Answered step by step

Verified Expert Solution

Question

1 Approved Answer

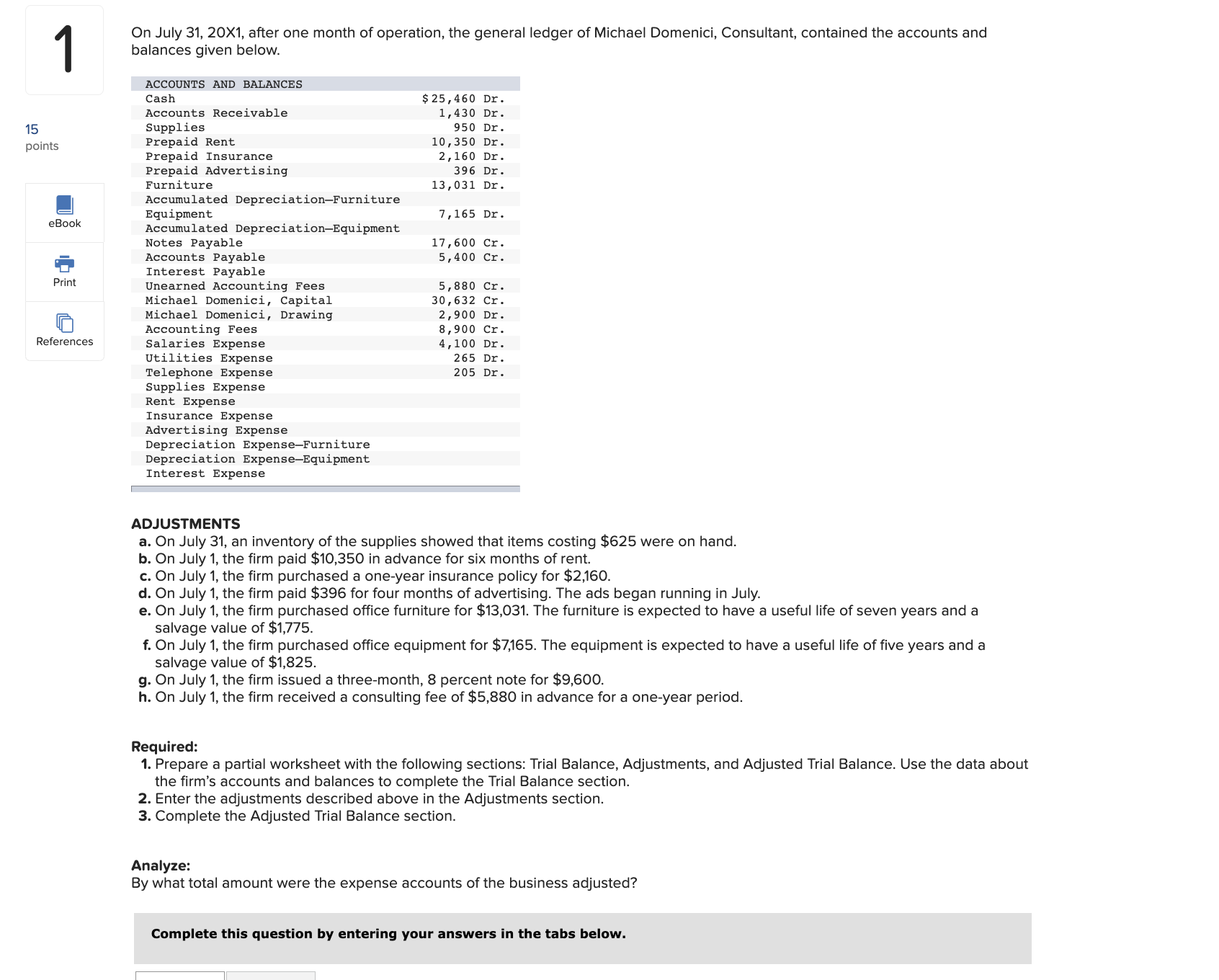

On July 31,201, after one month of operation, the general ledger of Michael Domenici, Consultant, contained the accounts and balances given below. ADJUSTMENTS a. On

