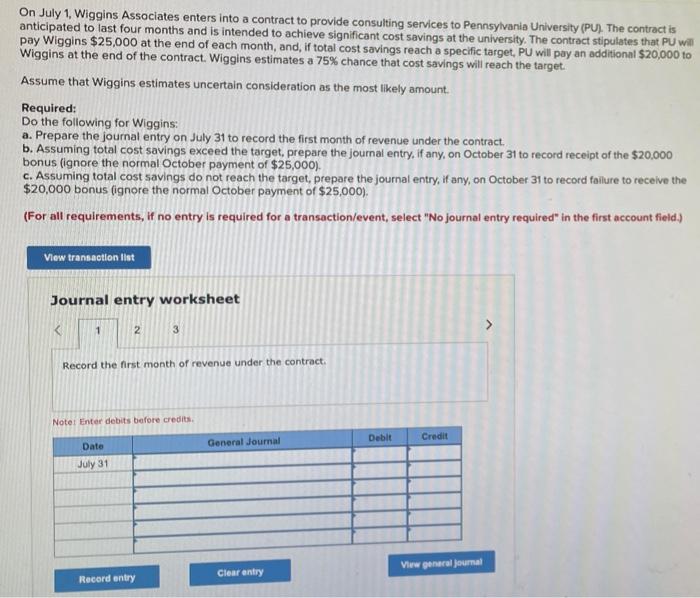

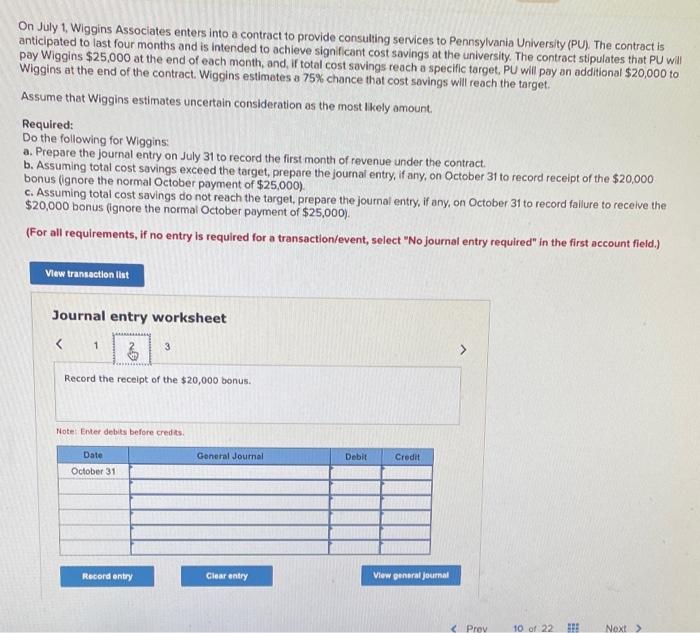

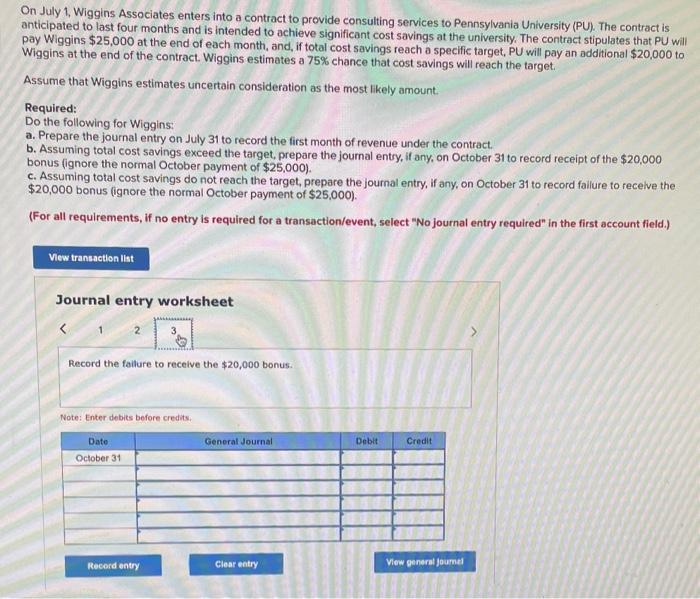

On July 1, Wiggins Associates enters into a contract to provide consulting services to Pennsylvania University (PU). The contract is anticipated to last four months and is intended to achieve significant cost savings at the university. The contract stipulates that PU will. pay Wiggins $25,000 at the end of each month, and, if total cost savings reach a specific target, PU will pay an additional $20,000 to Wiggins at the end of the contract. Wiggins estimates a 75% chance that cost savings will reach the target. Assume that Wiggins estimates uncertain consideration as the most likely amount. Required: Do the following for Wiggins: a. Prepare the journal entry on July 31 to record the first month of revenue under the contract. b. Assuming total cost savings exceed the target, prepare the journal entry, if any, on October 31 to record receipt of the $20,000 bonus (ignore the normal October payment of $25,000 ). c. Assuming total cost savings do not reach the target, prepare the journal entry, if any, on October 31 to record failure to receive the $20,000 bonus (ignore the normal October payment of $25,000 ). (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Record the first month of revenue under the contract. Notel Enter debits before credita. On July 1, Wiggins Associates enters into a contract to provide consulting services to Pennsylvania University (PU) The contract is anticipated to last four months and is intended to achieve significant cost savings at the university. The contract stipulates that PU will pay Wiggins $25,000 at the end of each month, and, if total cost savings reach a specific target, PU will pay an additional $20,000 to Wiggins at the end of the contract. Wiggins estimates a 75% chance that cost savings will reach the target. Assume that Wiggins estimates uncertain consideration as the most Ikely amount. Required: Do the following for Wiggins: a. Prepare the journal entry on July 31 to record the first month of revenue under the contract. b. Assuming total cost savings exceed the target, prepare the journal entry, if any, on October 31 to record receipt of the $20,000 bonus (ignore the normal October payment of $25,000 ). c. Assuming total cost savings do not reach the target, prepare the journal entry, if any, on October 31 to record failure to receive the. $20,000 bonus (ignore the normal October payment of $25,000 ). (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet On July 1, Wiggins Associates enters into a contract to provide consulting services to Pennsylvania University (PU). The contract is anticipated to last four months and is intended to achieve significant cost savings at the university. The contract stipulates that PU will pay Wiggins $25,000 at the end of each month, and, if total cost savings reach a specific target, PU will pay an additional $20,000 to Wiggins at the end of the contract. Wiggins estimates a 75% chance that cost savings will reach the target. Assume that Wiggins estimates uncertain consideration as the most likely amount. Required: Do the following for Wiggins: a. Prepare the journal entry on July 31 to record the first month of revenue under the contract. b. Assuming total cost savings exceed the target, prepare the journal entry, if any, on October 31 to record receipt of the $20,000 bonus (ignore the normal October payment of $25,000 ). c. Assuming total cost savings do not reach the target, prepare the journal entry, if any, on October 31 to record fallure to recelve the $20,000 bonus (ignore the normal October payment of $25,000 ). (For all requirements, if no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet Pecord the fallure to recelve the $20,000 bonus. Note: Enter debits before credits