Answered step by step

Verified Expert Solution

Question

1 Approved Answer

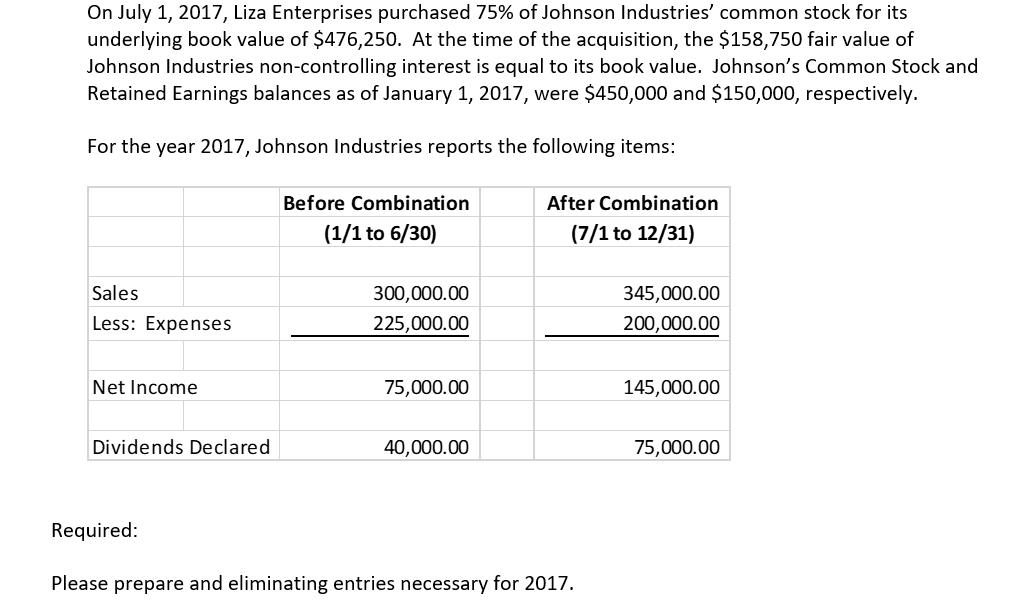

On July 1, 2017, Liza Enterprises purchased 75% of Johnson Industries' common stock for its underlying book value of $476,250. At the time of

On July 1, 2017, Liza Enterprises purchased 75% of Johnson Industries' common stock for its underlying book value of $476,250. At the time of the acquisition, the $158,750 fair value of Johnson Industries non-controlling interest is equal to its book value. Johnson's Common Stock and Retained Earnings balances as of January 1, 2017, were $450,000 and $150,000, respectively. For the year 2017, Johnson Industries reports the following items: Sales Less: Expenses Net Income Dividends Declared Required: Before Combination (1/1 to 6/30) 300,000.00 225,000.00 75,000.00 40,000.00 After Combination (7/1 to 12/31) Please prepare and eliminating entries necessary for 2017. 345,000.00 200,000.00 145,000.00 75,000.00

Step by Step Solution

★★★★★

3.38 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Journal Entries Capital Retained Earnings Godwill Investment ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d760045e46_175825.pdf

180 KBs PDF File

635d760045e46_175825.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started