Answered step by step

Verified Expert Solution

Question

1 Approved Answer

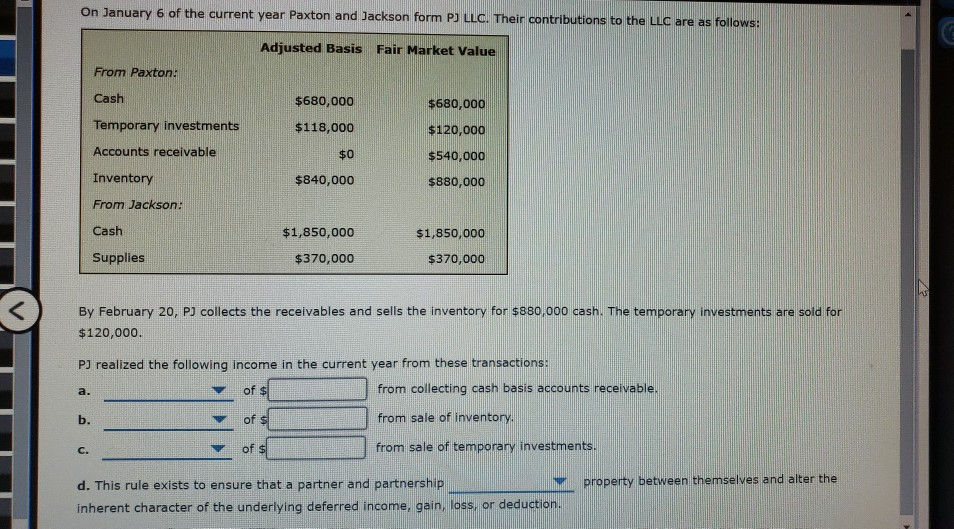

On January 6 of the current year Paxton and Jackson form PJ LLC. Their contributions to the LLC are as follows: Adjusted Basis Fair Market

On January 6 of the current year Paxton and Jackson form PJ LLC. Their contributions to the LLC are as follows: Adjusted Basis Fair Market Value From Paxton: Cash $680,000 $680,000 Temporary investments $120,000 Accounts receivable $118,000 $0 $840,000 $540,000 Inventory $880,000 From Jackson: Cash $1,850,000 $370,000 $1,850,000 $370,000 Supplies By February 20, PJ collects the receivables and sells the inventory for $880,000 cash. The temporary investments are sold for $120,000. PJ realized the following income in the current year from these transactions from collecting cash basis accounts receivable, b. from sale of inventory. of s of $ from sale of temporary investments. property between themselves and alter the d. This rule exists to ensure that a partner and partnership inherent character of the underlying deferred income, gain, loss, or deduction

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started