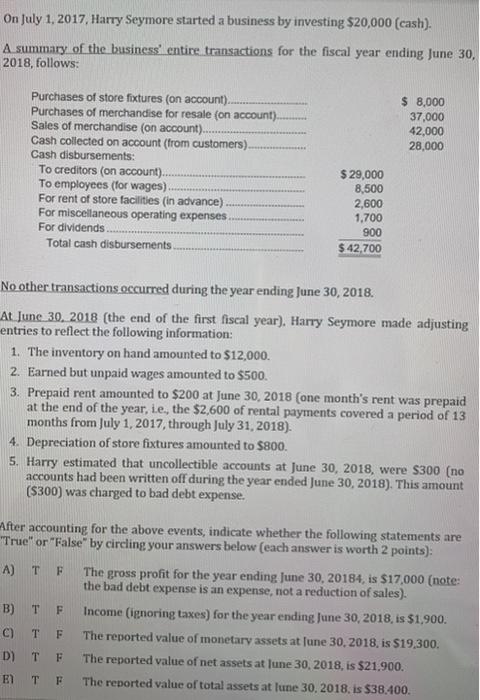

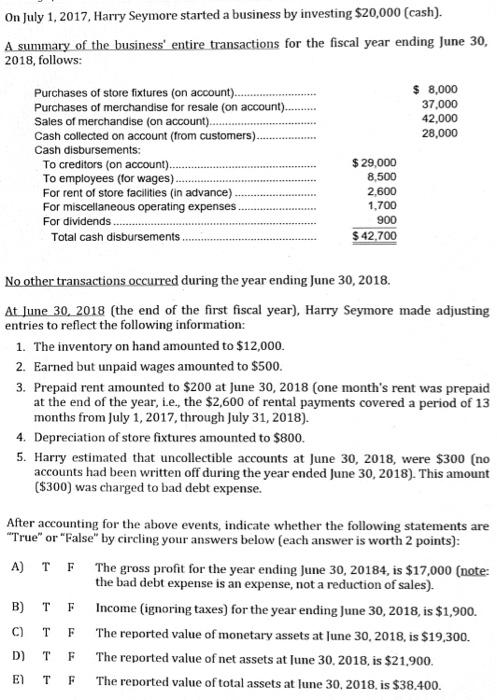

On July 1, 2017, Harry Seymore started a business by investing $20,000 (cash). A summary of the business entire transactions for the fiscal year ending June 30, 2018, follows: $ 8,000 37,000 42.000 28,000 Purchases of store fixtures (on account). Purchases of merchandise for resale (on account). Sales of merchandise (on account). Cash collected on account (from customers). Cash disbursements: To creditors (on account) To employees (for wages). For rent of store facilities (in advance) For miscellaneous operating expenses For dividends Total cash disbursements $ 29,000 8,500 2,600 1,700 900 $ 42,700 No other transactions occurred during the year ending June 30, 2018. At June 30, 2018 (the end of the first fiscal year). Harry Seymore made adjusting entries to reflect the following information: 1. The inventory on hand amounted to $12,000. 2. Earned but unpaid wages amounted to $500 3. Prepaid rent amounted to $200 at June 30, 2018 (one month's rent was prepaid at the end of the year, i.e., the $2,600 of rental payments covered a period of 13 months from July 1, 2017, through July 31, 2018). 4. Depreciation of store fixtures amounted to $800. 5. Harry estimated that uncollectible accounts at June 30, 2018, were $300 (no accounts had been written off during the year ended June 30, 2018). This amount (5300) was charged to bad debt expense. F After accounting for the above events, indicate whether the following statements are "True" or "false" by circling your answers below (each answer is worth 2 points): A) T The gross profit for the year ending June 30, 20184, is $17,000 (note: the bad debt expense is an expense, not a reduction of sales). B) T Income (ignoring taxes) for the year ending June 30, 2018, is $1,900. C) The reported value of monetary assets at June 30, 2018, is $19,300. D) T F The reported value of net assets at June 30, 2018, is $21.900. ) The reported value of total assets at lune 30, 2018, is $38.400. F F On July 1, 2017, Harry Seymore started a business by investing $20,000 (cash). A summary of the business' entire transactions for the fiscal year ending June 30, 2018, follows: $ 8,000 37,000 42,000 28,000 Purchases of store fixtures (on account)... Purchases of merchandise for resale (on account)... Sales of merchandise (on account)..... Cash collected on account (from customers). Cash disbursements: To creditors (on account). To employees (for wages). For rent of store facilities (in advance). For miscellaneous operating expenses For dividends. Total cash disbursements $ 29,000 8,500 2,600 1,700 900 $ 42.700 No other transactions occurred during the year ending June 30, 2018. At June 30, 2018 (the end of the first fiscal year), Harry Seymore made adjusting entries to reflect the following information: 1. The inventory on hand amounted to $12,000. 2. Earned but unpaid wages amounted to $500. 3. Prepaid rent amounted to $200 at June 30, 2018 (one month's rent was prepaid at the end of the year, i.e., the $2,600 of rental payments covered a period of 13 months from July 1, 2017, through July 31, 2018). 4. Depreciation of store fixtures amounted to $800. 5. Harry estimated that uncollectible accounts at June 30, 2018, were $300 (no accounts had been written off during the year ended June 30, 2018). This amount ($300) was charged to bad debt expense. After accounting for the above events, indicate whether the following statements are "True" or "False" by circling your answers below (each answer is worth 2 points): A) TF The gross profit for the year ending June 30, 20184, is $17,000 (note: the bad debt expense is an expense, not a reduction of sales). B) Income (ignoring taxes) for the year ending June 30, 2018, is $1,900. C) T F The reported value of monetary assets at June 30, 2018, is $19,300. D) TF The reported value of net assets at June 30, 2018, is $21.900. F The reported value of total assets at lune 30, 2018. is $38.400. T F E) T