Answered step by step

Verified Expert Solution

Question

1 Approved Answer

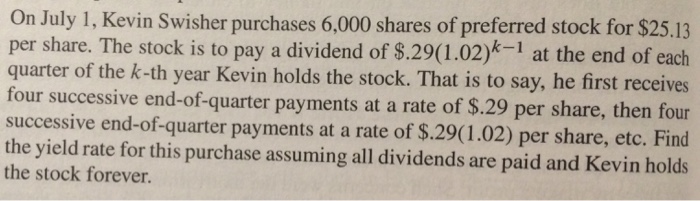

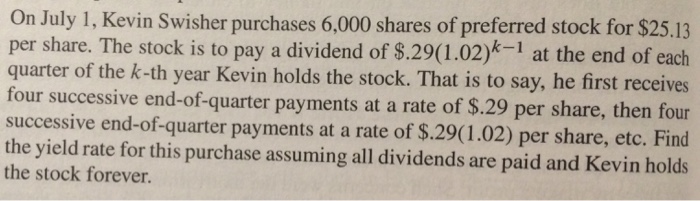

On July 1, Kevin Swisher purchased 6,000 shares of preferred for $25.12 per share. The stock is to pay a dividend of $.29(1.02)^k-1 at the

On July 1, Kevin Swisher purchased 6,000 shares of preferred for $25.12 per share. The stock is to pay a dividend of $.29(1.02)^k-1 at the end of each quarter of k-th year Kevin holds the stock. That is to say, he first recieves for successive end-of-quarter payments at a rate .29(1.02) per share, etc. Find the yield rate for this purchase assuming all dividends are paid and Kevin holds the stock forever.

On July 1, Kevin Swisher purchases 6,000 shares of preferred stock for $25.13 On July 1, Kevin Swisher purchases 6,000 shares of preferred stock for $25,13 per share. The stock is to pay a dividend of $.29(1.02)*- at the end of each quarter of the k-th year Kevin holds the stock. That is to say, he first receives four successive end-of-quarter payments at a rate of $.29 per share, then four successive end-of-quarter payments at a rate of $.29(1.02) per share, etc. Find the yield rate for this purchase assuming all dividends are paid and Kevin holds the stock forever Please show work. Not just spread sheet

I think my struggle is I know have to use the idea of a geometric series to solve but the fact the I have four of each payment is confusing me as to how to apply this.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started