Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1, 2022, Pepperpot Company made a lump sum purchase of an office building, including the land and some fixtures, for cash of $550,000.

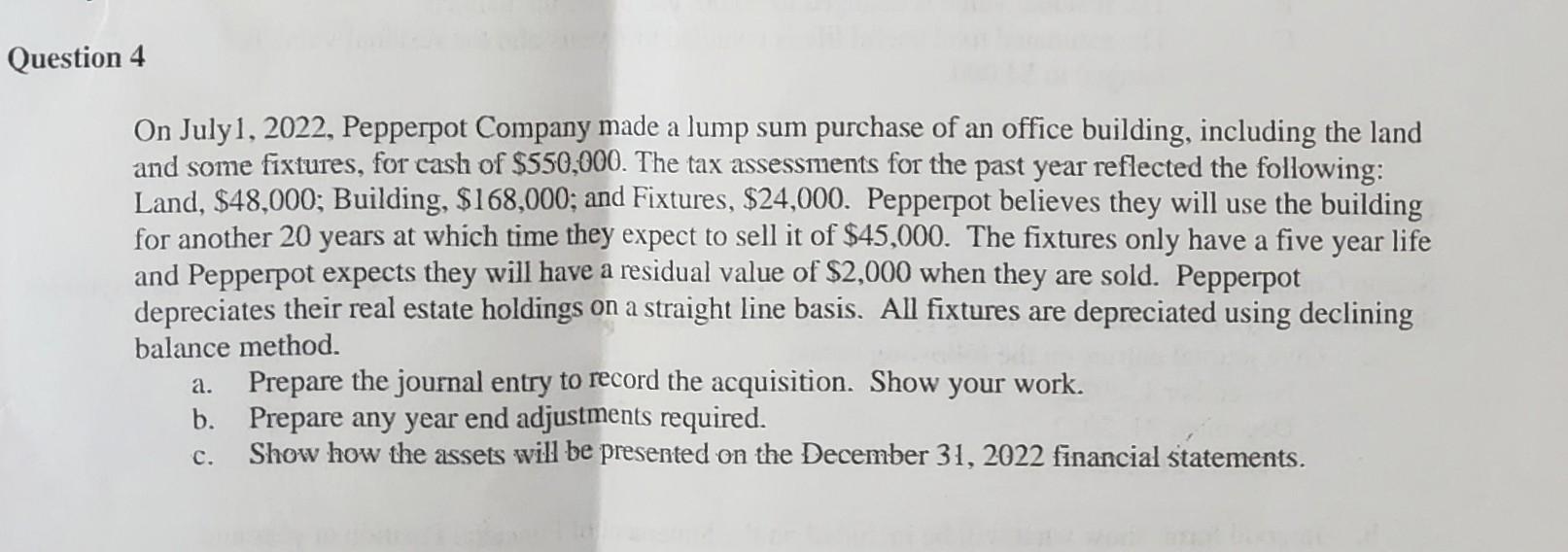

On July 1, 2022, Pepperpot Company made a lump sum purchase of an office building, including the land and some fixtures, for cash of $550,000. The tax assessments for the past year reflected the following: Land, $48,000; Building, $168,000; and Fixtures, $24,000. Pepperpot believes they will use the building for another 20 years at which time they expect to sell it of $45,000. The fixtures only have a five year life and Pepperpot expects they will have a residual value of $2,000 when they are sold. Pepperpot depreciates their real estate holdings on a straight line basis. All fixtures are depreciated using declining balance method. a. Prepare the journal entry to record the acquisition. Show your work. b. Prepare any year end adjustments required. c. Show how the assets will be presented on the December 31,2022 financial statements

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started