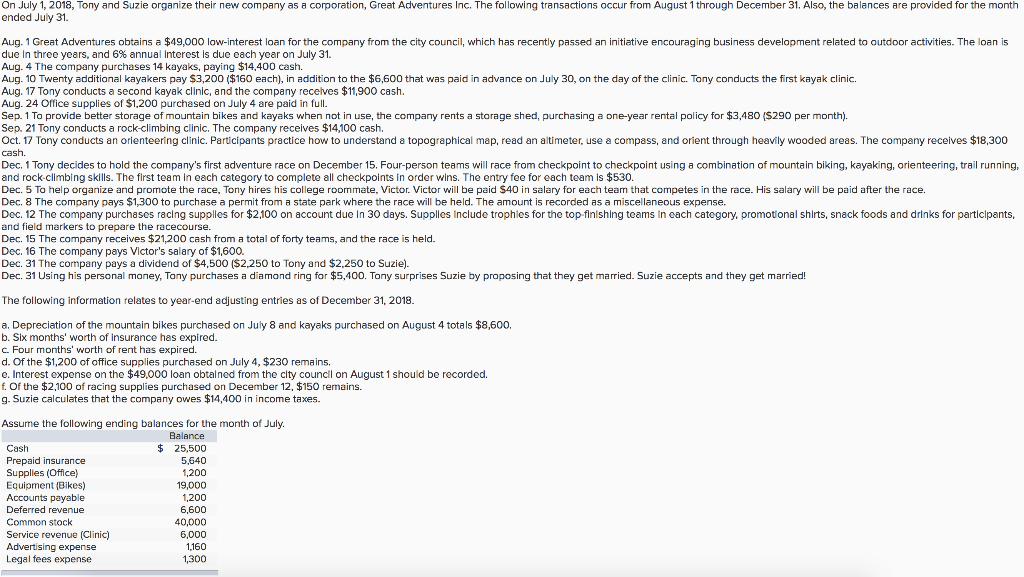

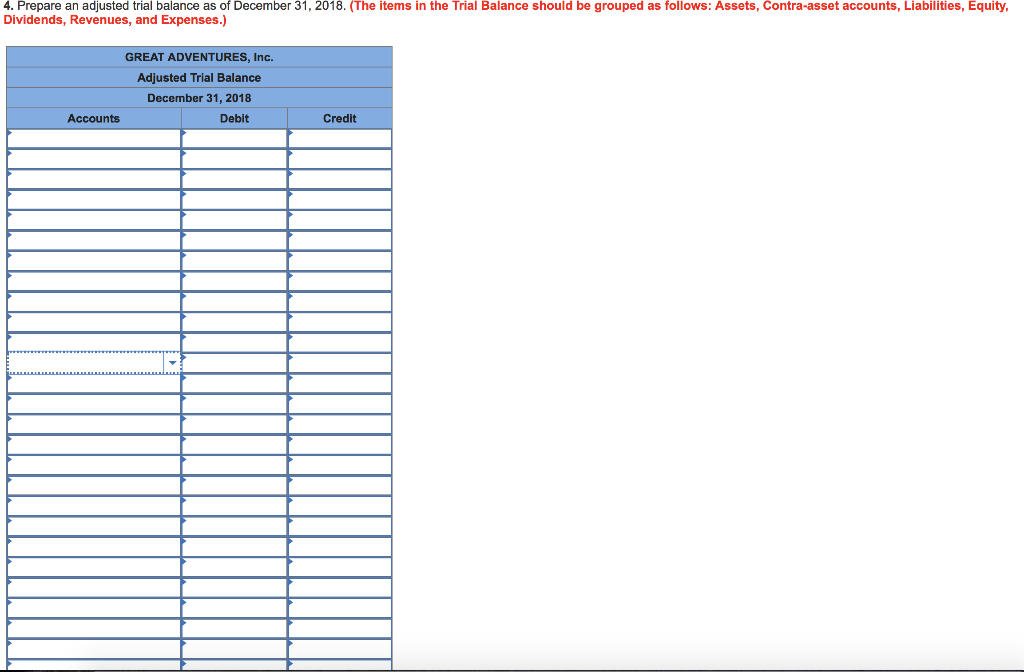

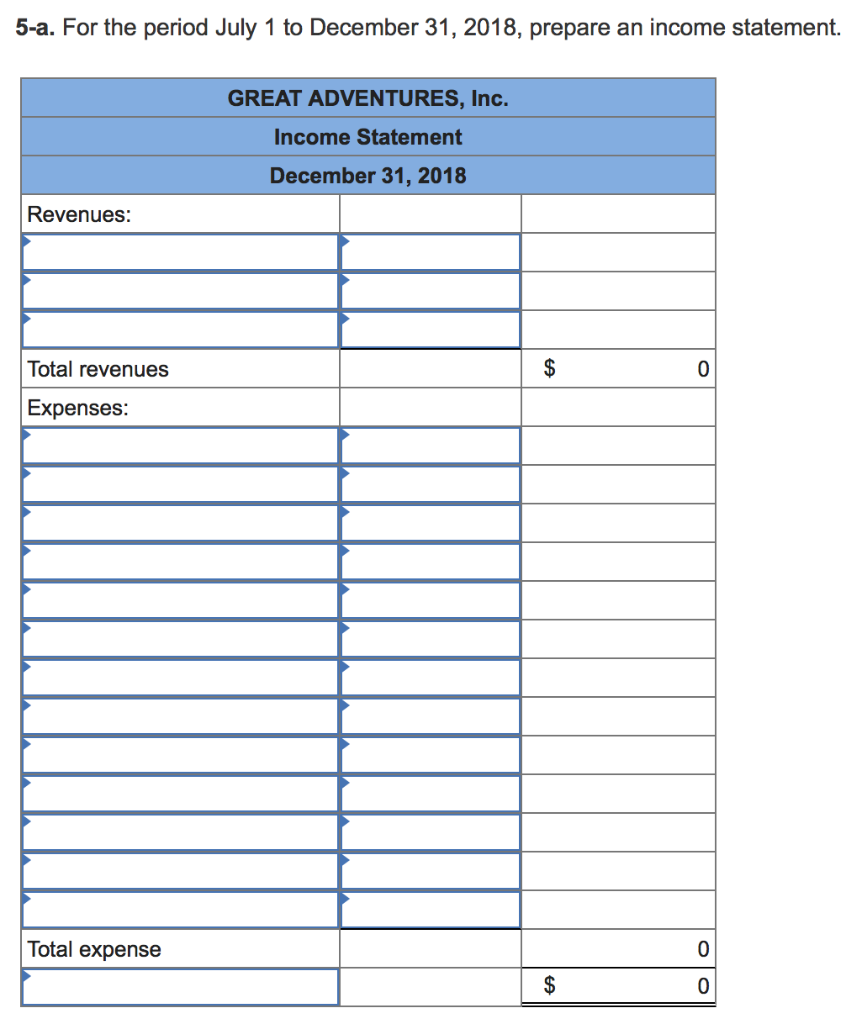

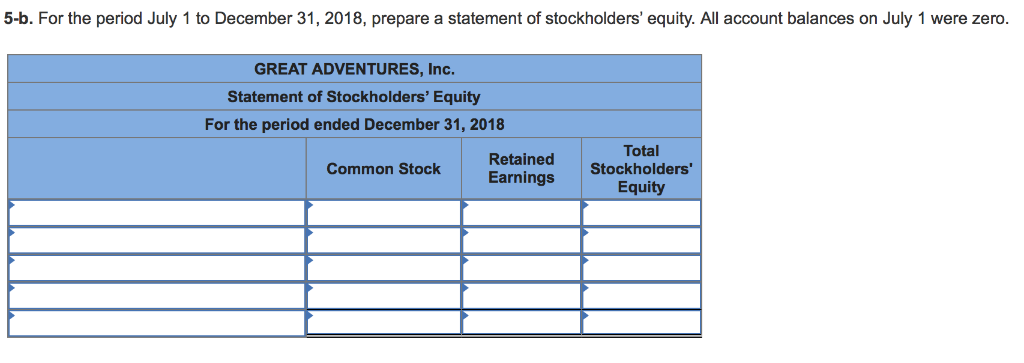

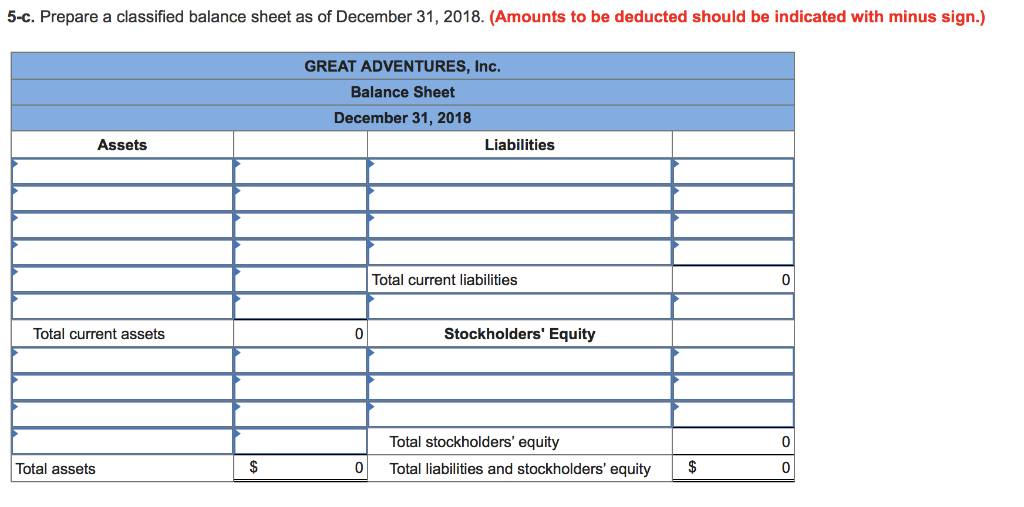

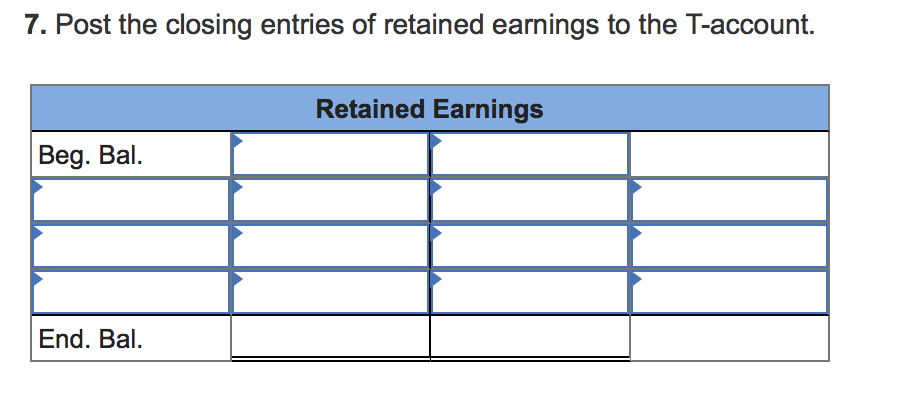

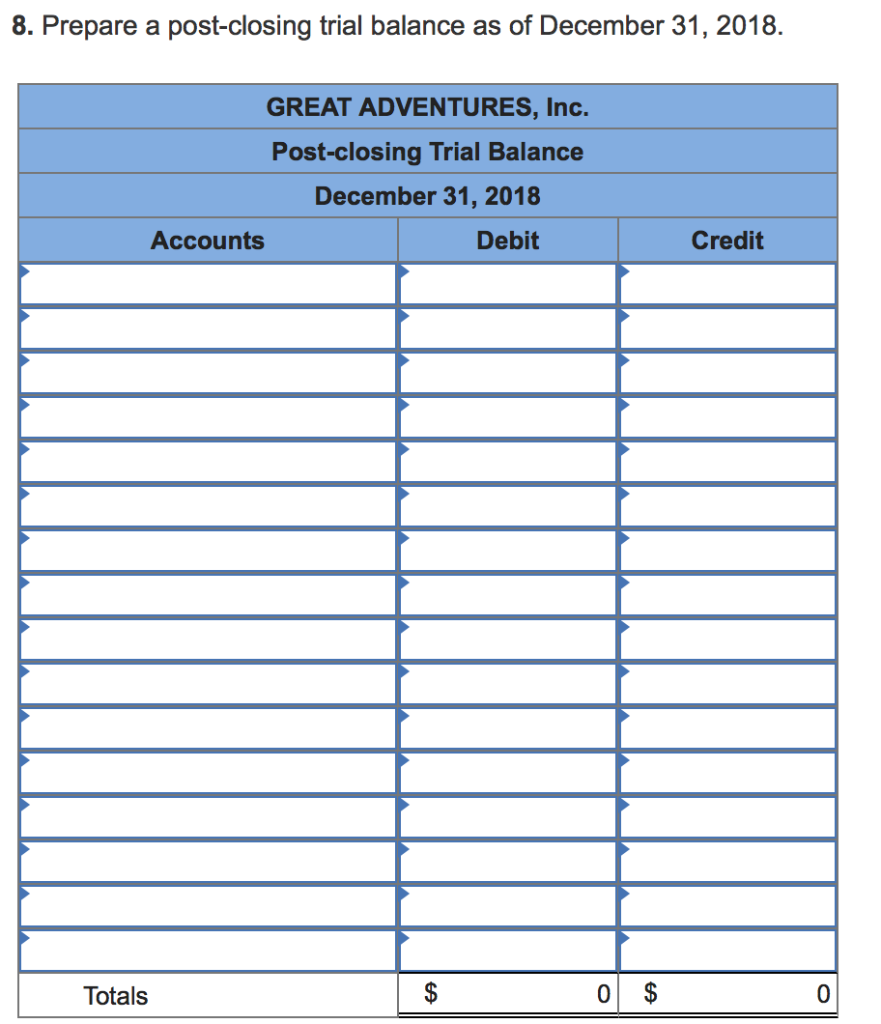

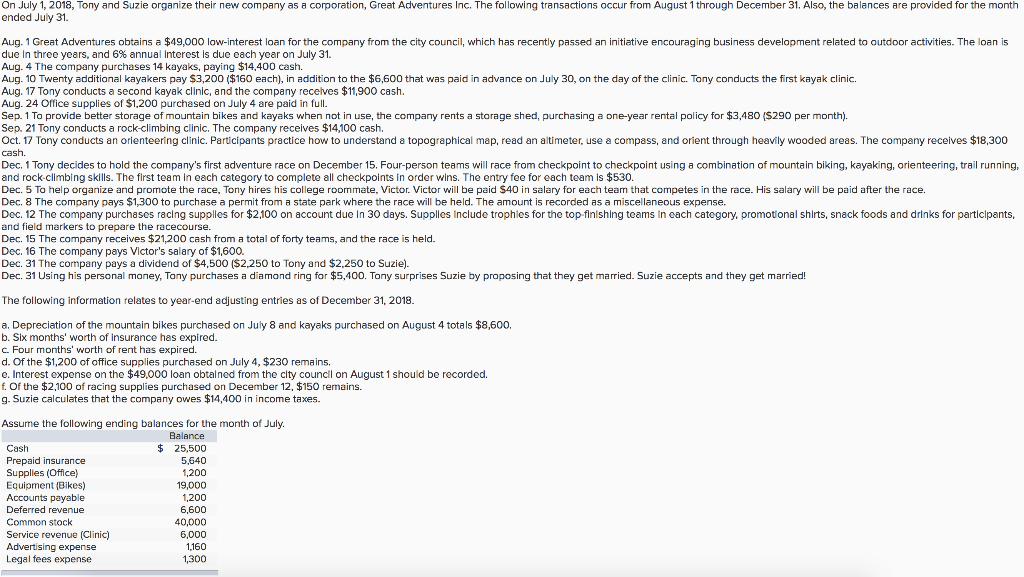

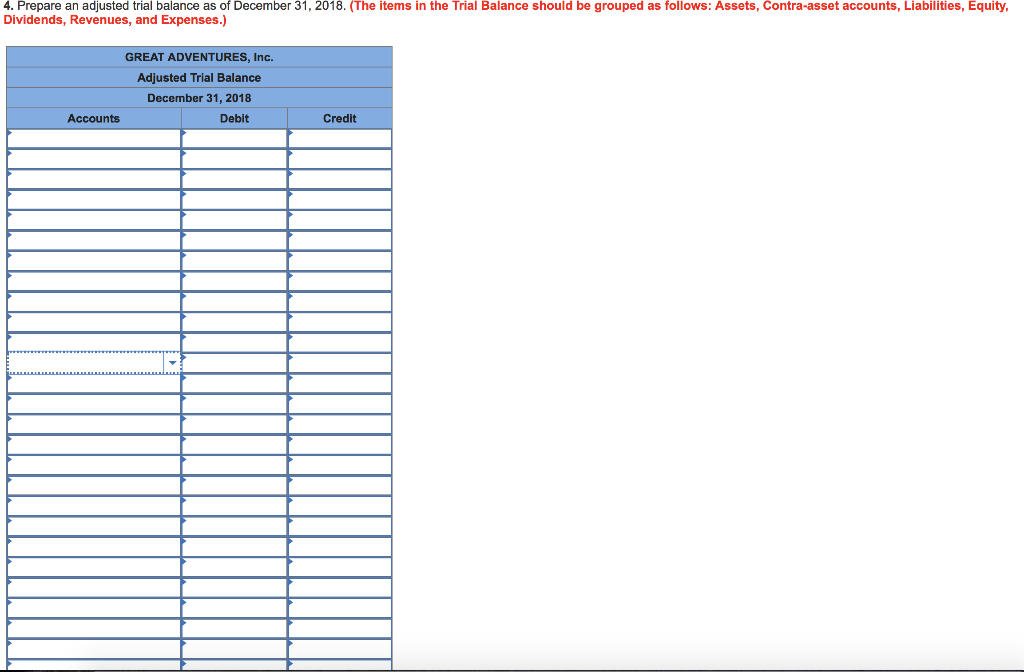

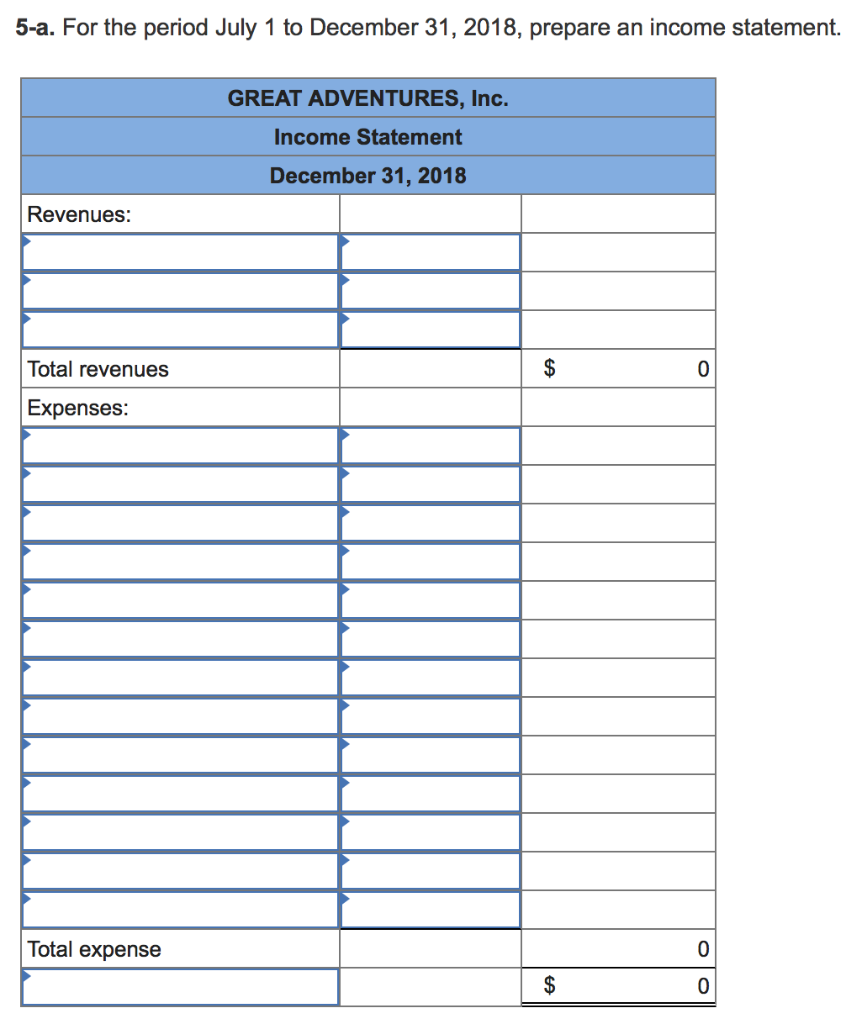

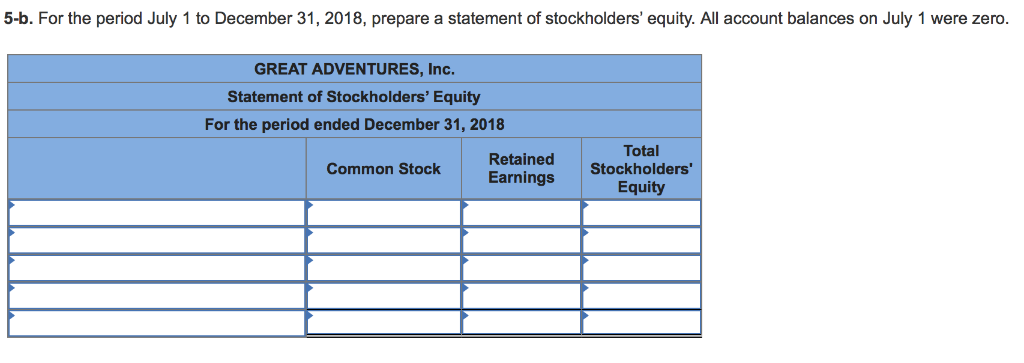

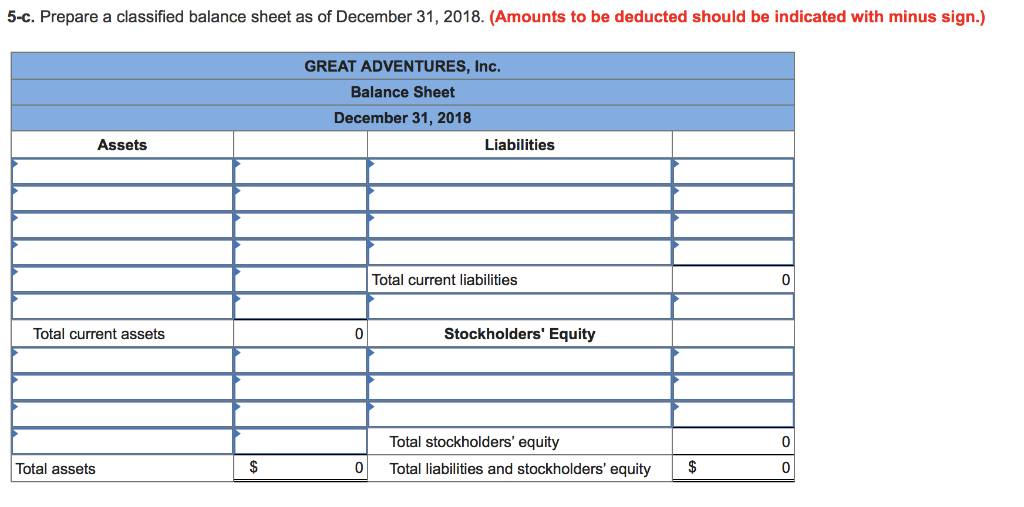

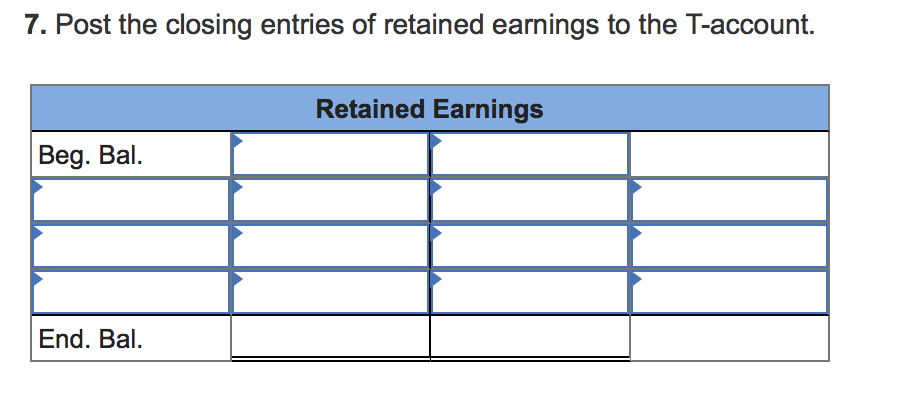

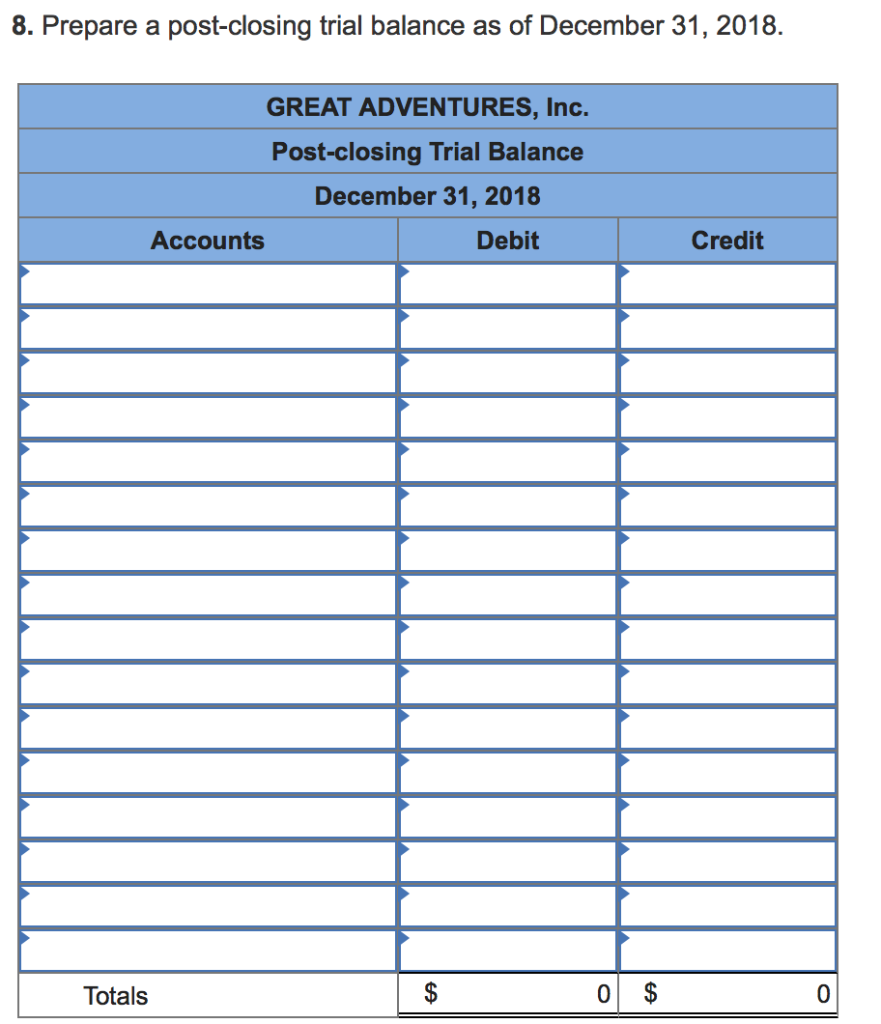

On July 1, 2018, Tony and Suzie organize their new company as a corporation, Great Adventures Inc. The following