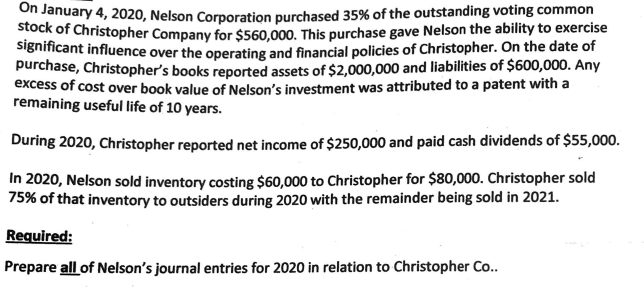

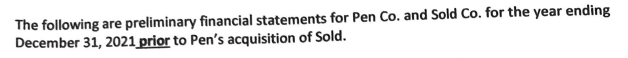

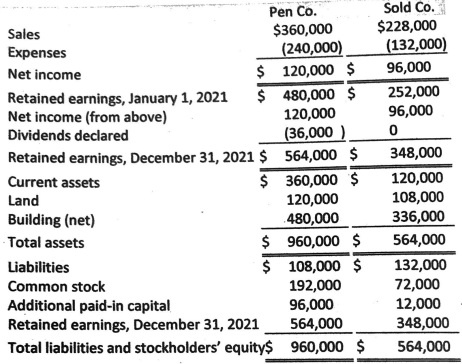

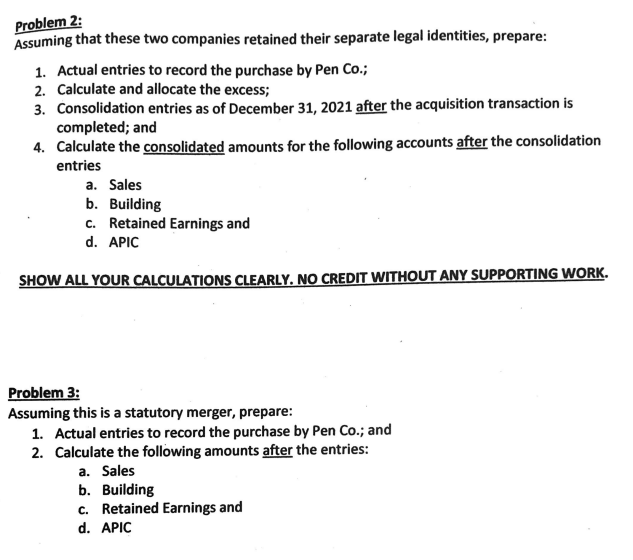

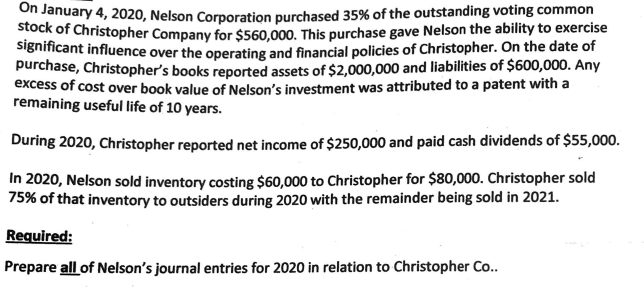

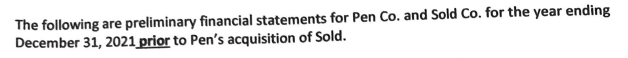

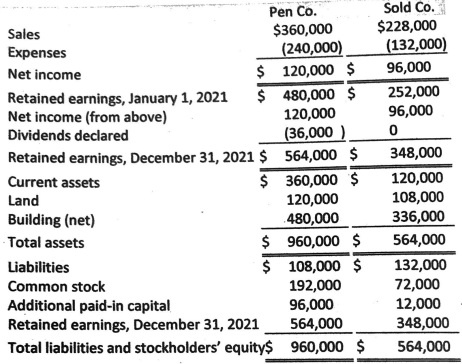

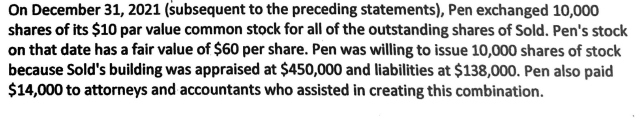

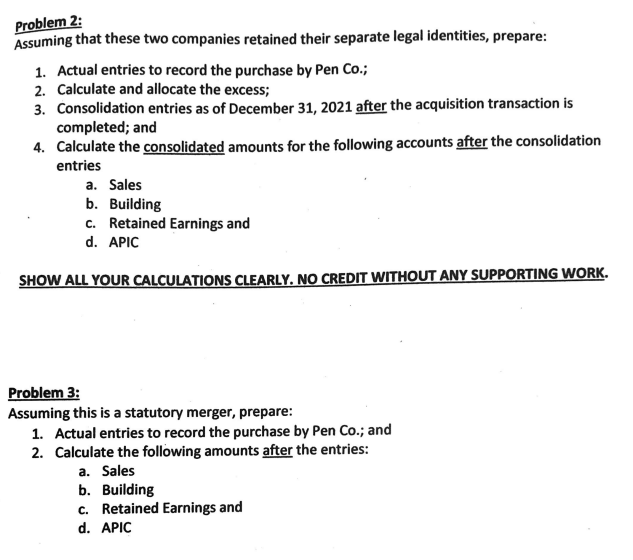

On January 4,2020 , Nelson Corporation purchased 35% of the outstanding voting common stock of Christopher Company for $560,000. This purchase gave Nelson the ability to exercise significant influence over the operating and financial policies of Christopher. On the date of purchase, Christopher's books reported assets of $2,000,000 and liabilities of $600,000. Any excess of cost over book value of Nelson's investment was attributed to a patent with a remaining useful life of 10 years. During 2020, Christopher reported net income of $250,000 and paid cash dividends of $55,000. In 2020, Nelson sold inventory costing $60,000 to Christopher for $80,000. Christopher sold 75% of that inventory to outsiders during 2020 with the remainder being sold in 2021. Required: Prepare all of Nelson's journal entries for 2020 in relation to Christopher Co.. The following are preliminary financial statements for Pen Co. and Sold Co. for the year ending December 31, 2021 prior to Pen's acquisition of Sold. On December 31, 2021 (subsequent to the preceding statements), Pen exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Sold. Pen's stock on that date has a fair value of $60 per share. Pen was willing to issue 10,000 shares of stock because Sold's building was appraised at $450,000 and liabilities at $138,000. Pen also paid $14,000 to attorneys and accountants who assisted in creating this combination. Problem 2: Assuming that these two companies retained their separate legal identities, prepare: 1. Actual entries to record the purchase by Pen Co.; 2. Calculate and allocate the excess; 3. Consolidation entries as of December 31, 2021 after the acquisition transaction is completed; and 4. Calculate the consolidated amounts for the following accounts after the consolidation entries a. Sales b. Building c. Retained Earnings and d. APIC SHOW ALL YOUR CALCULATIONS CLEARLY. NO CREDIT WITHOUT ANY SUPPORTING WORK. Problem 3: Assuming this is a statutory merger, prepare: 