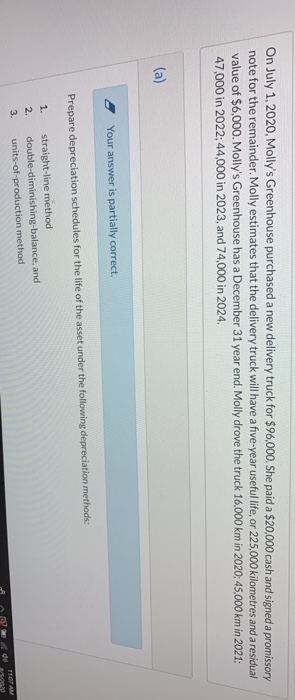

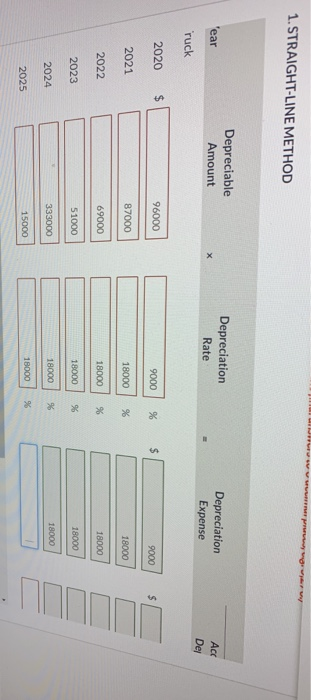

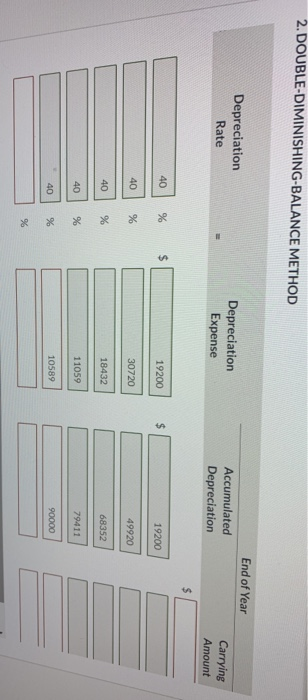

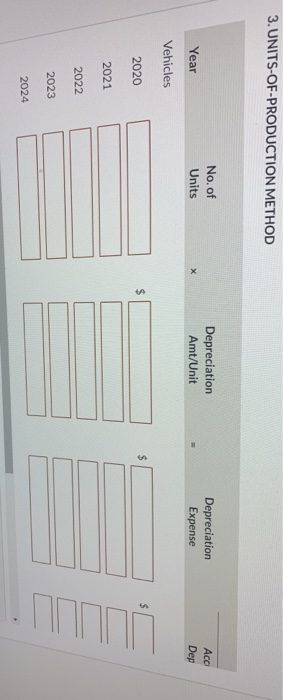

On July 1, 2020, Molly's Greenhouse purchased a new delivery truck for $96,000. She paid a $20,000 cash and signed a promissory note for the remainder. Molly estimates that the delivery truck will have a five-year useful life, or 225,000 kilometres and a residual value of $6,000. Molly's Greenhouse has a December 31 year end. Molly drove the truck 16,000 km in 2020:45,000 km in 2021; 47,000 in 2022:44,000 in 2023, and 74,000 in 2024. (a) Your answer is partially correct. Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. 2. 3. straight-line method double-diminishing-balance, and units-of-production method TOTAM 1. STRAIGHT-LINE METHOD 'ear Depreciable Amount Depreciation Rate Depreciation Expense Ace Dei ruck 2020 $ 96000 9000 % $ 9000 $ 2021 87000 18000 % 18000 2022 69000 18000 % 18000 2023 51000 18000 96 18000 2024 333000 18000 % 18000 15000 2025 18000 % 2. DOUBLE-DIMINISHING-BALANCE METHOD End of Year Depreciation Rate Depreciation Expense Accumulated Depreciation Carrying Amount $ 40 % $ 19200 $ 19200 40 % 30720 49920 40 18432 68352 40 % 11059 79411 40 % 10589 90000 % 3.UNITS-OF-PRODUCTION METHOD No. of Units Depreciation Amt/Unit Depreciation Expense Year Dep Vehicles $ 2020 2021 2022 2023 2024 On July 1, 2020, Molly's Greenhouse purchased a new delivery truck for $96,000. She paid a $20,000 cash and signed a promissory note for the remainder. Molly estimates that the delivery truck will have a five-year useful life, or 225,000 kilometres and a residual value of $6,000. Molly's Greenhouse has a December 31 year end. Molly drove the truck 16,000 km in 2020:45,000 km in 2021; 47,000 in 2022:44,000 in 2023, and 74,000 in 2024. (a) Your answer is partially correct. Prepare depreciation schedules for the life of the asset under the following depreciation methods: 1. 2. 3. straight-line method double-diminishing-balance, and units-of-production method TOTAM 1. STRAIGHT-LINE METHOD 'ear Depreciable Amount Depreciation Rate Depreciation Expense Ace Dei ruck 2020 $ 96000 9000 % $ 9000 $ 2021 87000 18000 % 18000 2022 69000 18000 % 18000 2023 51000 18000 96 18000 2024 333000 18000 % 18000 15000 2025 18000 % 2. DOUBLE-DIMINISHING-BALANCE METHOD End of Year Depreciation Rate Depreciation Expense Accumulated Depreciation Carrying Amount $ 40 % $ 19200 $ 19200 40 % 30720 49920 40 18432 68352 40 % 11059 79411 40 % 10589 90000 % 3.UNITS-OF-PRODUCTION METHOD No. of Units Depreciation Amt/Unit Depreciation Expense Year Dep Vehicles $ 2020 2021 2022 2023 2024