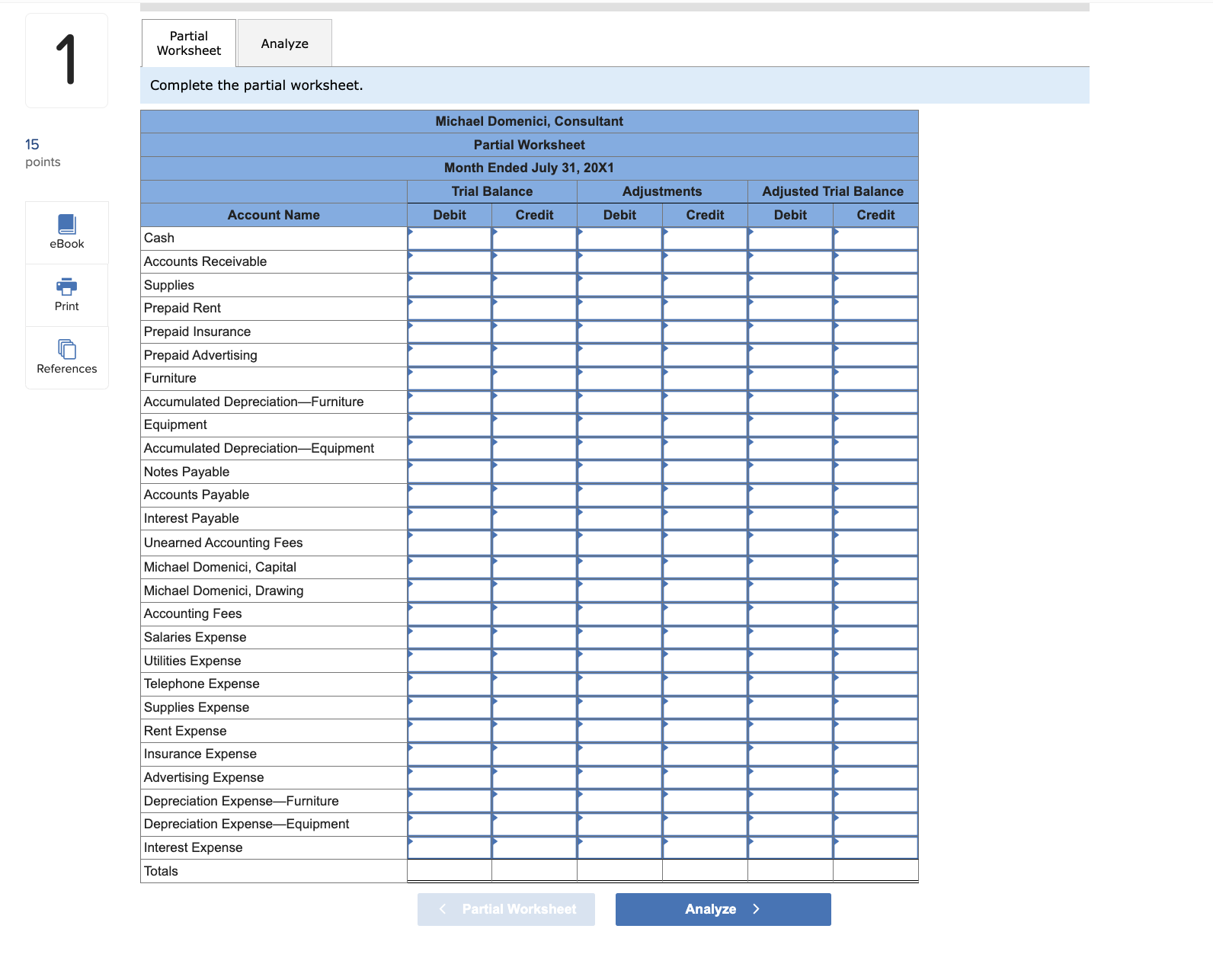

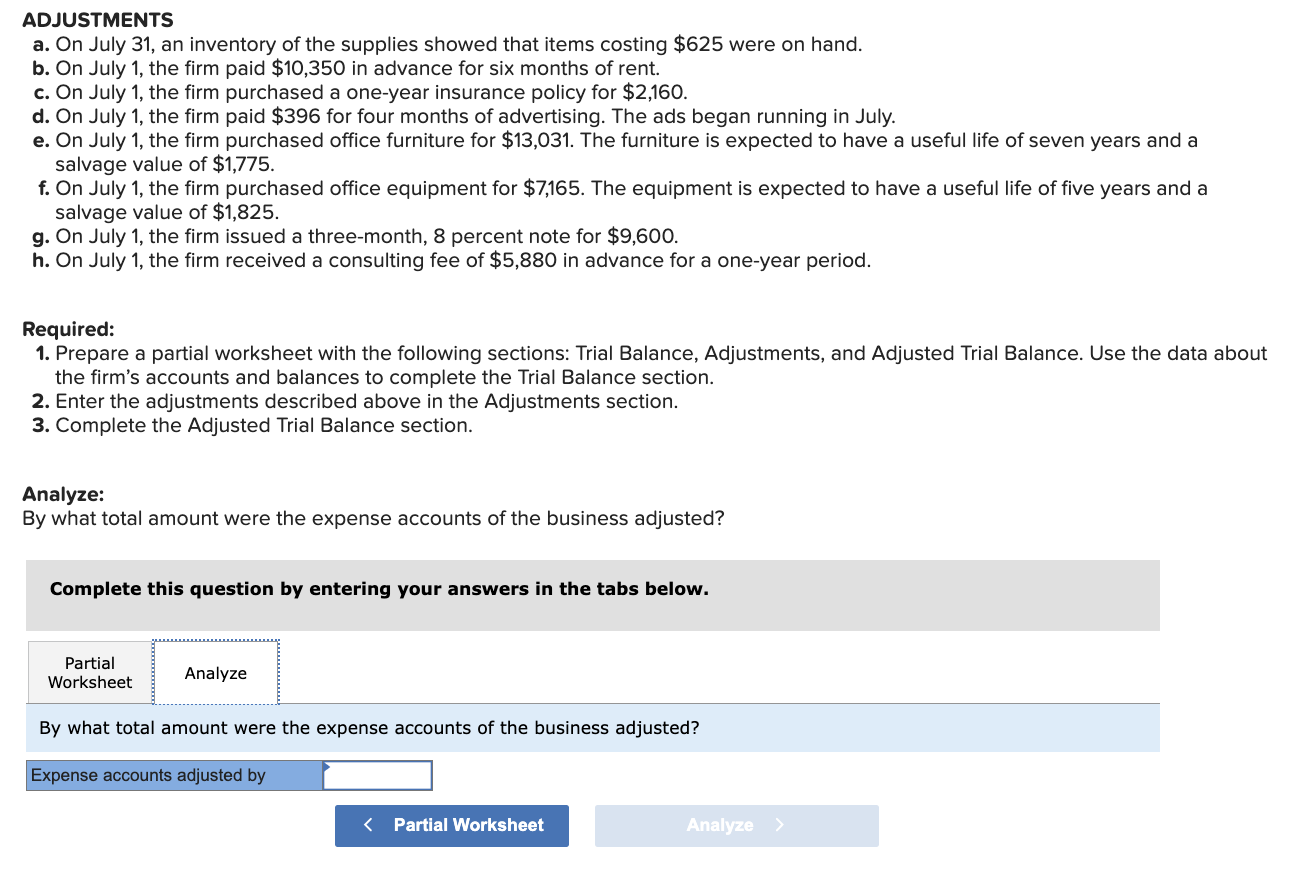

On July 31,201, after one month of operation, the general ledger of Michael Domenici, Consultant, contained the accounts and balances given below. ADJUSTMENTS a. On July 31 , an inventory of the supplies showed that items costing $625 were on hand. b. On July 1 , the firm paid $10,350 in advance for six months of rent. c. On July 1 , the firm purchased a one-year insurance policy for $2,160. d. On July 1 , the firm paid $396 for four months of advertising. The ads began running in July. e. On July 1, the firm purchased office furniture for $13,031. The furniture is expected to have a useful life of seven years and a salvage value of $1,775. f. On July 1 , the firm purchased office equipment for $7,165. The equipment is expected to have a useful life of five years and a salvage value of $1,825. g. On July 1 , the firm issued a three-month, 8 percent note for $9,600. h. On July 1 , the firm received a consulting fee of $5,880 in advance for a one-year period. Required: 1. Prepare a partial worksheet with the following sections: Trial Balance, Adjustments, and Adjusted Trial Balance. Use the data about the firm's accounts and balances to complete the Trial Balance section. 2. Enter the adjustments described above in the Adjustments section. 3. Complete the Adjusted Trial Balance section. ADJUSTMENTS a. On July 31 , an inventory of the supplies showed that items costing $625 were on hand. b. On July 1 , the firm paid $10,350 in advance for six months of rent. c. On July 1 , the firm purchased a one-year insurance policy for $2,160. d. On July 1 , the firm paid $396 for four months of advertising. The ads began running in July. e. On July 1 , the firm purchased office furniture for $13,031. The furniture is expected to have a useful