On July 1, Year 1, the board of directors of All Seasons Sports, Inc. voted to dispose of the Ski & Snowboard operating segment of

On July 1, Year 1, the board of directors of All Seasons Sports, Inc. voted to dispose of the Ski & Snowboard operating segment of the company. On that date, the carrying value of the segment was $3,000,000, but the Board believed that it could sell the segment for no more than $2,500,000. The company was committed to its plan to sell the segment and was actively looking for a buyer until April 1, Year 2, when the division was sold to We Love Winter, Inc. for a sales price of $3,200,000. All Seasons Sports paid a brokers fee of 10% of the sales price when the transaction was closed.

Ski & Snowboard's operating results were as follows:

| 1/1/Year 1 – 6/30/Year 1 | ($300,000) | |

| 7/1/Year 1 – 12/31/Year 1 | ($400,000) | |

| 1/1/Year 2 – 3/31/Year 2 | ($200,000) |

All Seasons Sports has a tax rate of 30%.

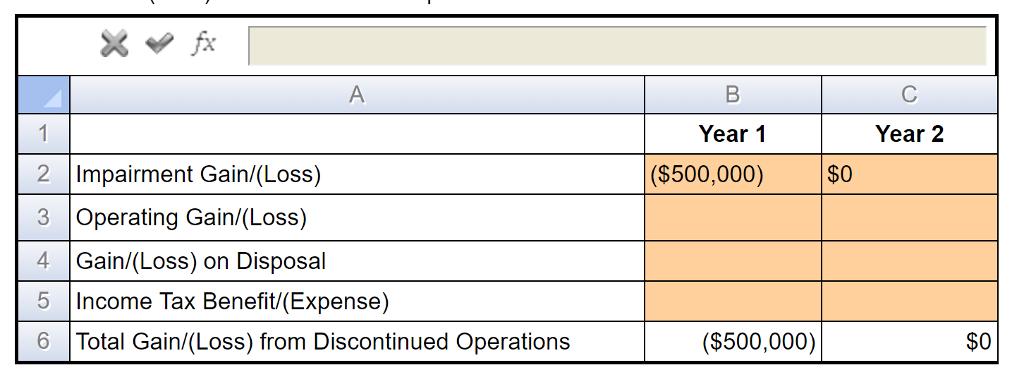

Calculate the Gain/(Loss) from Discontinued Operations for Year 1 and Year 2:

A 1 2 Impairment Gain/(Loss) 3 Operating Gain/(Loss) 4 Gain/(Loss) on Disposal 5 Income Tax Benefit/(Expense) 6 Total Gain/(Loss) from Discontinued Operations B Year 1 ($500,000) ($500,000) $0 C Year 2 $0

Step by Step Solution

3.41 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

step 1 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started