transactions occur from August 1 through December 31. Also, the balances are provided for the month ended July 31. Aug. 1 Great Adventures obtains a $49,000 low-interest loan for the company from the city council, which has recently passed an initiative encouraging business development related to outdoor activities. The loan is due in three years, and 6% annual Interest is due each year on July 31. Aug. 4 The company purchases 14 kayaks, paying $14,400 cash. Aug. 10 Twenty additional kayakers pay $3,200 ($160 each), in addition to the $6,600 that was paid in advance on July 30, on the day of the clinic. Tony conducts the first kayak clinic. Aug. 17 Tony conducts a second kayak clinic, and the company recelves $11,900 cash. Aug. 24 Office supplies of $1,200 purchased on July 4 are paid in full. Sep. 1 To provide better storage of mountain bikes and kayaks when not in use, the company rents a storage shed, purchasing a one-year rental policy for $3,480 ($290 per month). Sep. 21 Tony conducts a rock-climbing clinic. The company receives $14,100 cash. Oct. 17 Tony conducts an orienteering clinic. Participants practice how to understand a topographical map, read an altimeter, use a compass, and orient through heavily wooded areas. The company receives $18,300 cash. Dec. 1 Tony decides to hold the company's first adventure race on December 15. Four-person teams will race from checkpoint to checkpoint