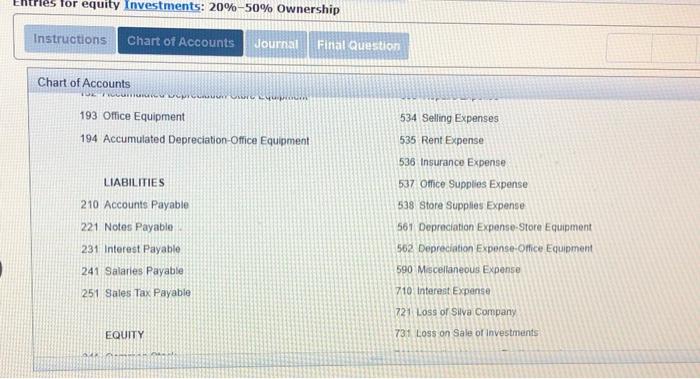

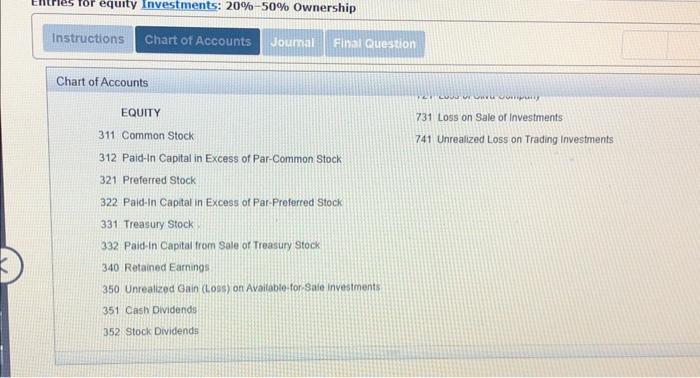

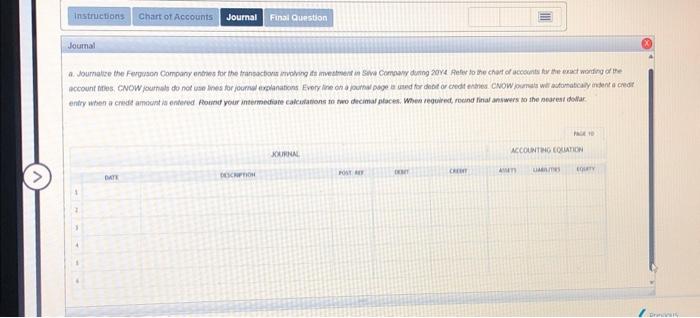

On January 4, 20Y4, Ferguson Company purchased 168,000 shares of Silva Company's common stock directiy from one of the founders for a price of $27 per share. Silva has $60,000 shares outstanding, including the Daniels shares. On July 2,20Y4,5. shareholders. On December 31,20Y4, Silva reported a net income of $963,000 for the year. Ferguson uses the equity method in accounting for its investment in Siva. Required: a. Voumalize the Ferguson Company entries for the transactions invaiving is investment in Siva Company during 20 Y Refer fo the chart of accounts for the exact wording of the account intes. CNOWjoumais do not use ines for joumal explanations Evory fine an a joumal page is Used for debit or credit entres CNOW jourrals ww aufomascaliy indert a credt entry when a credt amount is entered Round your intermediate calculations to two decimal places. When required, round finar answers to the nearest dollar. b. Deremme the December 31,20 Y , patance of the investment in Silva Company stock account Instructions Chart of Accounts vamat final equestion Chart of Accounts CHART OF ACCOUNTS Ferguson Company General Ledger ASSETS 110 Cash 111 Petty Cash 120 Accounts Recelvable 121. Alowance for Doubtful Accounts 131 Notes Recelvable 132 interest Receivable REVENUE 410 Sales 611 interest Revenue 612 Dividend Revenue 621 income of Silva Compary 631 Gain on Sale of investments 641 Unreakzed Gain on Trading investments Instructions Chart of Accounts Joumal Final eyestion Chart of Accounts 132 interest Receivable 141 Merchandise inventory 145 Office Supplies 146 Store Supplies 151 Prepaid insurance 161 investment in Silva Company Stock 165 Valuation Allowance for Trading Investments 166. Valuation Allowance for Available-for-Sale Investments 181 Land 191 Store Equipment 192 Accumulated Depreciation-Store Equipment 193 Office Equipment 641 Unrealized Gain on Trading Investments EXPENSES 511 Cost of Merchandise Sold 512 Bad Debt Expense 515 Credit Card Expense 516 Cash Short and Over 520 Salaries Expense 531 Advertsing Expense 532 Delivery Expense 533 Reparr Expense 534 Seling Expenses Entries for equity Investments: 20%50% Ownership Instructions Chart of Accounts Jourss Fintal quastion Chart of Accounts 193 Office Equipment 194 Accumulated Depreciation-office Equipment LIABILITIES 210 Accounts Payable 221 Notes Payabie 231 Interest Payable 241 Salaries Payable 251 Sales Tax Payable EQUITY 534 Selling Expenses 535 Rent Expense 536 insurance Expense 537 Otice Supples Expense 538 Store Supplies Expense 561 Deprectation Expense-Store Equipment 562 Depreciation Expense-Ofice Equipment 590 Miscellaneous Expense 710 interest Expense 721 Loss of Shva Company 731 Loss on Sale of investments Chart of Accounts EQUITY 311 Common Stock 731 Loss on Sale of Investments 741 Unrealized Loss on Trading investments 312 Paid-In Capital in Excess of Par-Common Stock 321 Preferred Stock 322. Paid-in Capital in Excess of Par-Preferred Stock 331 Treasury Stock 332 Paid-in Capital from Sale of Treasury Stock 340 Retained Earnings 350 Unrealized Gain (Loss) on Available-for-Sale investments 351 Cash Dividends 352 Stock Dividends instruetork chart of Accounts dourial Final guestion Jourtal Post an canm cinist. ARCotenteno Lgamen 4. 7. 1. b. Determine the December 31,204, balance of the investment in Silva Company stock account