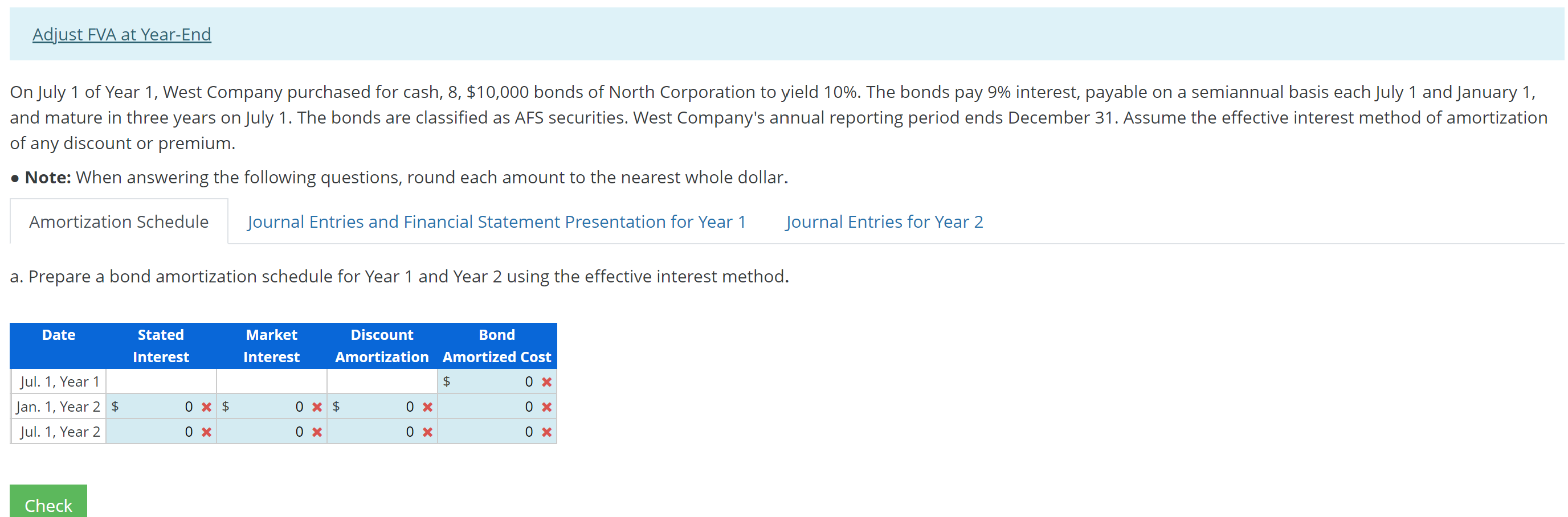

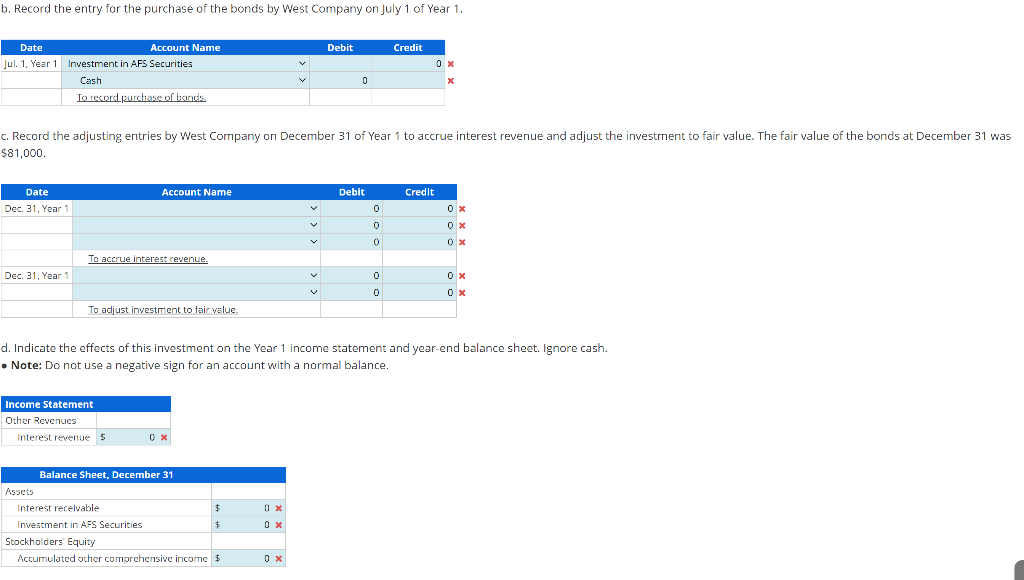

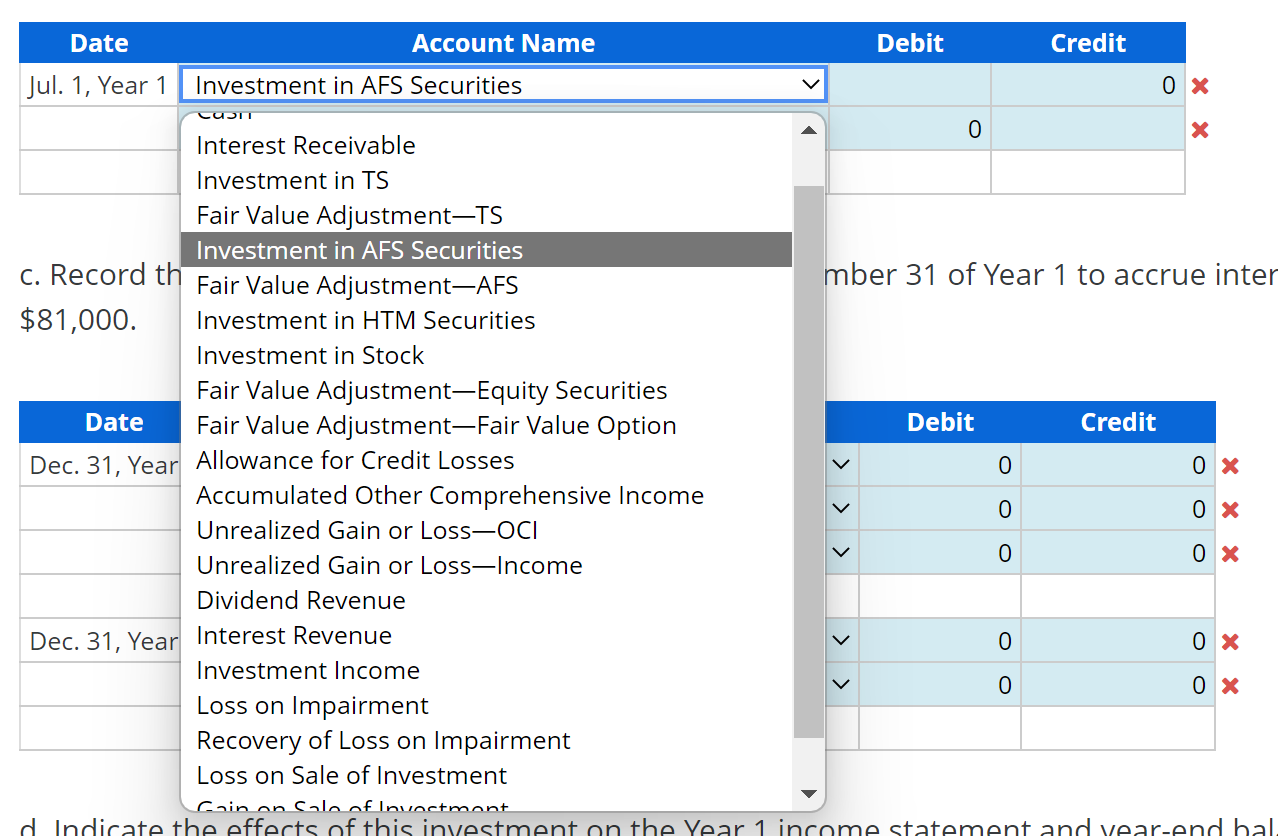

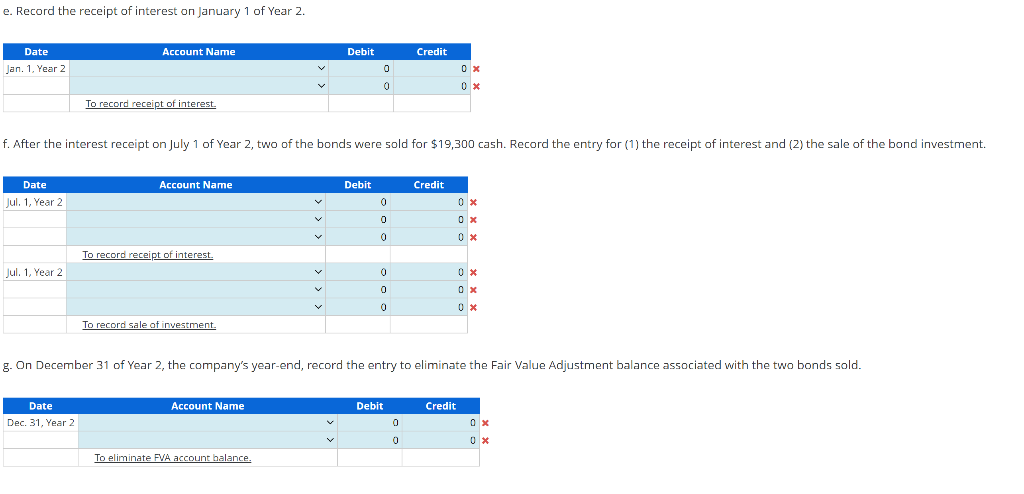

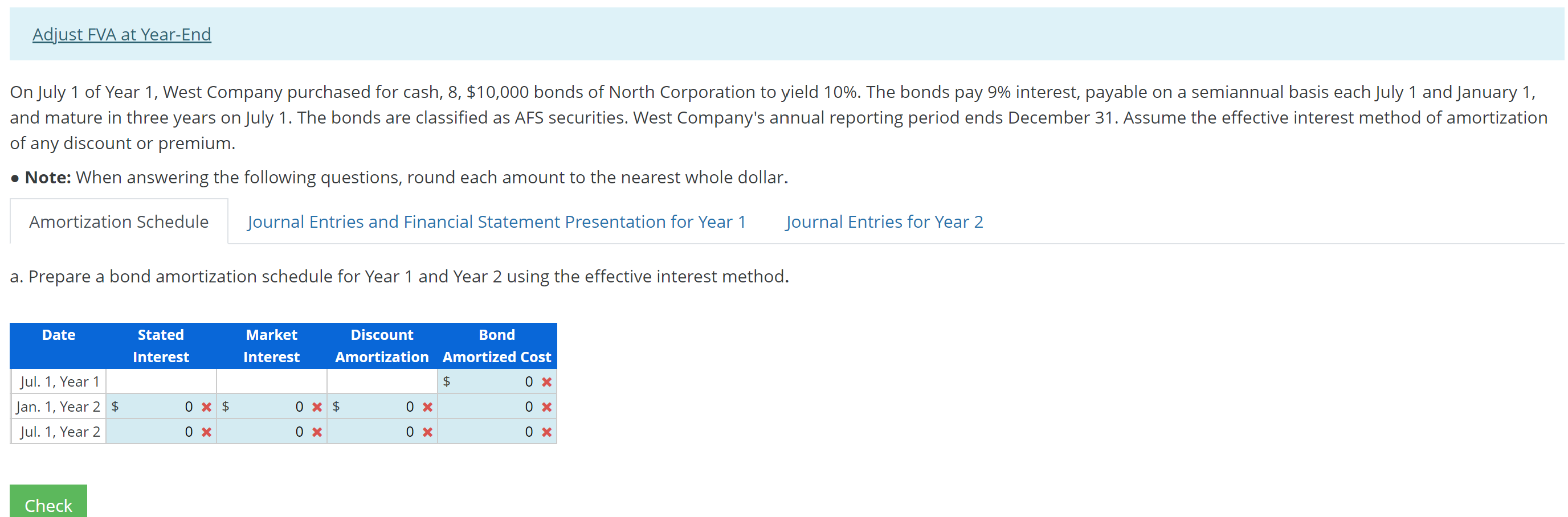

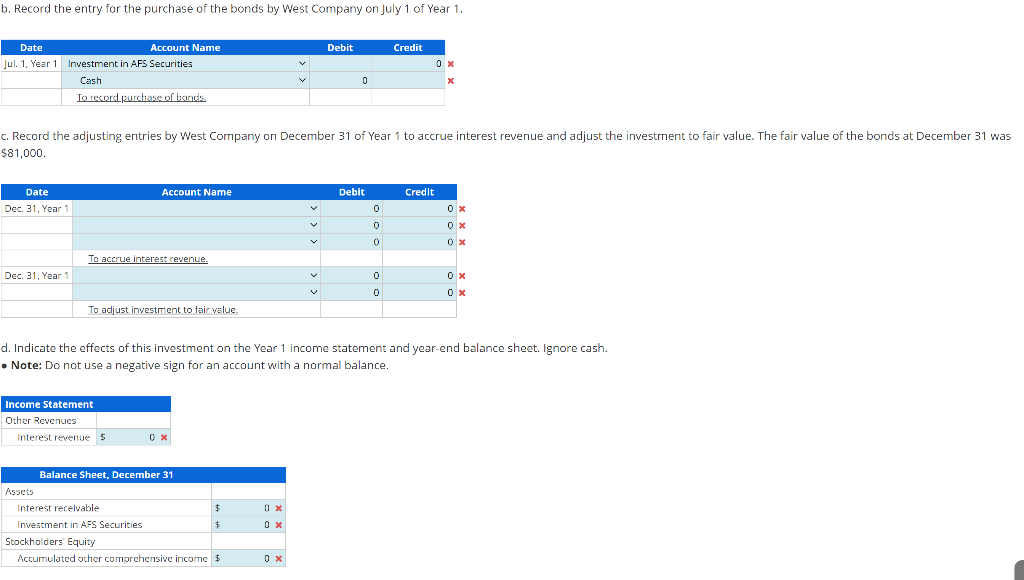

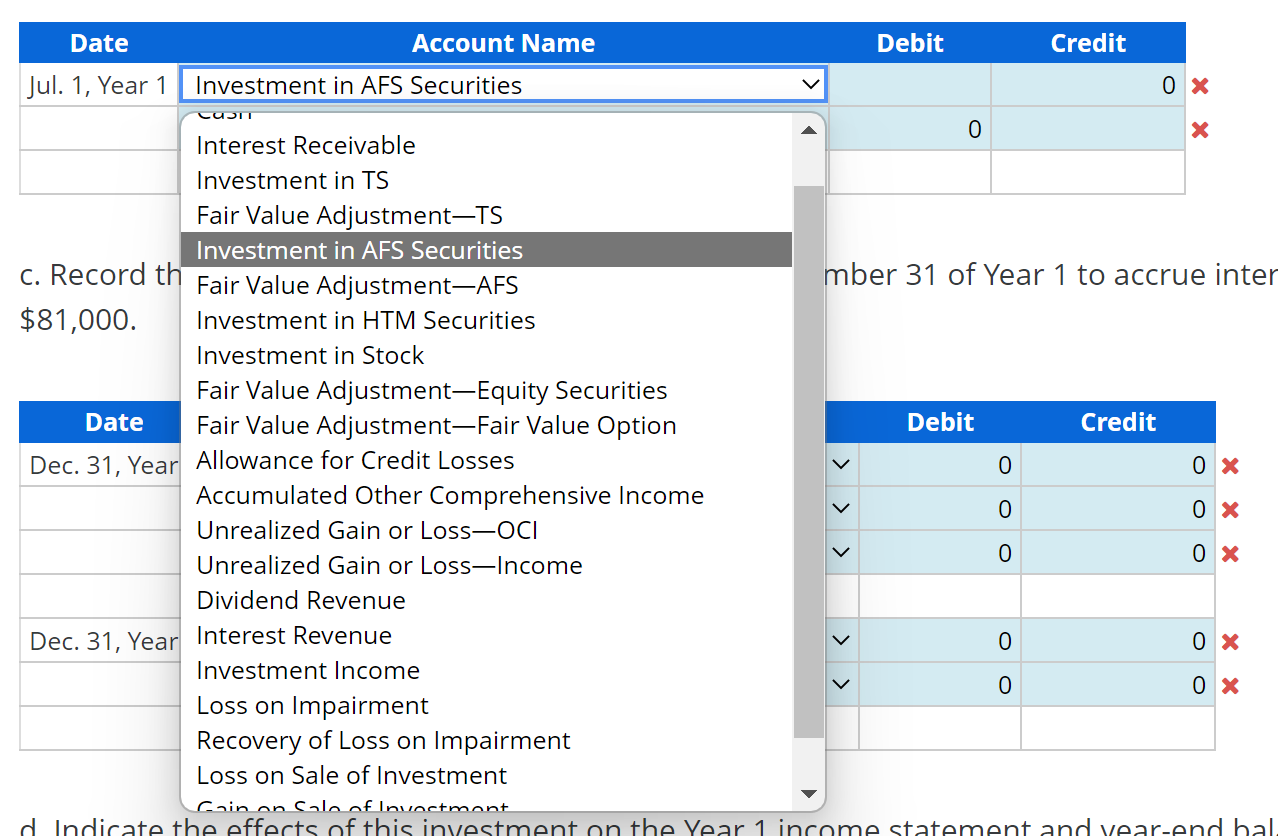

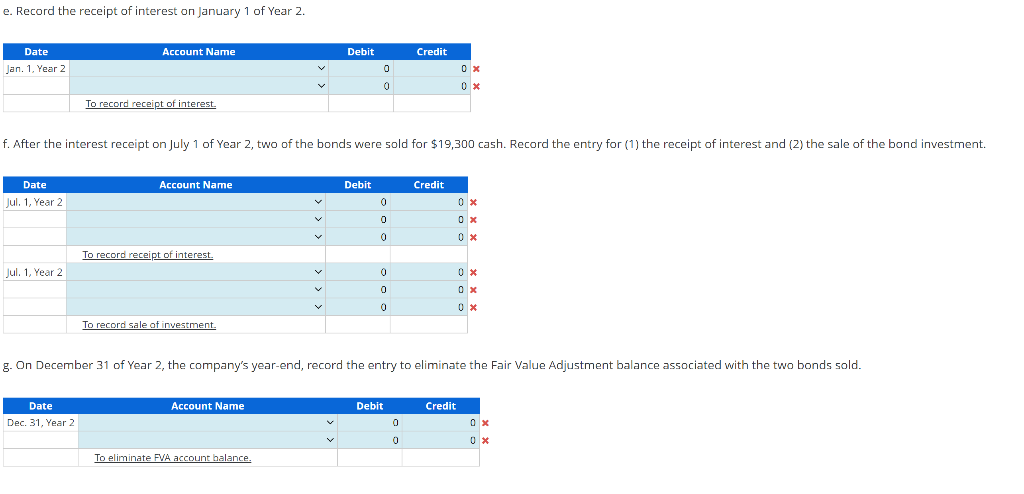

On July 1 of Year 1, West Company purchased for cash, 8,$10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1 , and mature in three years on July 1. The bonds are classified as AFS securities. West Company's annual reporting period ends December 31 . Assume the effective interest method of amortization of any