using a combination of mountain biking, kayaking, orienteering, trail running, and rock climbing skills. The first team in each category to complete all checkpoints in order wins. The entry fee for each team is $530. Dec. 5 To help organize and promote the race, Tony hires his college roommate, Victor. Victor will be paid $40 in salary for each team that competes in the race. His salary will be paid after the race. Dec. 8 The company pays $1,300 to purchase a permit from a state park where the race will be held. The amount is recorded as a miscellaneous expense. Doc. 12 The company purchases raclng supplles for $2,100 on account due In 30 days. Supplles Include trophles for the top finlshing teams in cach category. promotional shirts, snack foods and drinks for partlclpants, and field markers to prepare the racecourse. Dec. 15 The company receives $21,200 cash from a total of forty teams, and the race is held. Dec. 16 The company pays Victor's salary of $1,600. Dec. 31 The company pays a dividend of $4,500 (S2,250 to Tony and $2,250 to Suzie) Dec. 31 Using his personal money, Tany purchases a diamond ring for $5,400. Tony surprises Suzie by proposing that they get married. Suzie accepts and they get married! The following information relates to year-end adjusting entries as of December 31, 2018 a. Depreciation of the mountain bikes purchased on July 8 and kayaks purchased on August 4 totals $8,600. b. Six months' worth of insurance has expired. c. Four months' worth of rent has expired. d. Of the $1,200 of office supplies purchased on July 4, $230 remains. e. Interest expense on the $49,000 loan obtalned from the clty council on August 1 should be recorded. f. Of the $2,100 of racing supplies purchased on December 12, $150 remains. g. Suzie calculates that the company owes $14,400 in income taxes. Assume the following ending balances for the month of July Cash Prepaid insurance Supplies (Office Equipment (Bikes) Accounts payable Deferred revenue Common stock Service revenue (Clinic) Advertising expense Legal fees expense Balance $ 25,500 5,640 1,200 19,000 1,200 6,600 40,000 6,000 