Question

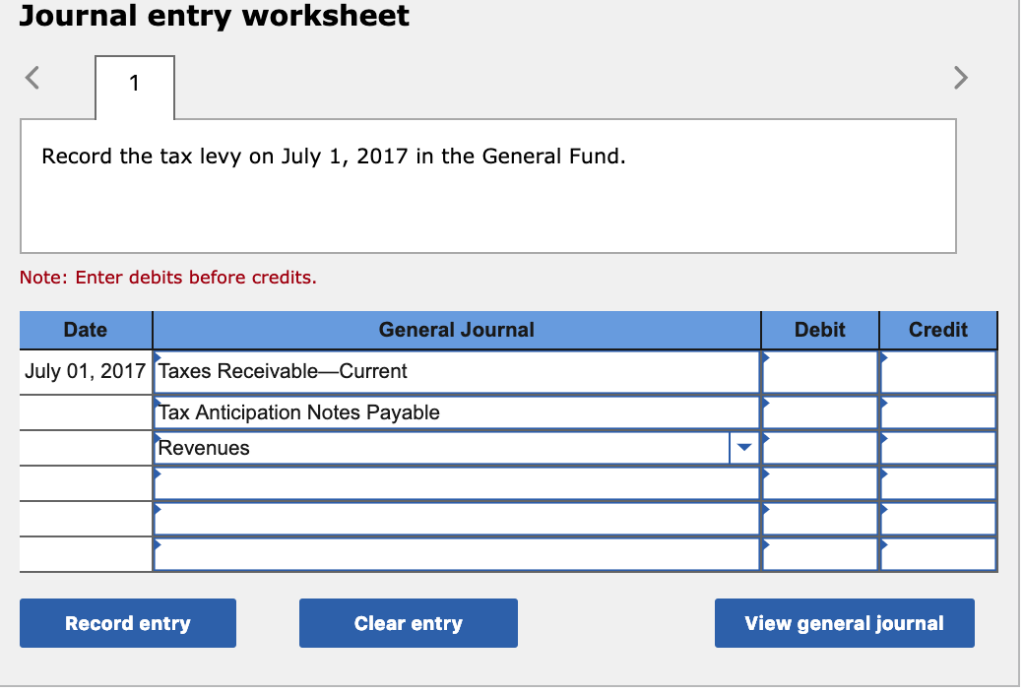

On July 1, 2017, the beginning of its fiscal year, Ridgedale County recorded gross property tax levies of $4,500,000. The county estimated that 4 percent

