Question

On July 1, 2016, the first day of its 2017 fiscal year, the City of Nevin issued at par $7,200,000 of 4 percent term bonds

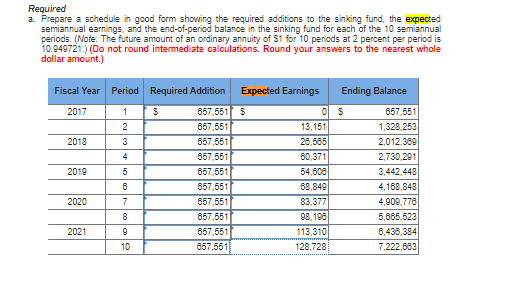

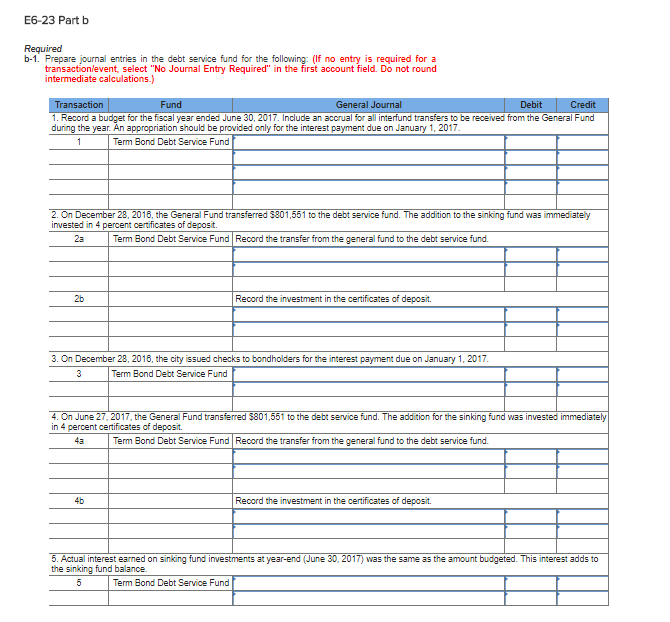

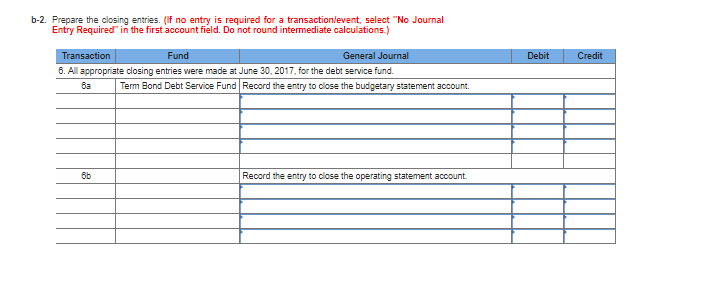

On July 1, 2016, the first day of its 2017 fiscal year, the City of Nevin issued at par $7,200,000 of 4 percent term bonds to construct a new city office building. The bonds mature in five years on July 1, 2021. Interest is payable semiannually on January 1 and July 1. A sinking fund is to be established with equal semiannual additions made on June 30 and December 31, with the first addition to be made on December 31, 2016. Cash for the sinking fund additions and the semiannual interest payments will be transferred from the General Fund shortly before the due dates. City officials assume a yield on sinking fund investments of 4 percent per annum, compounded semiannually. Investment earnings are added to the investment principal.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started