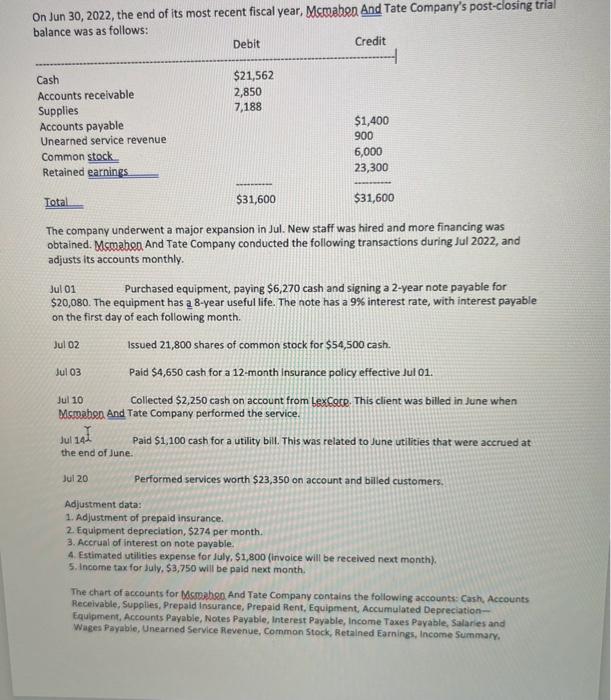

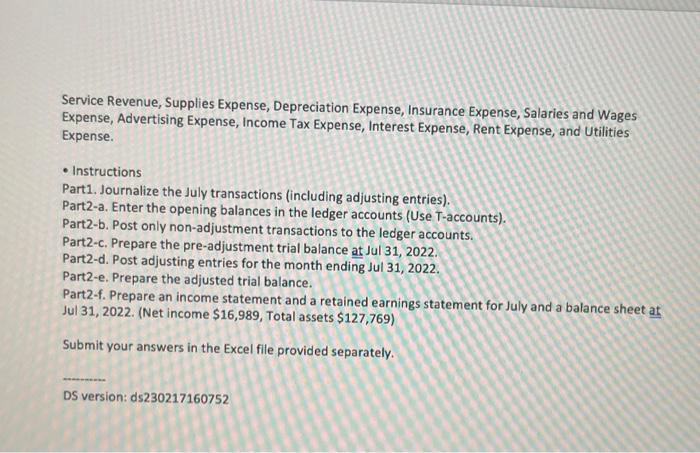

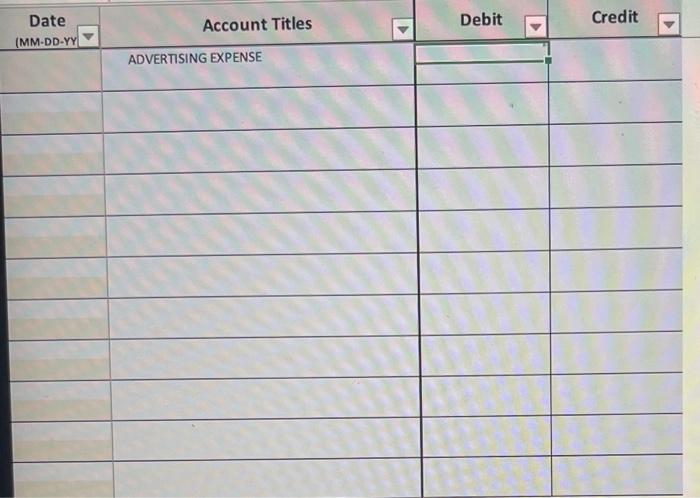

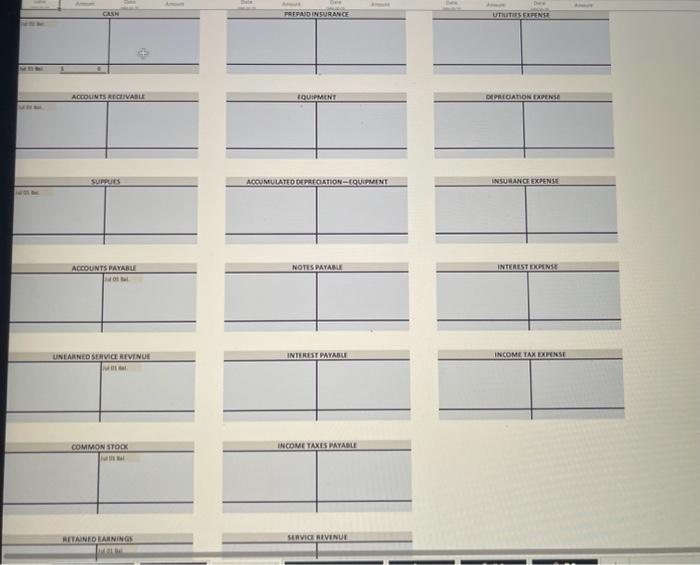

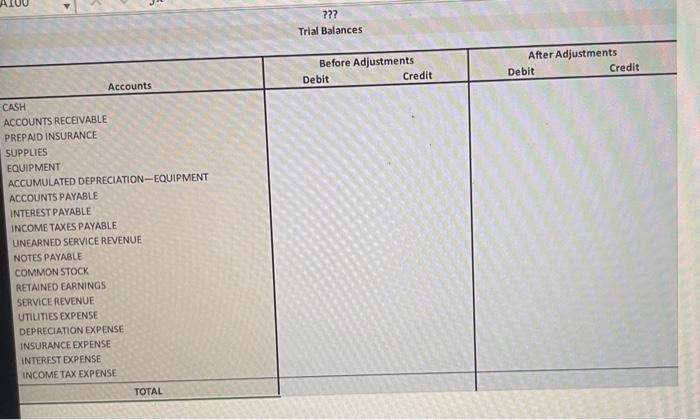

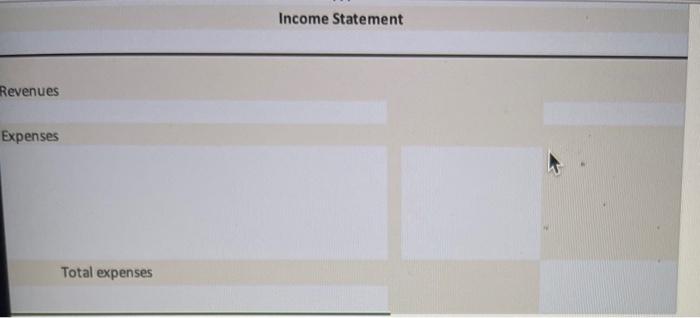

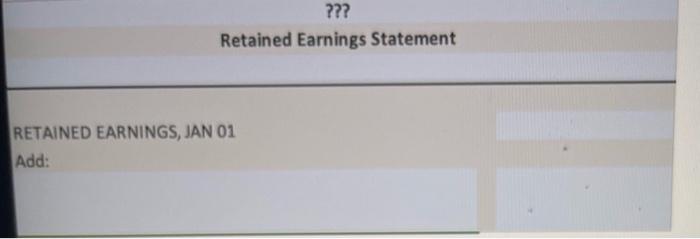

On Jun 30, 2022, the end of its most recent fiscal year, Mcopah@2 And Tate Company's post-ciosing trial halance was as follows: The company underwent a major expansion in Jul. New staff was hired and more financing was obtained. Mcomahen And Tate Company conducted the following transactions during Jul 2022, and adjusts its accounts monthly. Jul 01 Purchased equipment, paying \$6,270 cash and signing a 2-year note payable for $20,080. The equipment has a 8-year useful life. The note has a 9% interest rate, with interest payable on the first day of each following month. Jul 02 Issued 21,800 shares of common stock for $54,500 cash. Jul 03 Paid $4,650 cash for a 12 -month Insurance policy effective Jul 01. Jul 10 Collected $2,250 cash on account from bex Face. This client was billed in June when Msmahsa And Tate Company performed the service. Jul 14 Paid $1,100 cash for a utility bill. This was related to June utilities that were accrued at the end of June. Jul 20 Performed services worth $23,350 on account and biled customers. Adjustment data: 1. Adjustment of prepaid insurance. 2. Equipment depreciation, $274 per month. 3. Accrual of interest on note payable. 4. Estimated utilities expense for July, $1,800 (invoice will be received next month). 