1,160 1,300 4. Prepare an adjusted trial balance as of December 31, 2018. (The items in the Trial Balance should be grouped as follows: Assets, Contra-asset accounts, Liabilities, Equity, Dividends, Revenues, and Expenses.) GREAT ADVENTURES, Inc. Adjusted Trial Balance December 31, 2018 Accounts Debit Credit 5-a. For the period July 1 to December 31, 2018, prepare an income statement. GREAT ADVENTURES, Inc. Income Statement December 31, 2018 Revenues: Total revenues Expenses: Total expense 5-b. For the period July 1 to December 31, 2018, prepare a statement of stockholders' equity. All account balances on July 1 were zero GREAT ADVENTURES, Inc. Statement of Stockholders' Equity For the period ended December 31, 2018 Total Retained Common Stock Earnings Stockholders Earnings Equity 5-c. Prepare a classified balance sheet as of December 31, 2018. (Amounts to be deducted should be indicated with minus sign.) GREAT ADVENTURES, Inc. Balance Sheet December 31, 2018 Assets Liabilities Total current liabilities Total current assets Stockholders' Equity Total stockholders' equity 0 Total liabilities and stockholders' equity$ Total assets 7. Post the closing entries of retained eamings to the T-account Retained Earnings Beg. Bal. End. Bal. 8. Prepare a post-closing trial balance as of December 31, 2018. GREAT ADVENTURES, Inc. Post-closing Trial Balance December 31, 2018 Accounts Debit Credit Totals 0