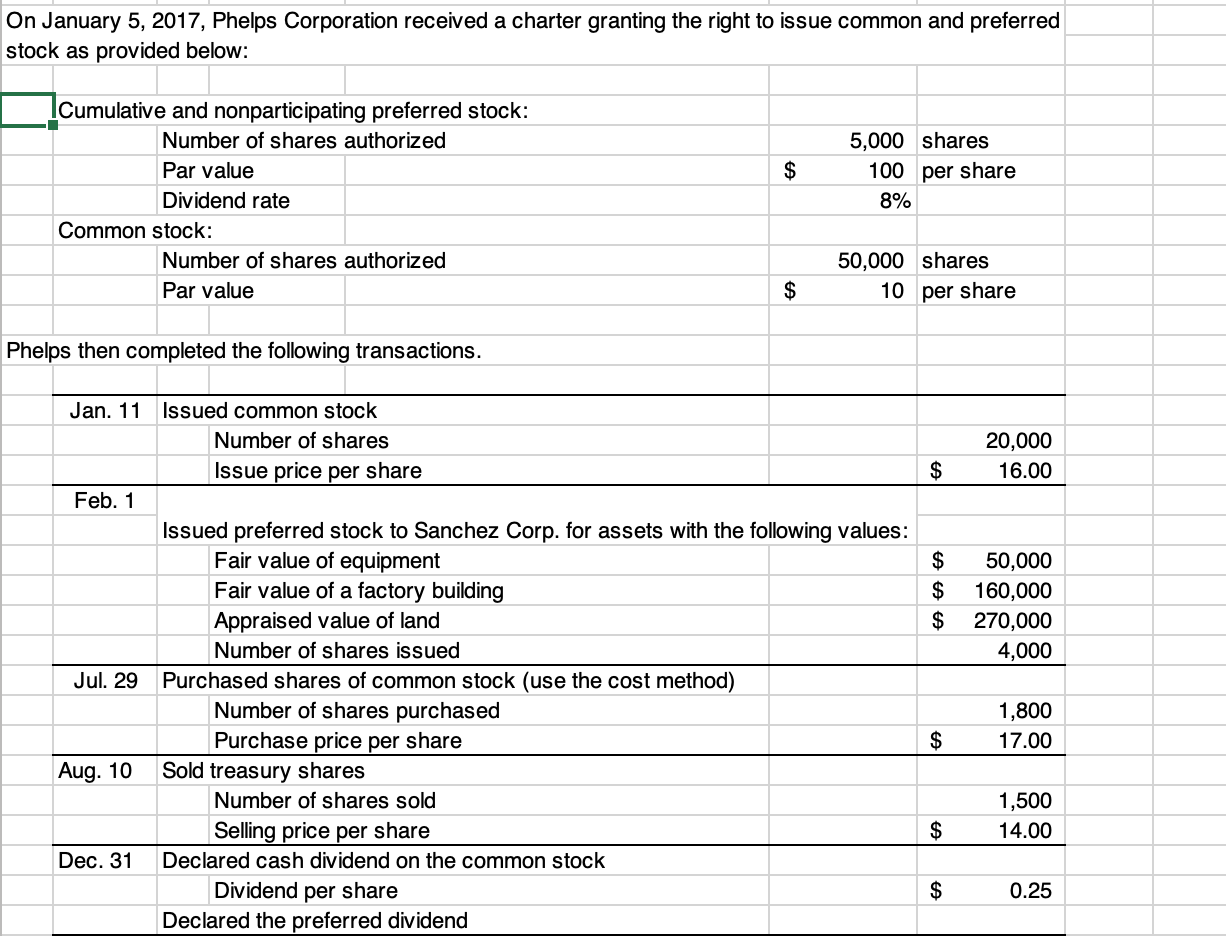

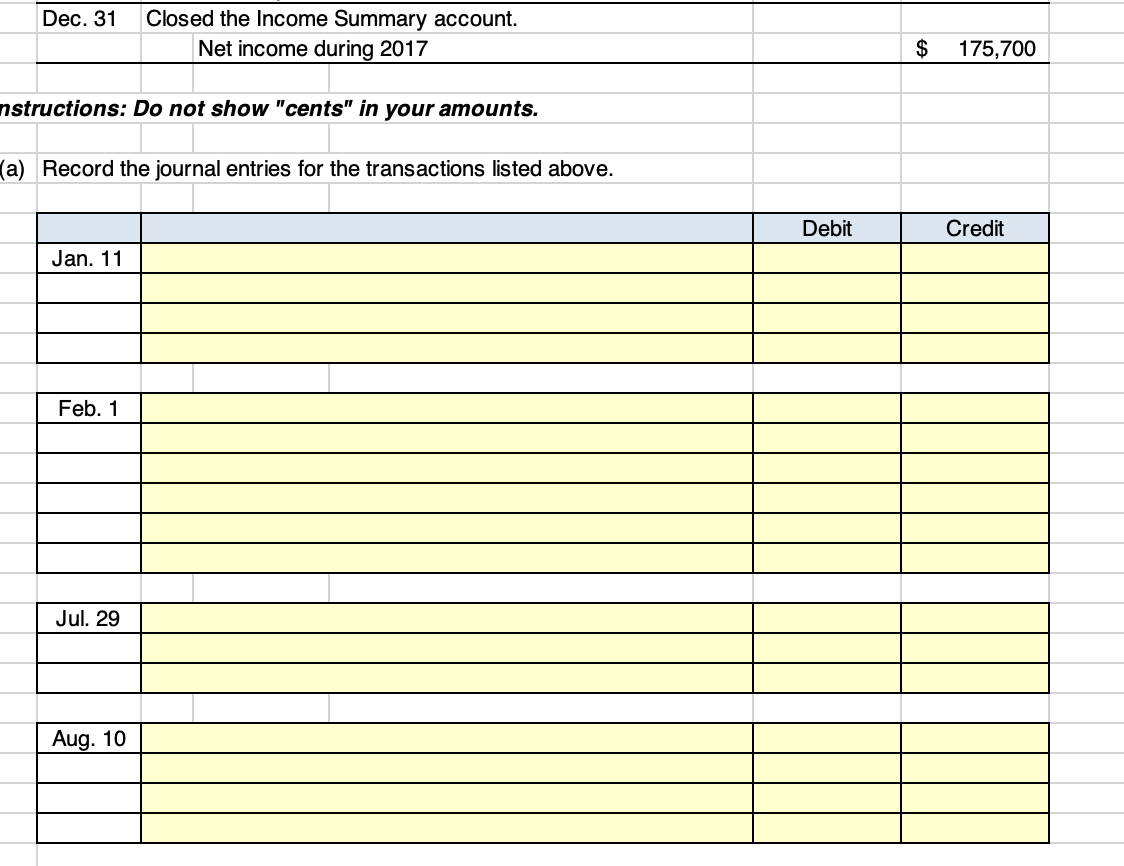

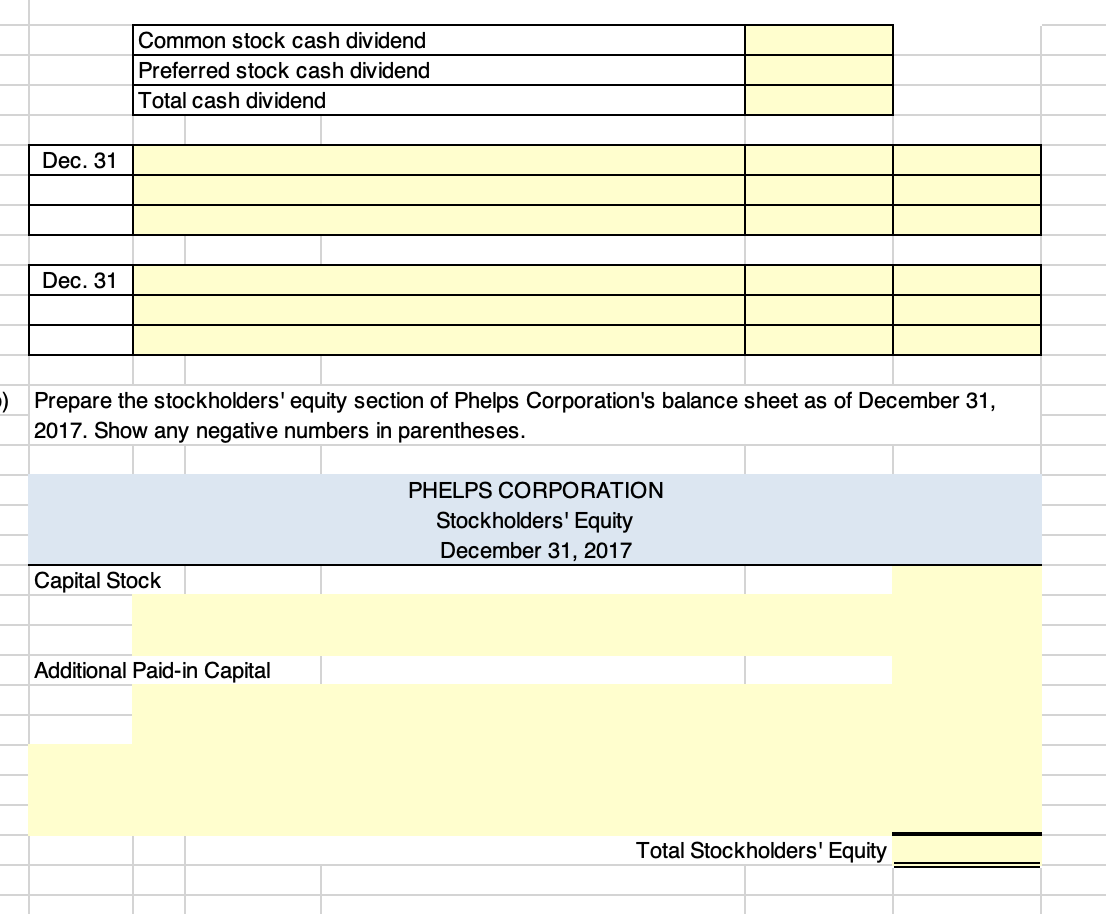

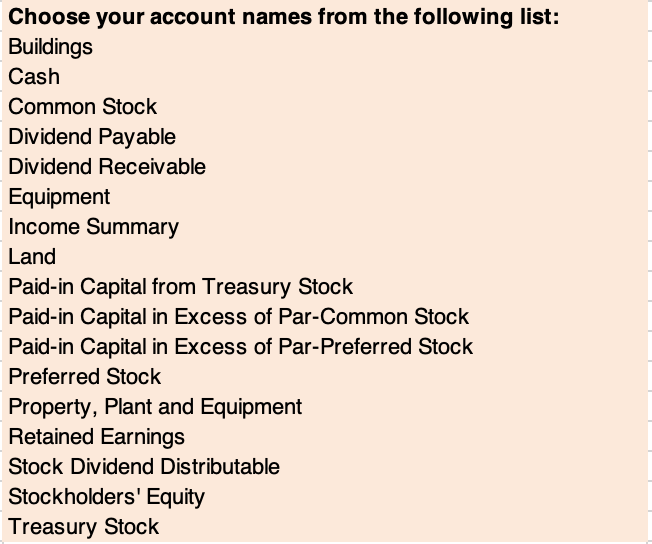

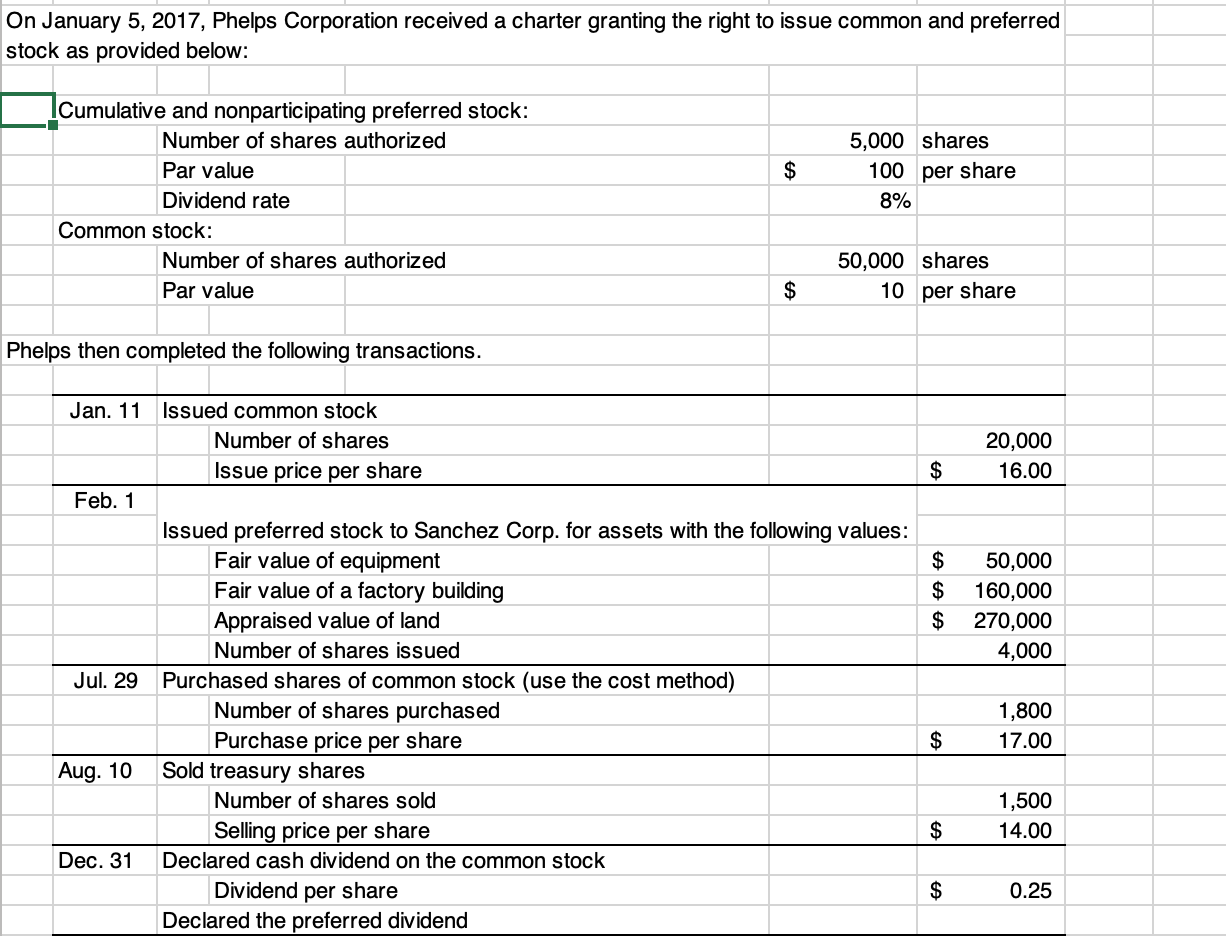

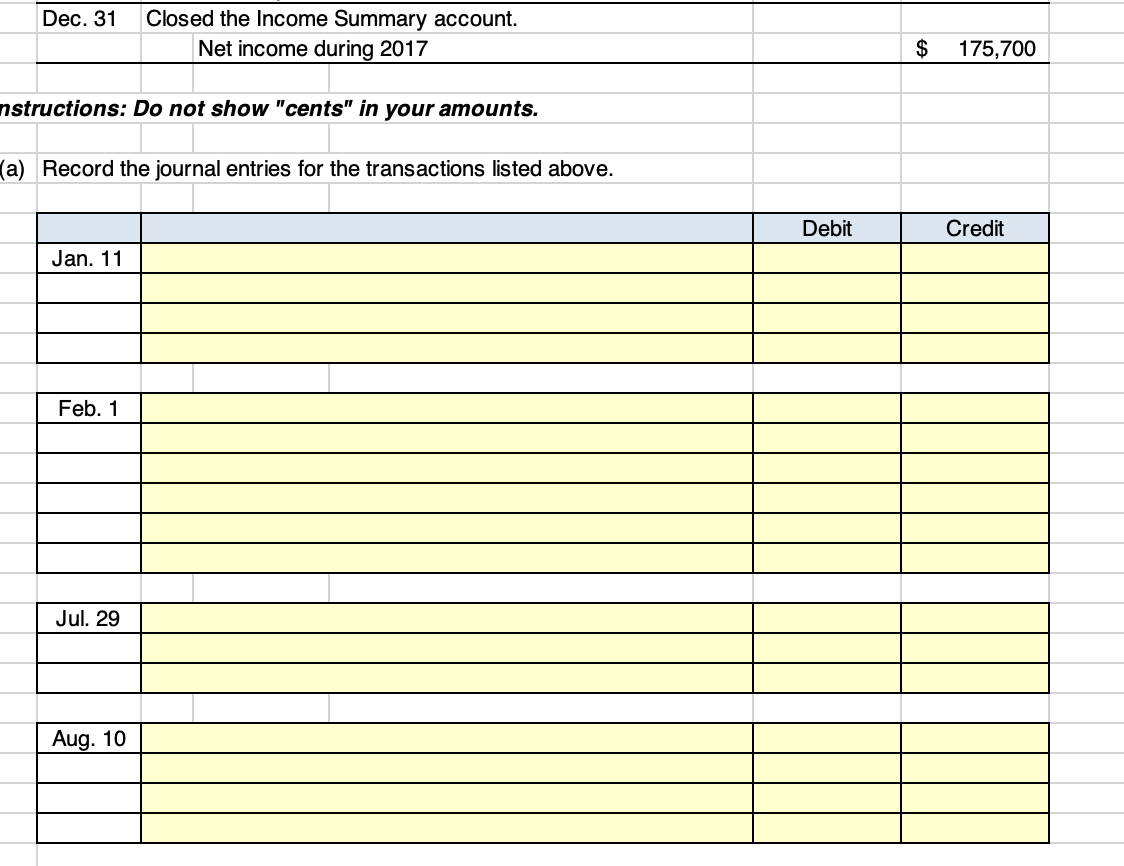

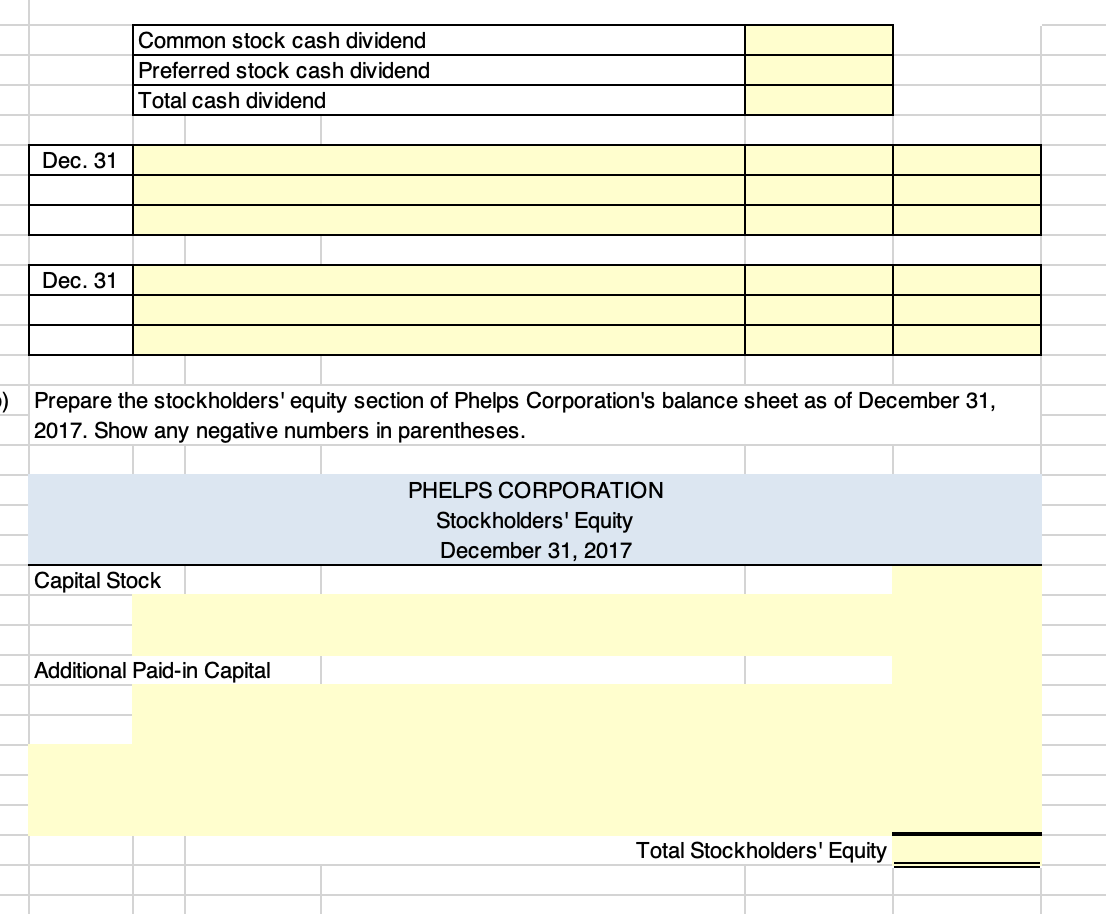

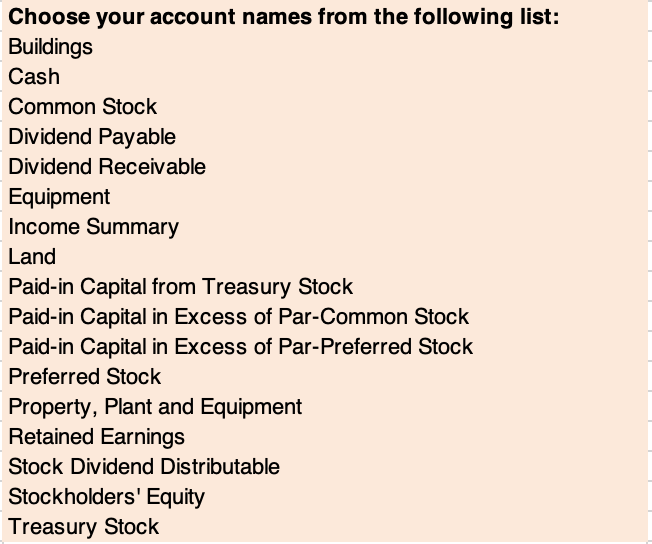

On January 5, 2017, Phelps Corporation received a charter granting the right to issue common and preferred stock as provided below: Cumulative and nonparticipating preferred stock: Number of shares authorized Par value Dividend rate Common stock: Number of shares authorized Par value 5,000 