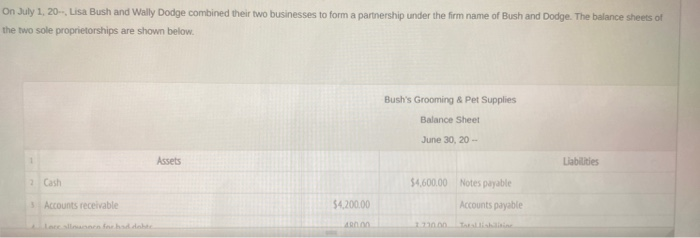

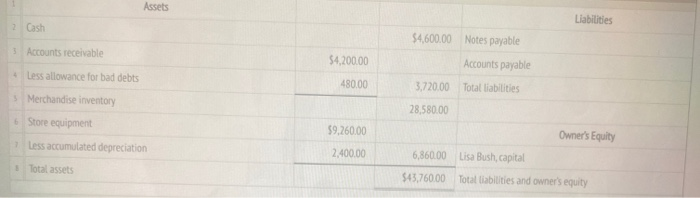

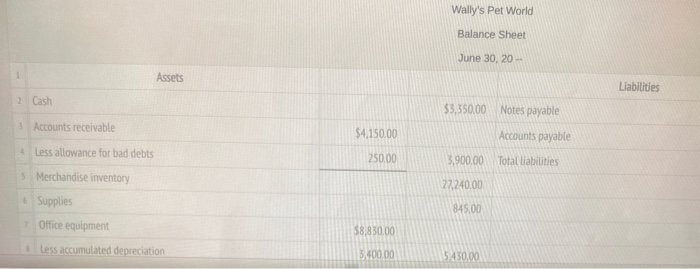

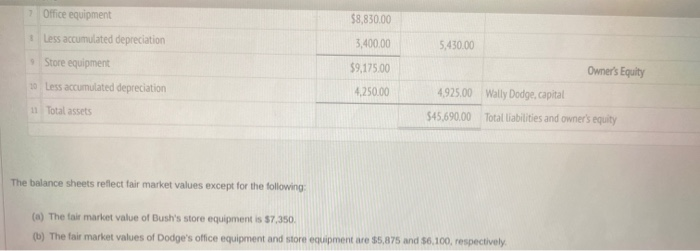

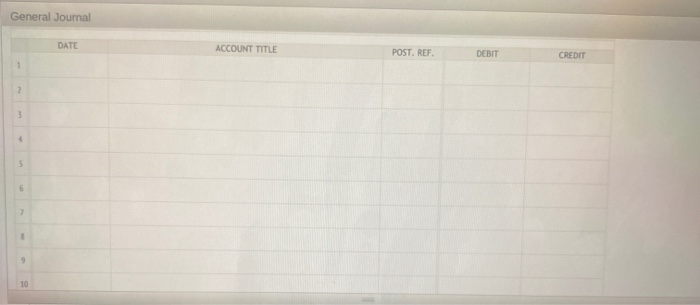

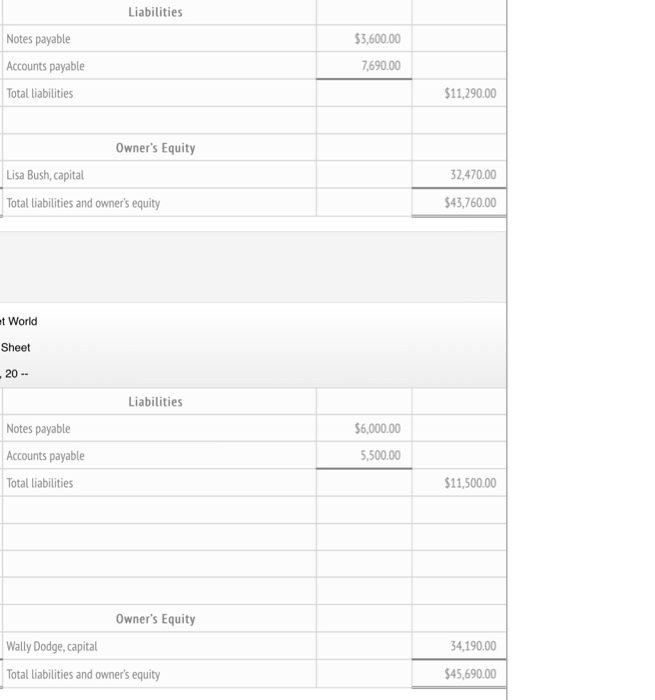

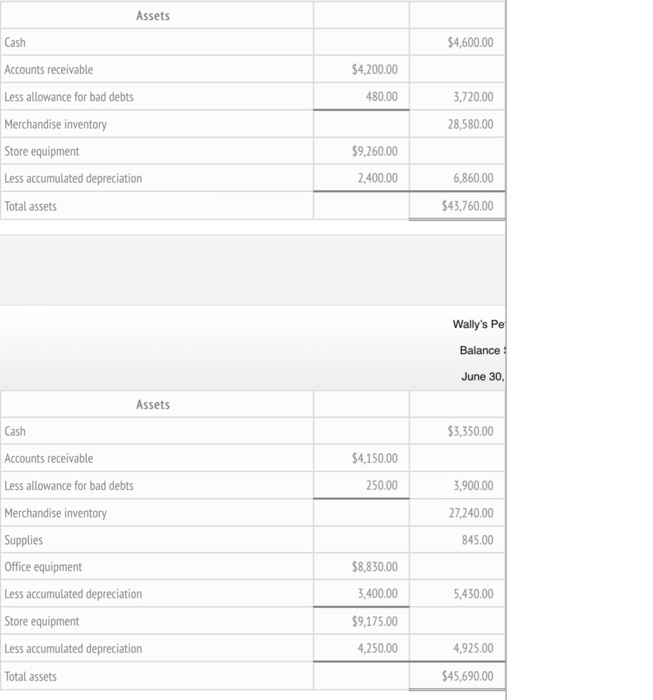

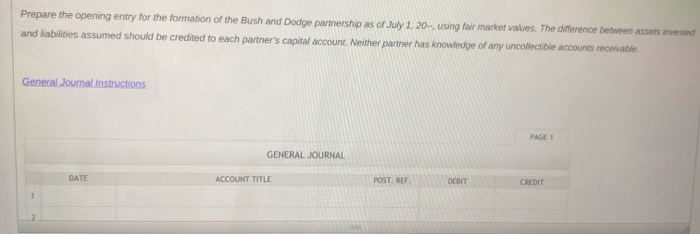

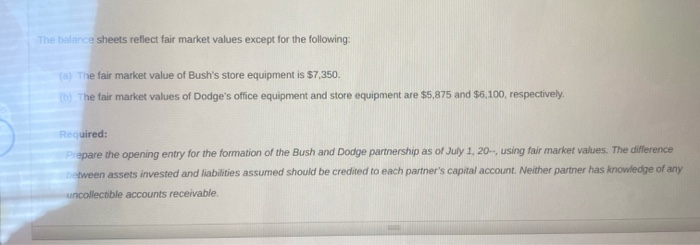

On July 1, 20--. Lisa Bush and Wally Dodge combined their two businesses to form a partnership under the firm name of Bush and Dodge. The balance sheets of the two sole proprietorships are shown below. Bush's Grooming & Pet Supplies Balance Sheet June 30, 20 - Assets Liabilities 2 Cash 54,600.00 Notes payable Accounts payable 3 Accounts receivable $4,200.00 Laterne AR Assets Liabilities 2 Cash 3 Accounts receivable $4,600.00 Notes payable Accounts payable $4,200.00 + Less allowance for bad debts 480.00 3,720.00 Total liabilities Merchandise inventory 28.580.00 Store equipment Less accumulated depreciation 59.260.00 Owner's Equity 2,400.00 Total assets 6,860.00 Lisa Bush, capital $43,760.00 Total liabilities and owner's equity Wally's Pet World Balance Sheet June 30, 20- 1 Assets Liabilities 2 Cash $3,350.00 Notes payable 3 Accounts receivable $4.150.00 Accounts payable Less allowance for bad debts 250.00 3,900.00 Total liabilities 5 Merchandise inventory Supplies 27.240.00 845.00 Office equipment $8,830.00 Less accumulated depreciation 3,400.00 5,450.00 7 Office equipment $8,830.00 5,430.00 Less accumulated depreciation Store equipment 10 Less accumulated depreciation 3,400.00 $9,175.00 Owner's Equity 4,250.00 1 Total assets 4,925.00 Wally