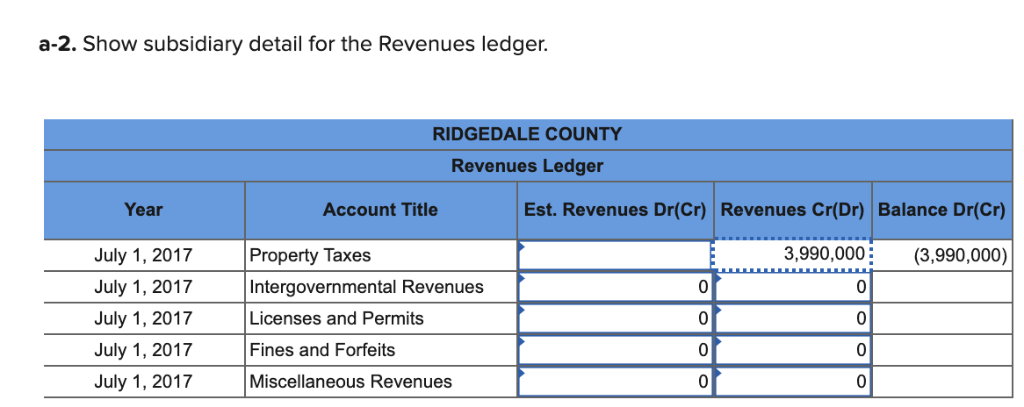

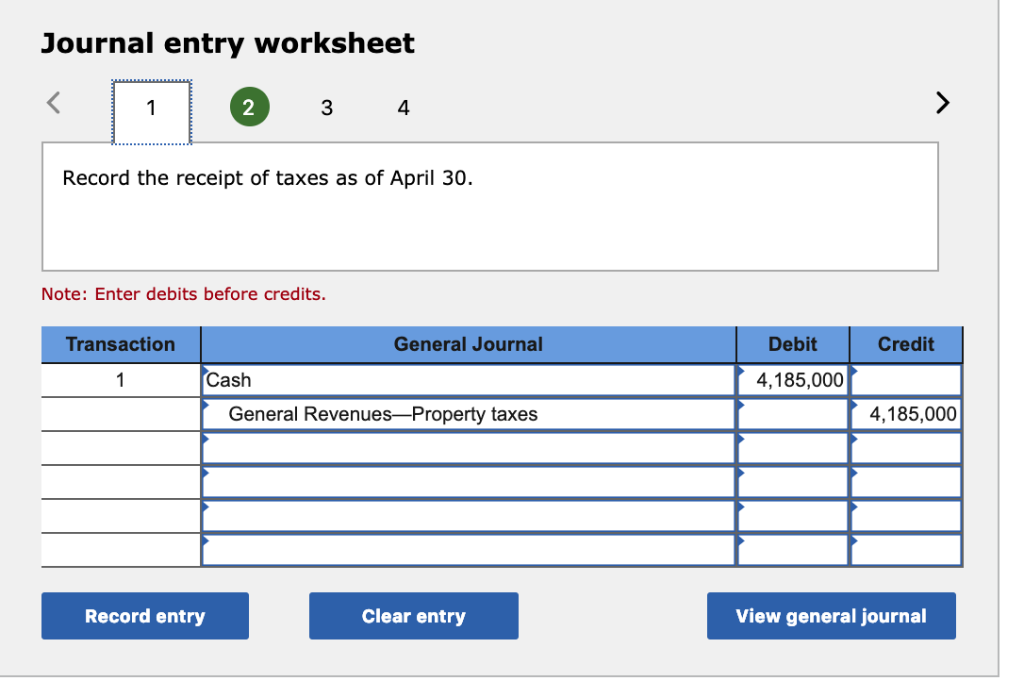

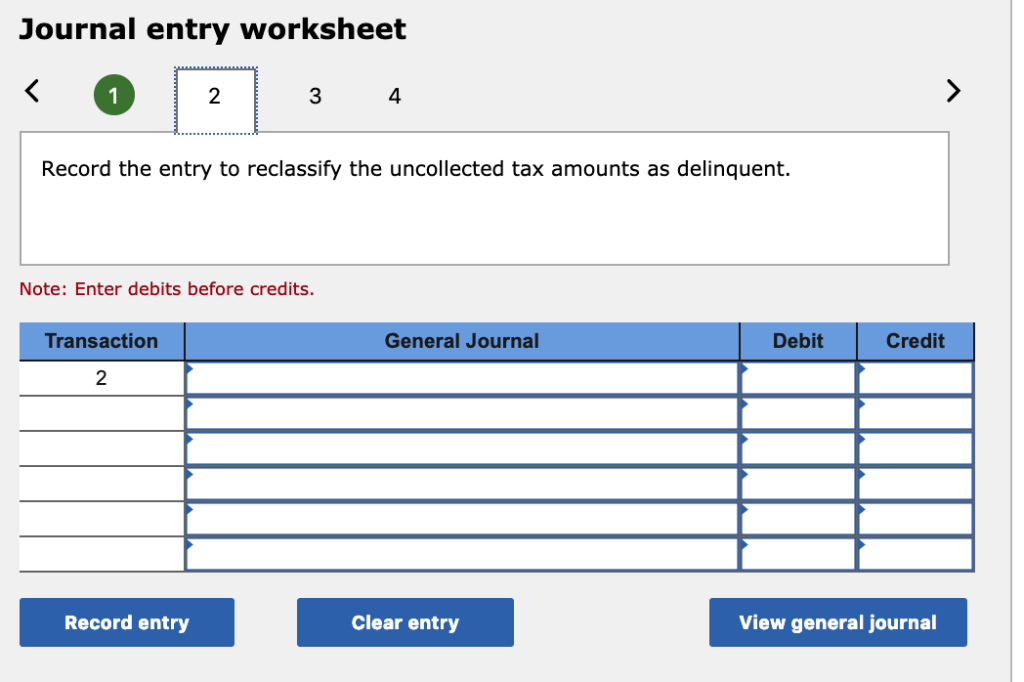

On July 1, 2017, the beginning of its fiscal year, Ridgedale County recorded gross property tax levies of $4,500,000. The county estimated that 4 percent of the taxes levied would be uncollectible. As of April 30, 2018, the due date for all property taxes, the county had collected $4,185,000 in taxes. The county imposed penalties and interest in the amount of $14,800, but only expects to collect $12,950 of that amount. At the end of the fiscal year (June 30, 2018) the county had collected $54,500 in delinquent taxes and $5,100 in interest and penalties on the delinquent taxes.

Available Accounts to use:

- No Journal Entry Required

- Allowance for Uncollectible Current Taxes

- Allowance for Uncollectible Delinquent Taxes

- Allowance for Uncollectible Interest and Penalties

- Appropriations

- Budgetary Fund Balance

- Cash

- Due from State Government

- Due to Federal Government

- Due to State Government

- Encumbrances

- Encumbrances Outstanding

- Estimated Revenues

- Expenditures

- ExpensesGeneral Government

- ExpensesPublic Safety

- Fund BalanceNonspendableInterfund Loans Receivable

- Fund BalanceNonspendableInventory of Supplies

- Fund BalanceUnassigned

- General RevenuesInterest and penalities on delinquent taxes

- General RevenuesMiscellaneous

- General RevenuesProperty taxes

- Interest and Penalties Receivable on Taxes

- Interfund Loans PayableCurrent

- Interfund Loans PayableNoncurrent

- Interfund Loans ReceivableCurrent

- Interfund Loans ReceivableNoncurrent

- Inventory of Supplies

- Other Financing Sources

- Other Financing Uses

- Program RevenuesGeneral Government

- Program RevenuesPublic Safety

- Revenues

- Tax Anticipation Notes Payable

- Taxes ReceivableCurrent

- Taxes ReceivableDelinquent

- Vouchers Payable

If you have time please explain why you choose the account and the meaning behind it too. thank you