life of seven years and a salvage value of $1,775. f. On July 1 , the firm purchased office equipment for $7,165. The equipment is expected to have a useful life of five years and a salvage value of $1,825. g. On July 1 , the firm issued a three-month, 8 percent note for $9,600. h. On July 1 , the firm received a consulting fee of $5,880 in advance for a one-year period. Required: 1. Prepare a partial worksheet with the following sections: Trial Balance, Adjustments, and Adjusted Trial Balance. Use the data about the firm's accounts and balances to complete the Trial Balance section. 2. Enter the adjustments described above in the Adjustments section. 3. Complete the Adjusted Trial Balance section. Analyze: By what total amount were the expense accounts of the business adjusted? Complete this question by entering your answers in the tabs below. By what total amount were the expense accounts of the business adjusted? On July 31,201, after one month of operation, the general ledger of Michael Domenici, Consultant, contained the accounts and balances given below. ADJUSTMENTS a. On July 31 , an inventory of the supplies showed that items costing $625 were on hand. b. On July 1 , the firm paid $10,350 in advance for six months of rent. c. On July 1 , the firm purchased a one-year insurance policy for $2,160. d. On July 1 , the firm paid $396 for four months of advertising. The ads began running in July. e. On July 1, the firm purchased office furniture for $13,031. The furniture is expected to have a useful life of seven years and a salvage value of $1,775. f. On July 1 , the firm purchased office equipment for $7,165. The equipment is expected to have a useful life of five years and a salvage value of $1,825. g. On July 1 , the firm issued a three-month, 8 percent note for $9,600. h. On July 1 , the firm received