1. Actual entries to record the purchase by Pen Co.; and 2. Calculate the following amounts after the entries: a. Sales b. Building c. Retained Earnings and d. APIC On January 4,2020 , Nelson Corporation purchased 35% of the outstanding voting common stock of Christopher Company for $560,000. This purchase gave Nelson the ability to exercise significant influence over the operating and financial policies of Christopher. On the date of purchase, Christopher's books reported assets of $2,000,000 and liabilities of $600,000. Any excess of cost over book value of Nelson's investment was attributed to a patent with a remaining useful life of 10 years. During 2020, Christopher reported net income of $250,000 and paid cash dividends of $55,000. In 2020, Nelson sold inventory costing $60,000 to Christopher for $80,000. Christopher sold 75% of that inventory to outsiders during 2020 with the remainder being sold in 2021. Required: Prepare all of Nelson's journal entries for 2020 in relation to Christopher Co.. The following are preliminary financial statements for Pen Co. and Sold Co. for the year ending December 31, 2021 prior to Pen's acquisition of Sold. On December 31, 2021 (subsequent to the preceding statements), Pen exchanged 10,000 shares of its $10 par value common stock for all of the outstanding shares of Sold. Pen's stock on that date has a fair value of $60 per share. Pen was willing to issue 10,000 shares of stock because Sold's building was appraised at $450,000 and liabilities at $138,000. Pen also paid $14,000 to attorneys and accountants who assisted in creating this combination. Problem 2: Assuming that these two companies retained their separate legal identities, prepare: 1. Actual entries to record the purchase by Pen Co.; 2. Calculate and allocate the excess; 3. Consolidation entries as of December 31, 2021 after the acquisition transaction is completed; and 4. Calculate the consolidated amounts for the following accounts after the consolidation entries a. Sales b. Building c. Retained Earnings and d. APIC SHOW ALL YOUR CALCULATIONS CLEARLY. NO CREDIT WITHOUT ANY SUPPORTING WORK. Problem 3: Assuming this is a statutory merger, prepare: 1. Actual entries to record the purchase by Pen Co.; and 2. Calculate the following amounts after the entries: a. Sales b. Building c. Retained Earnings and d. APIC