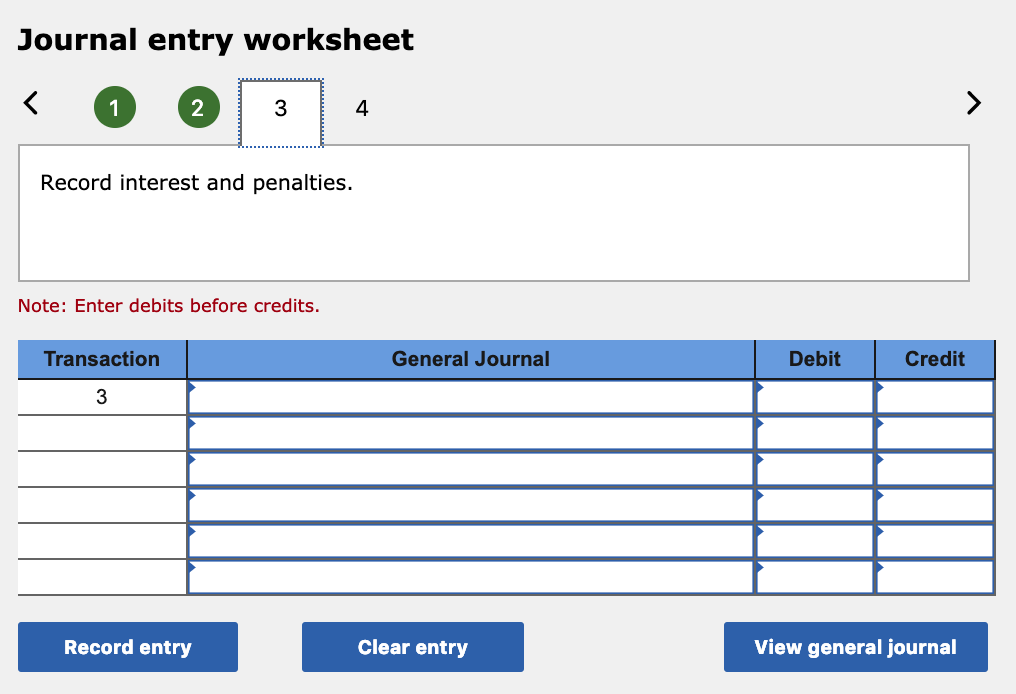

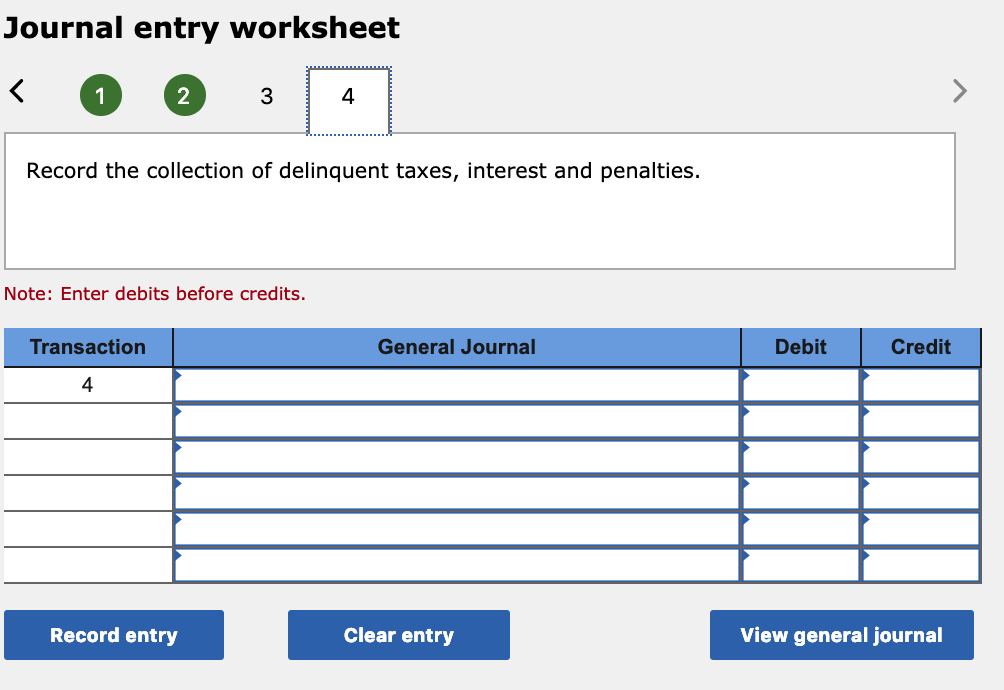

Journal entry worksheet Record the tax levy on July 1, 2017 in the General Fund Note: Enter debits before credits Date General Journal Debit Credit July 01, 2017 Taxes Receivable-Current Tax Anticipation Notes Payable evenues Record entry Clear entry View general journal a-2. Show subsidiary detail for the Revenues ledger. RIDGEDALE COUNTY Revenues Ledger Year Account Title Est. Revenues Dr(Cr) Revenues Cr(Dr) Balance Dr(C) July 1, 2017 July 1, 2017 July 1, 2017 July 1, 2017 July 1, 2017 3,990,000:(3,990,000) Property Taxes Intergovernmental Revenues Licenses and Permit Fines and Forfeits Miscellaneous Revenues 0 0 0 0 0 0 ournal entry worksheet 1 2 3 4 Record the entry to reclassify the uncollected tax amounts as delinquent. Note: Enter debits before credits. Transaction General Journal Debit Credit 2 Record entry Clear entry View general journal Journal entry worksheet 2 4 Record interest and penalties. Note: Enter debits before credits. Transaction General Journal Debit Credit Record entry Clear entry View general journal Journal entry worksheet 2 4 Record the collection of delinquent taxes, interest and penalties. Note: Enter debits before credits. Transaction General Journal Debit Credit 4 Record entry Clear entry View general journalStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started