shares 100 per share 8% 50,000 shares 10 per share Phelps then completed the following transactions. 20,000 16.00 $ $ $ $ 50,000 160,000 270,000 4,000 Jan. 11 Issued common stock Number of shares Issue price per share Feb. 1 Issued preferred stock to Sanchez Corp. for assets with the following values: Fair value of equipment Fair value of a factory building Appraised value of land Number of shares issued Jul. 29 Purchased shares of common stock (use the cost method) Number of shares purchased Purchase price per share Aug. 10 Sold treasury shares Number of shares sold Selling price per share Dec. 31 Declared cash dividend on the common stock Dividend per share Declared the preferred dividend 1,800 17.00 $ 1,500 14.00 $ 0.25 Dec. 31 Closed the Income Summary account. Net income during 2017 $ 175,700 nstructions: Do not show "cents" in your amounts. (a) Record the journal entries for the transactions listed above. Debit Credit Jan. 11 Feb. 1 Jul. 29 Aug. 10 Common stock cash dividend Preferred stock cash dividend Total cash dividend Dec. 31 Dec. 31 -) Prepare the stockholders' equity section of Phelps Corporation's balance sheet as of December 31, 2017. Show any negative numbers in parentheses. PHELPS CORPORATION Stockholders' Equity December 31, 2017 Capital Stock Additional Paid-in Capital Total Stockholders' Equity Choose your account names from the following list: Buildings Cash Common Stock Dividend Payable Dividend Receivable Equipment Income Summary Land Paid-in Capital from Treasury Stock Paid-in Capital in Excess of Par-Common Stock Paid-in Capital in Excess of Par-Preferred Stock Preferred Stock Property, Plant and Equipment Retained Earnings Stock Dividend Distributable Stockholders' Equity Treasury Stock On January 5, 2017, Phelps Corporation received a charter granting the right to issue common and preferred stock as provided below: Cumulative and