Dodge, capital $45,690.00 Total liabilities and owner's equity The balance sheets reflect fair market values except for the following: (a) The fair market value of Bush's store equipment is $7,350. (b) The fair market values of Dodge's office equipment and store equipment are 55,875 and 56,100, respectively. The balance sheets reflect fair market values except for the following: (a) The fair market value of Bush's store equipment is $7,350. (b) The fair market values of Dodge's office equipment and store equipment are $5,875 and 56,100, respectively. Required: Prepare the opening entry for the formation of the Bush and Dodge partnership as of July 1, 20-, using fair market values. The difference between assets invested and liabilities assumed should be credited to each partner's capital account. Neither partner has knowledge of any uncollectible accounts receivable. Prepare the opening entry for the formation of the Bush and Dodge partnership as of July 1, 20- using fair market values. The difference between assets invested and abilities assumed should be credited to each partner's capital account. Neither partner has knowledge of any uncollectible accounts receivable General Journal Instructions PAGE 1 GENERAL JOURNAL DATE ACCOUNT TITLE POST.EE DEBIT CREDIT General Journal DATE ACCOUNT TITLE POST. REF DEBIT CREDIT 1 2 9 10 10 11 11 13 16 17 Liabilities $3,600.00 Notes payable Accounts payable Total liabilities 7,690.00 $11,290.00 Owner's Equity Lisa Bush, capital Total liabilities and owner's equity 32,470.00 $43,760.00 et World Sheet - 20 - Liabilities $6,000.00 Notes payable Accounts payable Total liabilities 5,500.00 $11,500.00 Owner's Equity Wally Dodge, capital Total liabilities and owner's equity 34,190.00 $45,690.00 Assets Cash $4,600.00 $4,200.00 480.00 3,720.00 28,580.00 Accounts receivable Less allowance for bad debts Merchandise inventory Store equipment Less accumulated depreciation Total assets $9,260.00 2,400.00 6,860.00 $43,760.00 Wally's Pe Balance June 30 Assets Cash $3,350.00 $4,150.00 250,00 3,900.00 Accounts receivable Less allowance for bad debts Merchandise inventory Supplies Office equipment Less accumulated depreciation Store equipment 27,240.00 845.00 $8,830.00 3,400.00 5,430.00 $9,175.00 Less accumulated depreciation 4,250.00 4,925.00 Total assets $45,690.00 Prepare the opening entry for the formation of the Bush and Dodge partnership as of July 1, 20-, using fair market values. The difference between assets invested and liabilities assumed should be credited to each partner's capital account. Neither partner has knowledge of any uncollectible accounts receivable General Journal Instructions PAGE GENERAL JOURNAL DATE ACCOUNT TITLE POST. REF DEBIT CREDIT The balance sheets reflect fair market values except for the following: (a) The fair market value of Bush's store equipment is $7,350 (b) The fair market values of Dodge's office equipment and store equipment are $5,875 and $6,100, respectively. Required: Prepare the opening entry for the formation of the Bush and Dodge partnership as of July 1, 20-, using fair market values. The difference between assets invested and liabilities assumed should be credited to each partner's capital account. Neither partner has knowledge of any uncollectible accounts receivable