Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2019, Lillard, Inc. purchased a patent for $1,000,000. The patent was initially expected to have a 17 year useful life with no

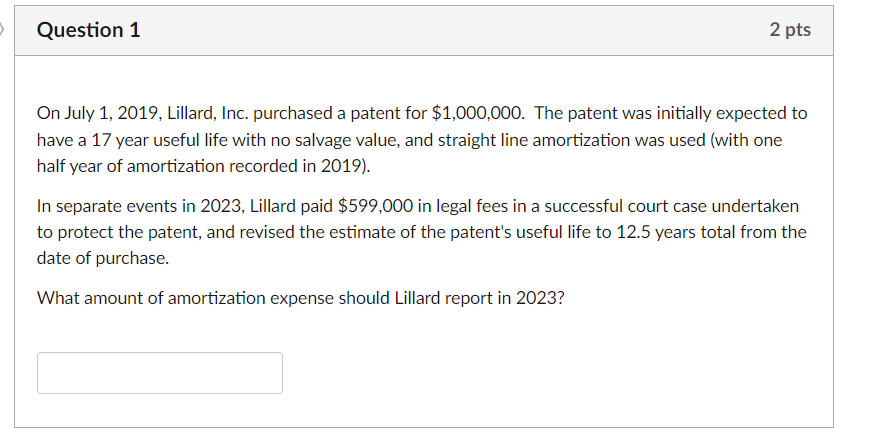

On July 1, 2019, Lillard, Inc. purchased a patent for $1,000,000. The patent was initially expected to have a 17 year useful life with no salvage value, and straight line amortization was used (with one half year of amortization recorded in 2019). In separate events in 2023, Lillard paid $599,000 in legal fees in a successful court case undertaken to protect the patent, and revised the estimate of the patent's useful life to 12.5 years total from the date of purchase. What amount of amortization expense should Lillard report in 2023

On July 1, 2019, Lillard, Inc. purchased a patent for $1,000,000. The patent was initially expected to have a 17 year useful life with no salvage value, and straight line amortization was used (with one half year of amortization recorded in 2019). In separate events in 2023, Lillard paid $599,000 in legal fees in a successful court case undertaken to protect the patent, and revised the estimate of the patent's useful life to 12.5 years total from the date of purchase. What amount of amortization expense should Lillard report in 2023 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started