Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2016, Janson Bottle Company sold $500,000 in 8%, 10-year bonds. The bonds were sold to yield a rate of 10%. The

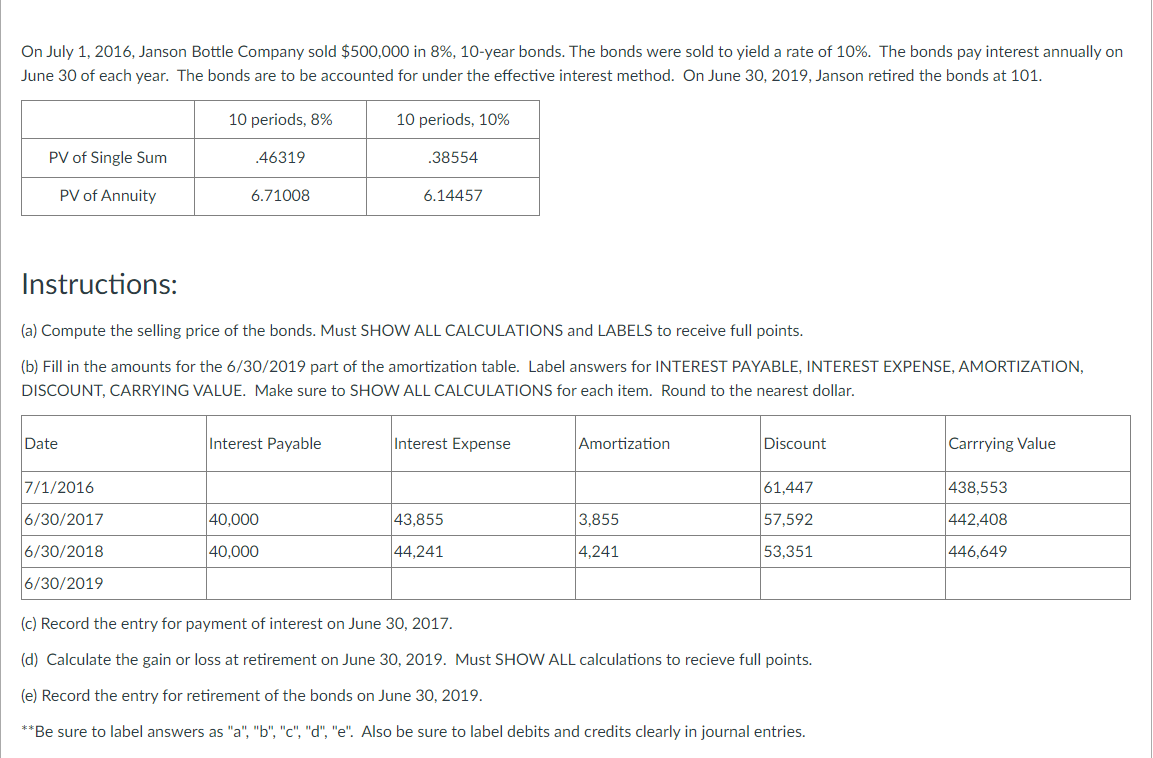

On July 1, 2016, Janson Bottle Company sold $500,000 in 8%, 10-year bonds. The bonds were sold to yield a rate of 10%. The bonds pay interest annually on June 30 of each year. The bonds are to be accounted for under the effective interest method. On June 30, 2019, Janson retired the bonds at 101. 10 periods, 10% PV of Single Sum PV of Annuity Instructions: Date 10 periods, 8% .46319 7/1/2016 6/30/2017 6/30/2018 6/30/2019 6.71008 (a) Compute the selling price of the bonds. Must SHOW ALL CALCULATIONS and LABELS to receive full points. (b) Fill in the amounts for the 6/30/2019 part of the amortization table. Label answers for INTEREST PAYABLE, INTEREST EXPENSE, AMORTIZATION, DISCOUNT, CARRYING VALUE. Make sure to SHOW ALL CALCULATIONS for each item. Round to the nearest dollar. Interest Payable .38554 40,000 40,000 6.14457 Interest Expense 43,855 44,241 Amortization 3,855 4,241 Discount 61,447 57,592 53,351 (c) Record the entry for payment of interest on June 30, 2017. (d) Calculate the gain or loss at retirement on June 30, 2019. Must SHOW ALL calculations to recieve full points. (e) Record the entry for retirement of the bonds on June 30, 2019. **Be sure to label answers as "a", "b", "c", "d", "e". Also be sure to label debits and credits clearly in journal entries. Carrrying Value 438,553 442,408 446,649

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started