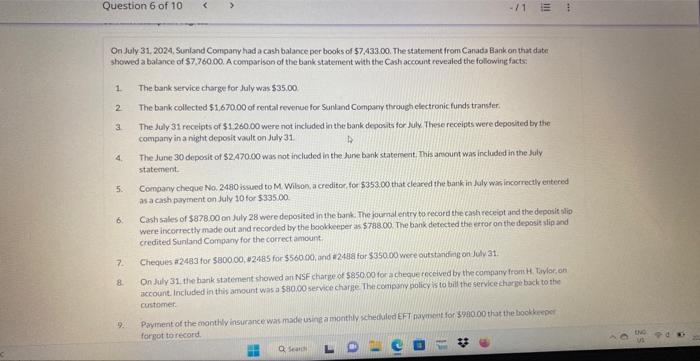

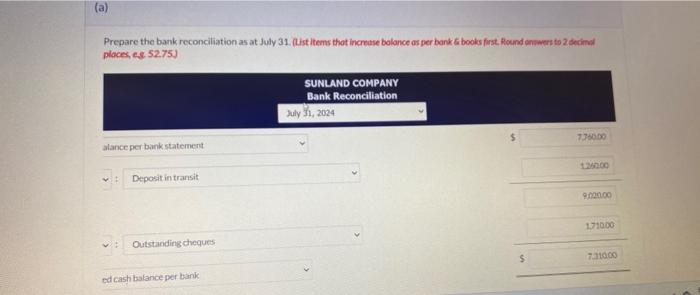

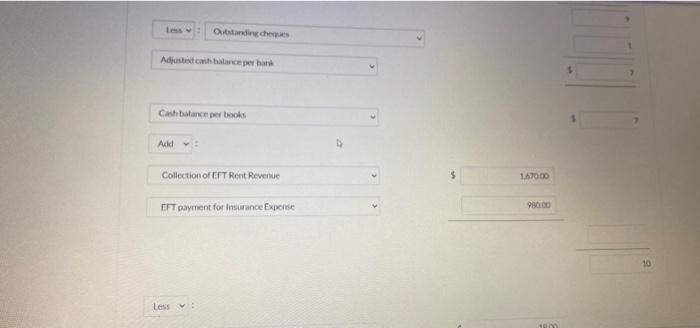

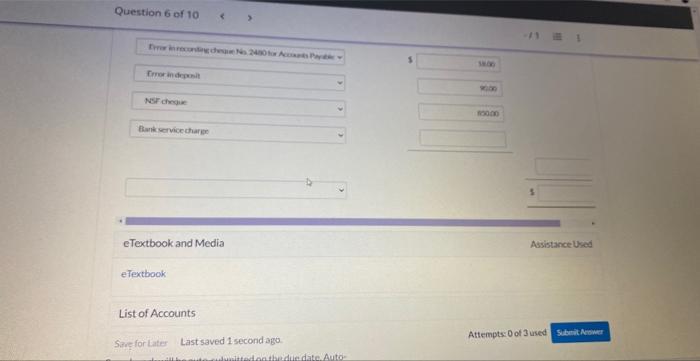

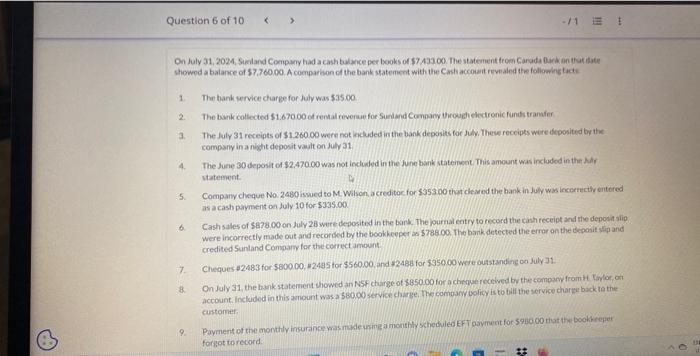

On July 31, 2024, Sunland Company had a cash balance per books of $7,433.00. The s4atement from Canada Bank on that date shewed a balance of $7.760.00. A comparison of the bank statement with the Cash account revealed the following facts: 1. The bank service charge for July was $35.00 2. The bank collected $1.670.00 of rental revenue for Sundand Compamy through chectronic funds transter. 3. The luly 31 receipts of $1.260.00 were not included in the bank deposits for July These receipts were deposited by the compary in a night deposit vasit on July 31 4. The June 30 deposit of $2.470.00 was not included in the fune bank statemert. This anount was included in the July statement. 5. Company cheque No. 2480 issued to M Wilson, a crediton for $35300 that cleared the bank in July was incorrectl/ entered as a crsh payment on July 10 for $335.00 6. Cash sales of $878.00 on July 28 were deposited in the bank. The juurnal entry to record the cash receiot and the deposit slio were incorrectly made out and recorded by the bookkeper as 578800 . The bank detected the error on the depasit slip and credited Suntand Company for the correct amount. 7. Cheques 2463 for $800,00,42485 for $56000, and a2 444 for $35000 were outstanding on July, 31 . 8. On duly 31. the hark statement chowed an NSF charge of 5850.00 for acheque fecelved by the company fromt H. Tarlar, on account Incloded in this anvount was a 590.00 seevice charge. The compyny policy is to bial the servicecharge back to she customer. 9. Payrient of the mantily insurance was made using a monthy ycheduled EfI paymeit for sopgo.00 that the bookkeoper. Prepare the bank reconciliation as at July 31. (List items thot increase bolance os per bank 6 books frat. Aoend entwers to 2 decind places, es 52.75 ) Adiusted conh balaree per bark Cash balance per books Ade>: Collection of EFT Rent Revenue EFT payment for Insiance Expeine . Fione Fror in deweil eTextbook and Media Assistance UYed efextbook List of Accounts Sirefor Later Last saved 1 second ago. Attempts: 0 of 3 used Shinerinewere On July 31,2024, Sunland Company had a cash bulence per looks of 57,43200 . the statenent from Carada 0ack an tfur ilate showod a balance of $7,76000 A comparhon of the bank statement with the Cast accoiant revialed the followirg tacts. 1. The bark mervice charge for July was $3500 2. The bunk collectod $1.67000 of remal teveruie foe Sundand Connany urougdekedranic funth tramfer 3. The July 31 receipts of \$1.260 00 were nat iecluded in the bank deponits foc July, Thece receipss were deposited by the company in a night deposit vauit on July 31. 4. The June 30 deposit of $2,470.00 was not ieduded in the June bank statencet. This amount was included in the Jur taterenent. 5. Company cheque No: 2480 iswed to M. Wilson a creditor for $35300 thet clesed the hank in July was incertectic entered as a cash payment on duly 10 for $33500 6. Cash sales of SB7a.00 on duly 28 were deposited in the bark. The purnal entry to record the caich receipt and the deposit slip. Were incorrectly made oat and recorded by the bookkeyper as $78800. Thin bark detected the error on the depenit silp and credited Sunland Compary for the corfect amount. 7. Cheques $2483 for $800,00,42495 tor $560.00, and 2488 for $95000 were oustanding on July 31. 8. On Jaly 31, the hank statement diowed an NSF charge of 385000 for a cheque recened by the compane framit tovlor at account ineluded in this ampunt was a 58000 seryice cha rue. The comoamy vofficy is to bill the service chare back ta the : customer. forhot torecord