a consulting fee of $5,880 in advance for a one-year period. Required: 1. Prepare a partial worksheet with the following sections: Trial Balance, Adjustments, and Adjusted Trial Balance. Use the data about the firm's accounts and balances to complete the Trial Balance section. 2. Enter the adjustments described above in the Adjustments section. 3. Complete the Adjusted Trial Balance section. ADJUSTMENTS a. On July 31 , an inventory of the supplies showed that items costing $625 were on hand. b. On July 1 , the firm paid $10,350 in advance for six months of rent. c. On July 1 , the firm purchased a one-year insurance policy for $2,160. d. On July 1 , the firm paid $396 for four months of advertising. The ads began running in July. e. On July 1 , the firm purchased office furniture for $13,031. The furniture is expected to have a useful life of seven years and a salvage value of $1,775. f. On July 1 , the firm purchased office equipment for $7,165. The equipment is expected to have a useful life of five years and a salvage value of $1,825. g. On July 1 , the firm issued a three-month, 8 percent note for $9,600. h. On July 1 , the firm received a consulting fee of $5,880 in advance for a one-year period. Required: 1. Prepare a partial worksheet with the following sections: Trial Balance, Adjustments, and Adjusted Trial Balance. Use the data about the firm's accounts and balances to complete the Trial Balance section. 2. Enter the adjustments described above in the Adjustments section. 3. Complete the Adjusted Trial Balance section. Analyze: By what total amount were the expense accounts of the business adjusted? Complete this question by entering your answers in the tabs below. By what total amount were the expense accounts of the business adjusted

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started