Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On January 5, 2020 the Pratts purchased a foreclosure home in Dallas Texas for $90,000 after three months of hard work fixing up their new

On January 5, 2020 the Pratts purchased a foreclosure home in Dallas Texas for $90,000 after three months of hard work fixing up their new home Mr. Pratt transferred to Tampa Florida for work. the Pratts manage to sale thier Dallas home on April 5, 2020 for a $100,000 gain and purchase a new home in Tampa for $200,000 how much of the $100,000 gain must the Pratts recognize on thier their 2020 tax return

all the info that i have.

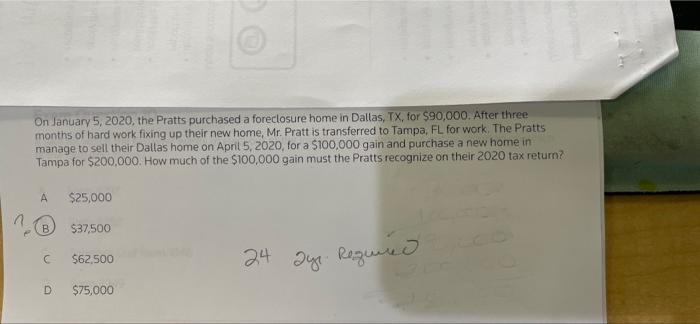

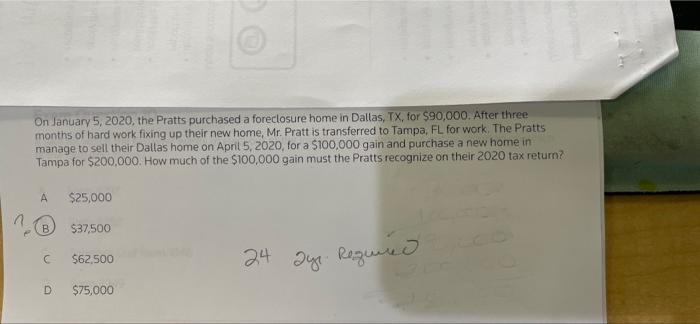

On January 5, 2020, the Pratts purchased a foreclosure home in Dallas, TX, for $90,000. After three months of hard work fixing up their new home, Mr. Pratt is transferred to Tampa, FL for work. The Pratts manage to sell their Dallas home on April 5, 2020, for a $100,000 gain and purchase a new home in Tampa for $200,000. How much of the $100,000 gain must the Pratts recognize on their 2020 tax return? A $25,000 B $37,500 $62,500 24 Required ang D $75,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started