Answered step by step

Verified Expert Solution

Question

1 Approved Answer

On July 1.2022. Petrocelli Company received $1,100,000 cash as compensation for the forced sale (condemnation) of the company's land and building. The state planned

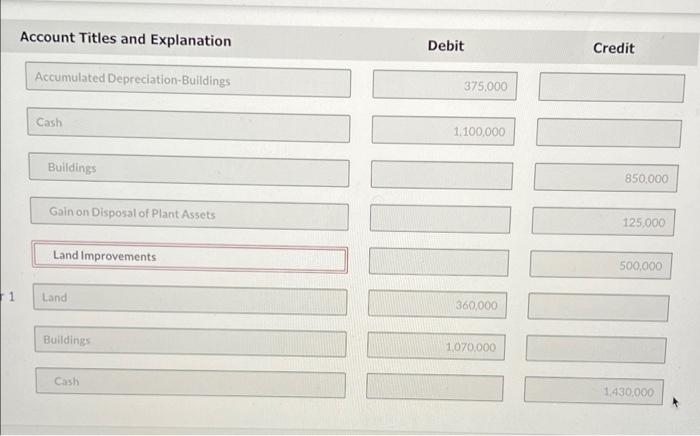

On July 1.2022. Petrocelli Company received $1,100,000 cash as compensation for the forced sale (condemnation) of the company's land and building. The state planned to use the property to build a new on-ramp for a nearby highway. The land and building cost $500,000 and $850,000, respectively. when they were acquired. At July 1, 2022, the accumulated depreciation relating to the building amounted to $375,000. On December 1,2022, Petrocelli purchased a piece of replacement property for cash. The new land cost $360,000, and the new building cost $1.070,000. Prepare the journal entries to record the transactions on July 1 and December 1, 2022. (Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit July 1 Accumulated Depreciation-Buildings 375,000 Cash 1.100.000 Account Titles and Explanation Debit Credit Accumulated Depreciation-Buildings 375,000 Cash 1.100,000 Buildings 850.000 Gain on Disposal of Plant Assets 125,000 Land Improvements 500,000 F1 Land 360,000 Buildings 1,070.000 Cash 1.430,000

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Cash 1100000 Jul01 Cash 1100000 Accumulated DepreciationBuildi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started