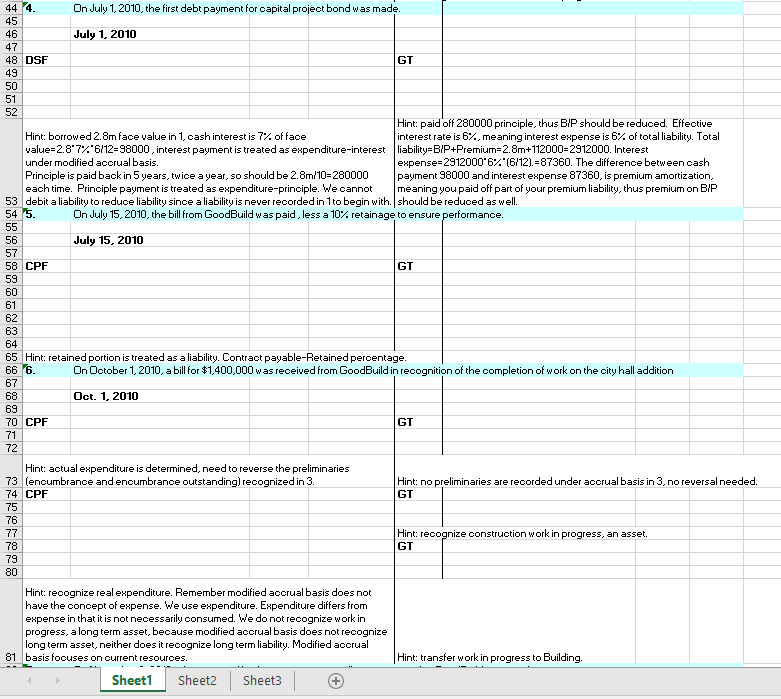

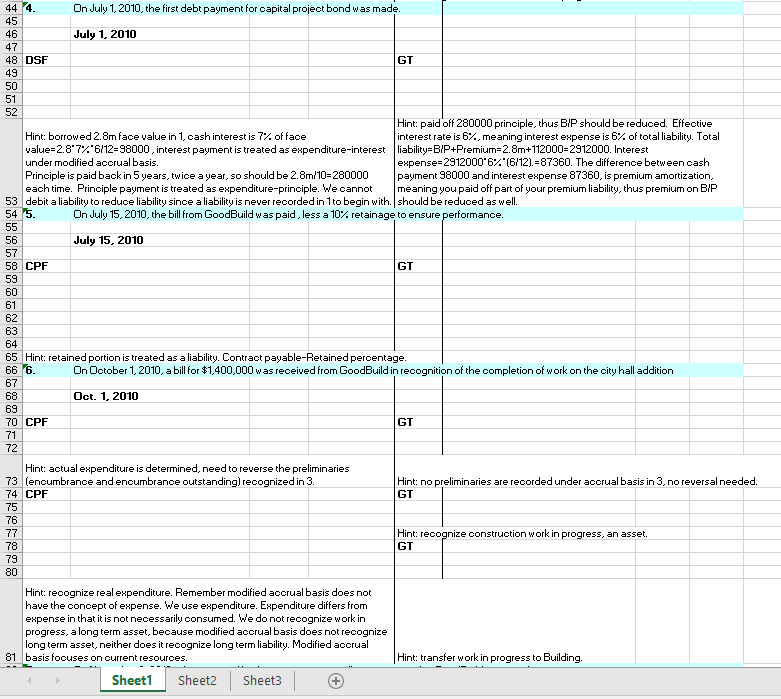

On July 1,2010, the first debt payment for capital project bond was made 45 46 47 48 DSF July 1. 2010 GT 52 Hint: paid off 280000 principle, thus BIP should be reduced. Effective interest rate is 6%, meaning interest Hint, borrowed 2.8m face value in 1, cash interest is 7% of face expense is 6% of total liability. Total | value-2.8.7%.6/12-98000 , interest payment is treated as expenditure-interest |liability-BIP+Premium-2.8m+112000-2912000. Interest expense-2912000. 6%(6112-87360. The difference between cash under modified accrual basis Principle is paid back in 5 years, twice a year, so should be 2.8m 10-280000 payment 98000 and interest epense 87360, is premium amortization each time. Principle payment is treated as expenditure-principle. We cannot meaning you paid off part of your premium liability, thus premium on BIP 53debit a liability to reduce liability since a liability is never recorded in 1to begin with. should be reduced as well. 54 5 On July 15, 2010, the bill from GoodBuild was paid, less a 10% retainage to ensure performance 56 57 58 CPF 59 July 15. 2010 GT 61 62 63 64 65 Hint: retained portion is treated as a liability. Contract payable-Retained percentage On October 1, 2010, a bill for $1,400,000 w as received from GoodBuild in recognition of the completion of work on the city hall addition 67 Oct. 1, 2010 69 70 CPF GT 72 Hint: actual expenditure is determined, need to reverse the preliminaries 73 (encumbrance and encumbrance outstanding) recognized in 3. Hint: no preliminaries are recorded under accrual basis in 3.no reversal needed GT 74 CPF 75 76 ize construction work in progress, an asset. 78 79 GT Hint: recognize real expenditure. Remember modified accrual basis does not have the concept of expense. We use expenditure. Expenditure differs from expense in that it is not necessarily consumed. 'We do not recognize work in progress, a long term asset, because modified accrual basis does not recognize long term asset, neither does it recognize long termliability. Modified accrual basis focuses on current resources 81 Hint: transfer work in prog ress to Building. SheetSheet2 Sheet3 On July 1,2010, the first debt payment for capital project bond was made 45 46 47 48 DSF July 1. 2010 GT 52 Hint: paid off 280000 principle, thus BIP should be reduced. Effective interest rate is 6%, meaning interest Hint, borrowed 2.8m face value in 1, cash interest is 7% of face expense is 6% of total liability. Total | value-2.8.7%.6/12-98000 , interest payment is treated as expenditure-interest |liability-BIP+Premium-2.8m+112000-2912000. Interest expense-2912000. 6%(6112-87360. The difference between cash under modified accrual basis Principle is paid back in 5 years, twice a year, so should be 2.8m 10-280000 payment 98000 and interest epense 87360, is premium amortization each time. Principle payment is treated as expenditure-principle. We cannot meaning you paid off part of your premium liability, thus premium on BIP 53debit a liability to reduce liability since a liability is never recorded in 1to begin with. should be reduced as well. 54 5 On July 15, 2010, the bill from GoodBuild was paid, less a 10% retainage to ensure performance 56 57 58 CPF 59 July 15. 2010 GT 61 62 63 64 65 Hint: retained portion is treated as a liability. Contract payable-Retained percentage On October 1, 2010, a bill for $1,400,000 w as received from GoodBuild in recognition of the completion of work on the city hall addition 67 Oct. 1, 2010 69 70 CPF GT 72 Hint: actual expenditure is determined, need to reverse the preliminaries 73 (encumbrance and encumbrance outstanding) recognized in 3. Hint: no preliminaries are recorded under accrual basis in 3.no reversal needed GT 74 CPF 75 76 ize construction work in progress, an asset. 78 79 GT Hint: recognize real expenditure. Remember modified accrual basis does not have the concept of expense. We use expenditure. Expenditure differs from expense in that it is not necessarily consumed. 'We do not recognize work in progress, a long term asset, because modified accrual basis does not recognize long term asset, neither does it recognize long termliability. Modified accrual basis focuses on current resources 81 Hint: transfer work in prog ress to Building. SheetSheet2 Sheet3