discount or premium. - Note: When answering the following questions, round each amount to the nearest whole dollar. Amortization Schedule Journal Entries and Financial Statement Presentation for Year 1 Journal Entries for Year 2 b. Record the entry for the purchase of the bonds by West Company on July 1 of Year 1 . c. Record the adjusting entries by West Company on December 31 of Year 1 to accrue interest revenue and adjust the investment to fair value. The fair value of the bonds at December 31 was $81,000. d. Indicate the effects of this investment on the Year 1 income statement and year-end balance sheet. Ignore cash. - Note: Do not use a negative sign for an account with a normal balance. mber 31 of Year 1 to accrue inter e. Record the receipt of interest on January 1 of Year 2. f. After the interest receipt on July 1 of Year 2, two of the bonds were sold for $19,300 cash. Record the entry for (1) the receipt of interest and (2) the sale of g. On December 31 of Year 2, the company's year-end, record the entry to eliminate the Fair Value Adjustment balance associated with the two bonds sold. On July 1 of Year 1, West Company purchased for cash, 8,$10,000 bonds of North Corporation to yield 10%. The bonds pay 9% interest, payable on a semiannual basis each July 1 and January 1 , and mature in three years on July 1. The bonds are classified as AFS securities. West Company's annual reporting period ends December 31 . Assume the effective interest method of amortization of any discount or premium. - Note: When answering the following questions, round each amount to the nearest whole dollar. Amortization Schedule Journal Entries and Financial Statement Presentation for Year 1 Journal Entries for Year 2 b. Record the entry for the purchase of the bonds by West Company on July 1 of Year 1 . c. Record the adjusting entries by West Company on December 31 of Year 1 to accrue interest revenue and adjust the investment to fair value. The fair value of the bonds at December 31 was $81,000. d. Indicate the effects of this investment on the Year 1 income statement and year-end balance sheet. Ignore cash. - Note: Do not use a negative sign for an account with a normal balance. mber 31 of Year 1 to accrue inter e. Record the receipt of interest on January 1 of Year 2. f. After the interest receipt on July 1 of Year 2, two of the bonds were sold for $19,300 cash. Record the entry for (1) the receipt of interest and (2) the sale of g. On December 31 of Year 2, the company's year-end, record the entry to eliminate the Fair Value Adjustment balance associated with the two bonds sold