nonparticipating preferred stock: Number of shares authorized Par value Dividend rate Common stock: Number of shares authorized Par value 5,000 shares 100 per share 8% 50,000 shares 10 per share Phelps then completed the following transactions. 20,000 16.00 $ $ $ $ 50,000 160,000 270,000 4,000 Jan. 11 Issued common stock Number of shares Issue price per share Feb. 1 Issued preferred stock to Sanchez Corp. for assets with the following values: Fair value of equipment Fair value of a factory building Appraised value of land Number of shares issued Jul. 29 Purchased shares of common stock (use the cost method) Number of shares purchased Purchase price per share Aug. 10 Sold treasury shares Number of shares sold Selling price per share Dec. 31 Declared cash dividend on the common stock Dividend per share Declared the preferred dividend 1,800 17.00 $ 1,500 14.00 $ 0.25 Dec. 31 Closed the Income Summary account. Net income during 2017 $ 175,700 nstructions: Do not show "cents" in your amounts. (a) Record the journal entries for the transactions listed above. Debit Credit Jan. 11 Feb. 1 Jul. 29 Aug. 10 Common stock cash dividend Preferred stock cash dividend Total cash dividend Dec. 31 Dec. 31 -) Prepare the stockholders' equity section of Phelps Corporation's balance sheet as of December 31, 2017. Show any negative numbers in parentheses. PHELPS CORPORATION Stockholders' Equity December 31, 2017 Capital Stock Additional Paid-in Capital Total Stockholders' Equity Choose your account names from the following list: Buildings Cash Common Stock Dividend Payable Dividend Receivable Equipment Income Summary Land Paid-in Capital from Treasury Stock Paid-in Capital in Excess of Par-Common Stock Paid-in Capital in Excess of Par-Preferred Stock Preferred Stock Property, Plant and Equipment Retained Earnings Stock Dividend Distributable Stockholders' Equity Treasury Stock