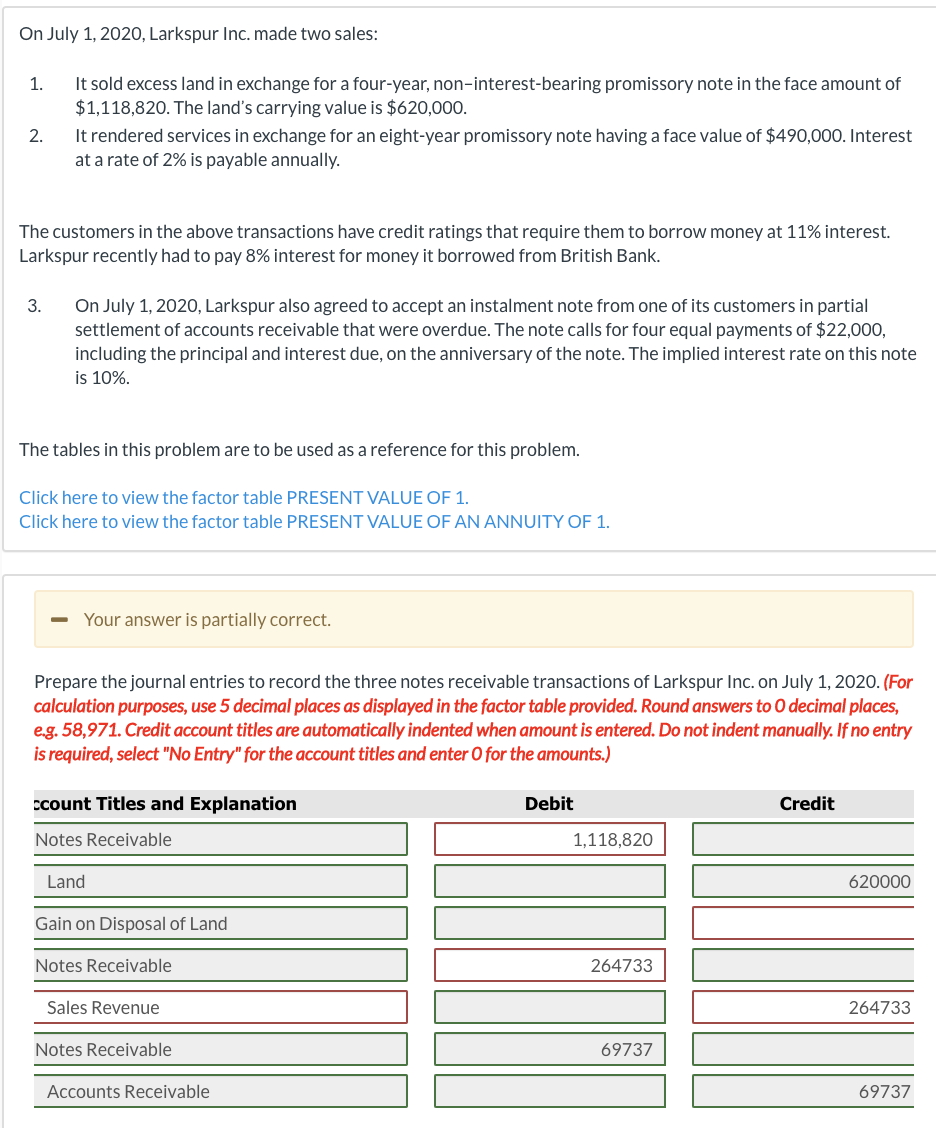

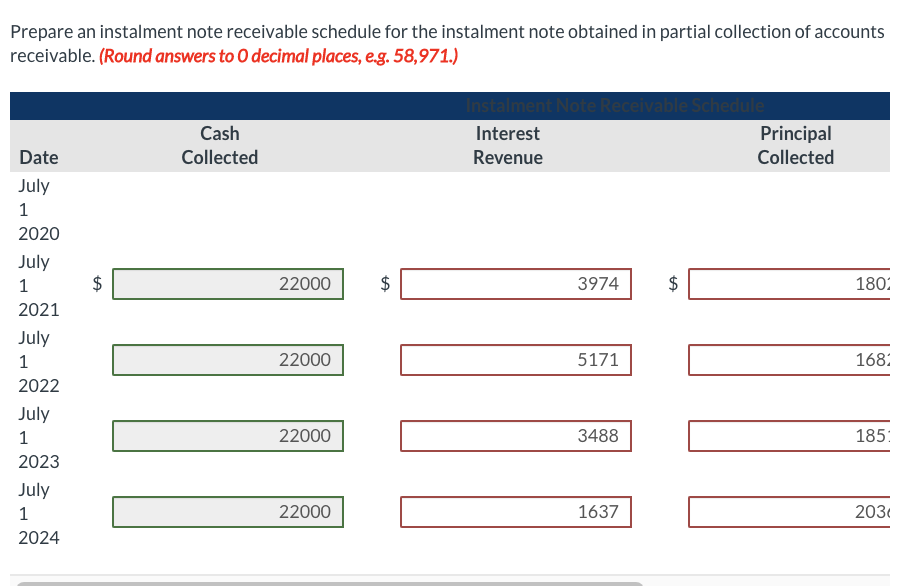

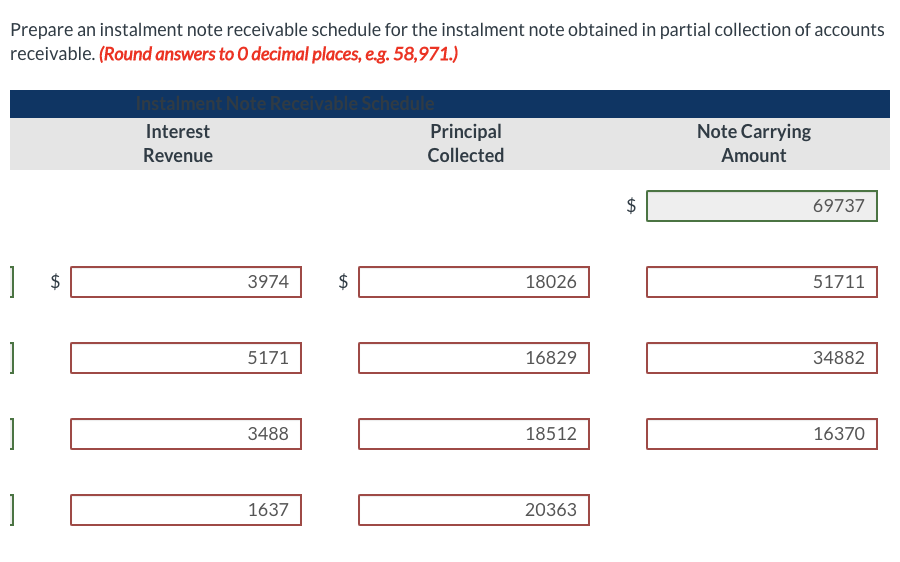

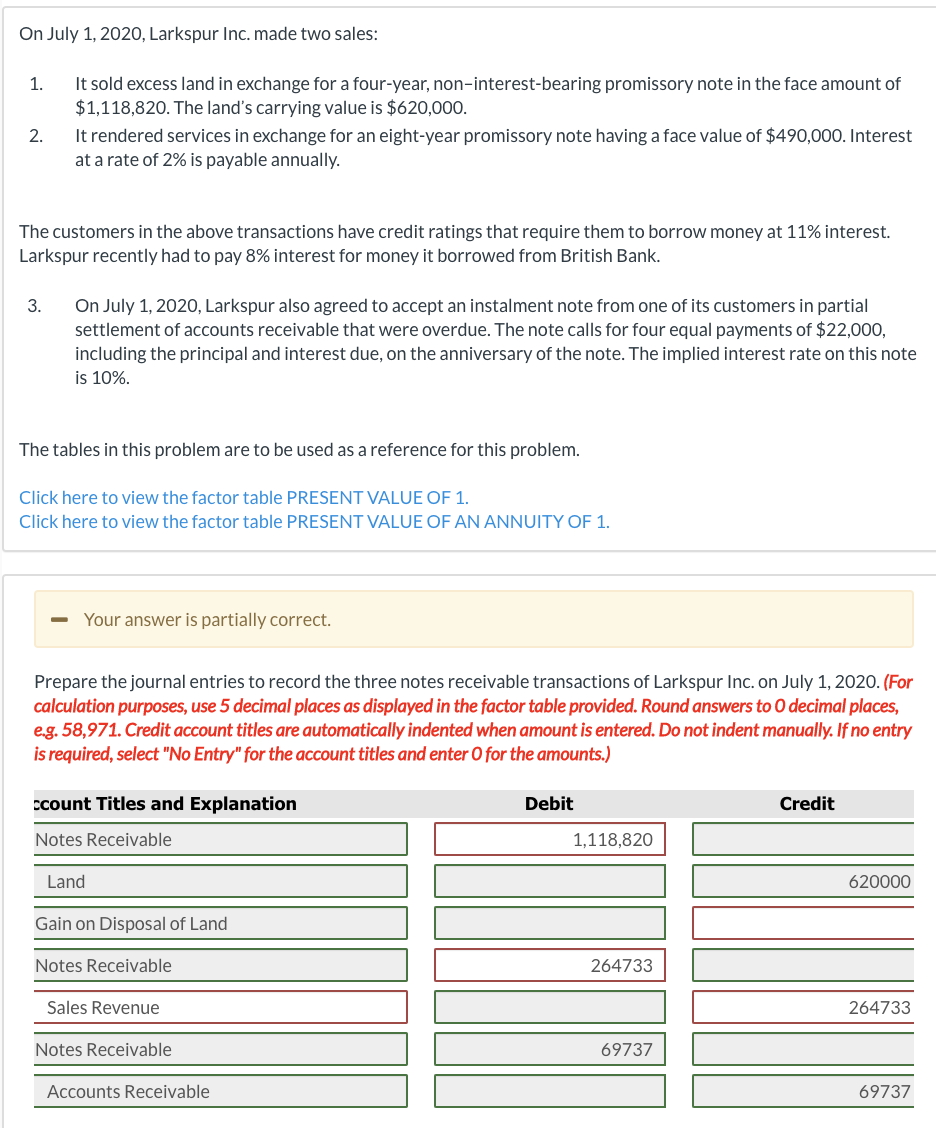

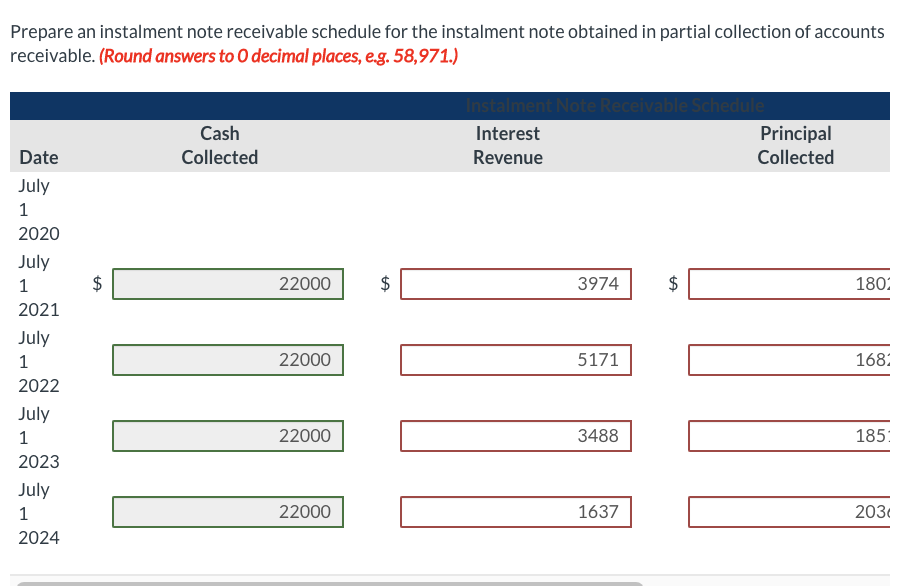

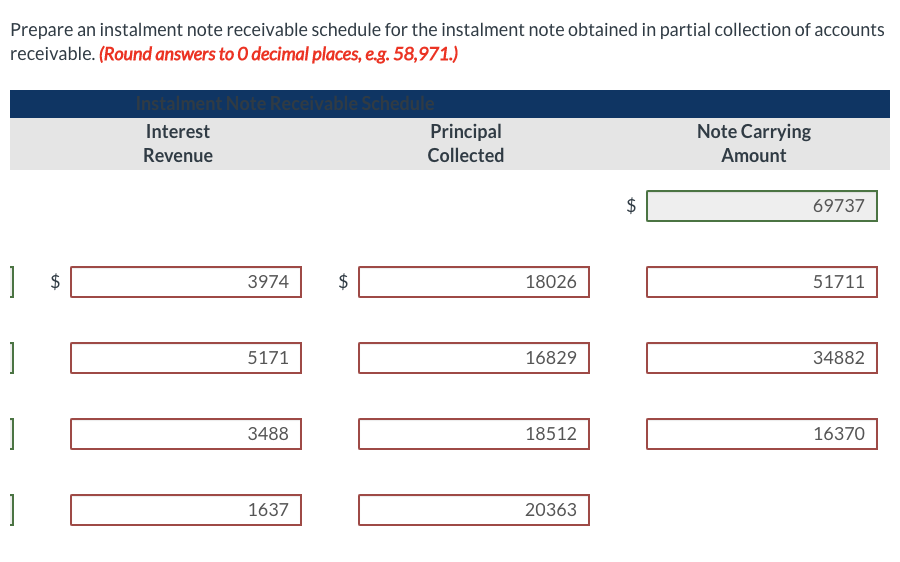

On July 1, 2020, Larkspur Inc. made two sales: 1. It sold excess land in exchange for a four-year, non-interest-bearing promissory note in the face amount of $1,118,820. The land's carrying value is $620,000. It rendered services in exchange for an eight-year promissory note having a face value of $490,000. Interest at a rate of 2% is payable annually. 2. The customers in the above transactions have credit ratings that require them to borrow money at 11% interest. Larkspur recently had to pay 8% interest for money it borrowed from British Bank. 3. On July 1, 2020, Larkspur also agreed to accept an instalment note from one of its customers in partial settlement of accounts receivable that were overdue. The note calls for four equal payments of $22,000, including the principal and interest due, on the anniversary of the note. The implied interest rate on this note is 10%. The tables in this problem are to be used as a reference for this problem. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Your answer is partially correct. Prepare the journal entries to record the three notes receivable transactions of Larkspur Inc. on July 1, 2020. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answers to 0 decimal places, e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) ccount Titles and Explanation Debit Credit Notes Receivable 1,118,820 Land 620000 Gain on Disposal of Land Notes Receivable 264733 Sales Revenue 264733 Notes Receivable 69737 Accounts Receivable 69737 Prepare an instalment note receivable schedule for the instalment note obtained in partial collection of accounts receivable. (Round answers to 0 decimal places, eg. 58,971.) Cash Collected Instalment Interest Revenue Principal Collected $ 22000 $ 3974 $ 180 Date July 1 2020 July 1 2021 July 1 2022 July 1 2023 July 1 2024 22000 5171 168 22000 3488 185 22000 1637 2034 Prepare an instalment note receivable schedule for the instalment note obtained in partial collection of accounts receivable. (Round answers to 0 decimal places, e.g. 58,971.) Interest Revenue Principal Collected Note Carrying Amount $ 69737 $ 3974 $ 18026 51711 5171 16829 34882 3488 18512 16370 1637 20363 On July 1, 2020, Larkspur Inc. made two sales: 1. It sold excess land in exchange for a four-year, non-interest-bearing promissory note in the face amount of $1,118,820. The land's carrying value is $620,000. It rendered services in exchange for an eight-year promissory note having a face value of $490,000. Interest at a rate of 2% is payable annually. 2. The customers in the above transactions have credit ratings that require them to borrow money at 11% interest. Larkspur recently had to pay 8% interest for money it borrowed from British Bank. 3. On July 1, 2020, Larkspur also agreed to accept an instalment note from one of its customers in partial settlement of accounts receivable that were overdue. The note calls for four equal payments of $22,000, including the principal and interest due, on the anniversary of the note. The implied interest rate on this note is 10%. The tables in this problem are to be used as a reference for this problem. Click here to view the factor table PRESENT VALUE OF 1. Click here to view the factor table PRESENT VALUE OF AN ANNUITY OF 1. Your answer is partially correct. Prepare the journal entries to record the three notes receivable transactions of Larkspur Inc. on July 1, 2020. (For calculation purposes, use 5 decimal places as displayed in the factor table provided. Round answers to 0 decimal places, e.g. 58,971. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) ccount Titles and Explanation Debit Credit Notes Receivable 1,118,820 Land 620000 Gain on Disposal of Land Notes Receivable 264733 Sales Revenue 264733 Notes Receivable 69737 Accounts Receivable 69737 Prepare an instalment note receivable schedule for the instalment note obtained in partial collection of accounts receivable. (Round answers to 0 decimal places, eg. 58,971.) Cash Collected Instalment Interest Revenue Principal Collected $ 22000 $ 3974 $ 180 Date July 1 2020 July 1 2021 July 1 2022 July 1 2023 July 1 2024 22000 5171 168 22000 3488 185 22000 1637 2034 Prepare an instalment note receivable schedule for the instalment note obtained in partial collection of accounts receivable. (Round answers to 0 decimal places, e.g. 58,971.) Interest Revenue Principal Collected Note Carrying Amount $ 69737 $ 3974 $ 18026 51711 5171 16829 34882 3488 18512 16370 1637 20363