Answered step by step

Verified Expert Solution

Question

1 Approved Answer

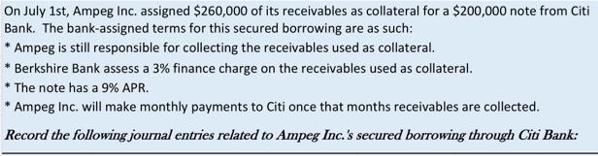

On July 1st, Ampeg Inc. assigned $260,000 of its receivables as collateral for a $200,000 note from Citi Bank. The bank-assigned terms for this

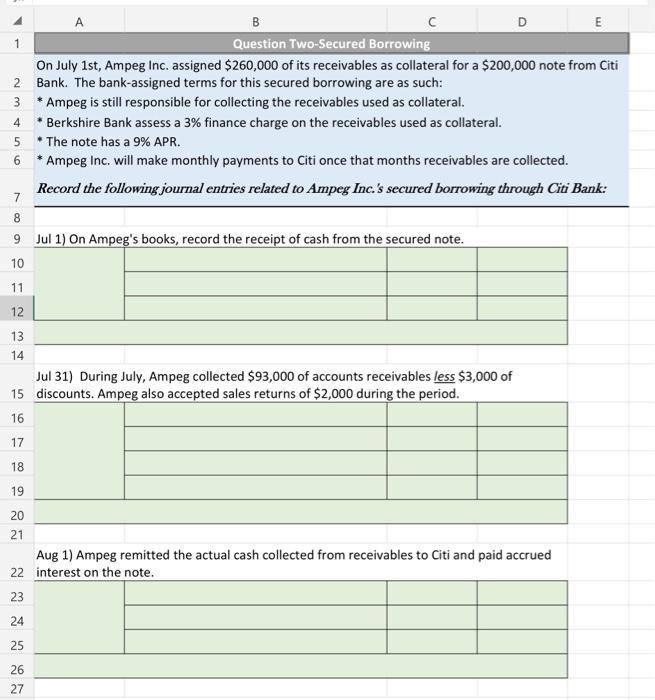

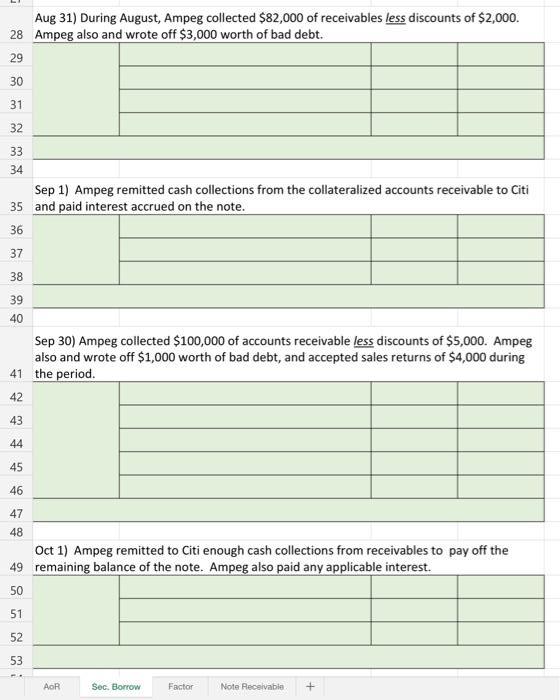

On July 1st, Ampeg Inc. assigned $260,000 of its receivables as collateral for a $200,000 note from Citi Bank. The bank-assigned terms for this secured borrowing are as such: * Ampeg is still responsible for collecting the receivables used as collateral. * Berkshire Bank assess a 3% finance charge on the receivables used as collateral. * The note has a 9% APR. * Ampeg Inc. will make monthly payments to Citi once that months receivables are collected. Record the following journal entries related to Ampeg Inc.'s secured borrowing through Citi Bank: 1 2 3 4 5 6 12 13 14 B Question Two-Secured Borrowing On July 1st, Ampeg Inc. assigned $260,000 of its receivables as collateral for a $200,000 note from Citi Bank. The bank-assigned terms for this secured borrowing are as such: *Ampeg is still responsible for collecting the receivables used as collateral. Berkshire Bank assess a 3% finance charge on the receivables used as collateral. *The note has a 9% APR. Ampeg Inc. will make monthly payments to Citi once that months receivables are collected. Record the following journal entries related to Ampeg Inc.'s secured borrowing through Citi Bank: 7 8 9 Jul 1) On Ampeg's books, record the receipt of cash from the secured note. 10 11 22 23 24 A 25 26 27 Jul 31) During July, Ampeg collected $93,000 of accounts receivables less $3,000 of 15 discounts. Ampeg also accepted sales returns of $2,000 during the period. 16 17 18 19 20 21 D E Aug 1) Ampeg remitted the actual cash collected from receivables to Citi and paid accrued interest on the note. G Aug 31) During August, Ampeg collected $82,000 of receivables less discounts of $2,000. 28 Ampeg also and wrote off $3,000 worth of bad debt. 29 30 31 32 33 34 Sep 1) Ampeg remitted cash collections from the collateralized accounts receivable to Citi 35 and paid interest accrued on the note. 36 37 38 39 40 Sep 30) Ampeg collected $100,000 of accounts receivable less discounts of $5,000. Ampeg also and wrote off $1,000 worth of bad debt, and accepted sales returns of $4,000 during 41 the period. 2 3 4 45 45 47 48 42 43 44 46 Oct 1) Ampeg remitted to Citi enough cash collections from receivables to pay off the 49 remaining balance of the note. Ampeg also paid any applicable interest. 50 51 52 53 AoR Sec. Borrow Factor Note Receivable

Step by Step Solution

★★★★★

3.41 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started