5. Income tax for luly. $3,750 will be paid next month. The chart of accounts for Mosmabse And Tate Company contains the following accounts: Cash, Accounts Receivable, Suppiles, Prepaid Insurance, Prepaid Rent, Equipment, Accumulated DepreciationEquipment, Accounts Payable, Notes Payabie, interest Payable, Income Taxes Payable, Salaries and Wages Payabie, Unearned Service Revenue, Comman Stock, Retained Earnings, Income, Surnmany. Service Revenue, Supplies Expense, Depreciation Expense, Insurance Expense, Salaries and Wages Expense, Advertising Expense, Income Tax Expense, Interest Expense, Rent Expense, and Utilities Expense. - Instructions Part1. Journalize the July transactions (including adjusting entries). Part2-a. Enter the opening balances in the ledger accounts (Use T-accounts). Part2-b. Post only non-adjustment transactions to the ledger accounts. Part2-c. Prepare the pre-adjustment trial balance at Jul 31,2022. Part2-d. Post adjusting entries for the month ending Jul 31, 2022. Part2-e. Prepare the adjusted trial balance. Part2-f. Prepare an income statement and a retained earnings statement for July and a balance sheet at Jul 31, 2022. (Net income $16,989, Total assets $127,769 ) Submit your answers in the Excel file provided separately. DS version: ds230217160752 This is your project submission file. Read the project details and the requirements provided in a separate MS Word file, then submit your answers in various sheets of this file. DO NOT share this file and its accompanying MS Word file with ANYONE! Sharing the content of this project with anybody, regardless of the reason, is a violation of the University Student Code of Conduct as well as copyright infringement and the student will be treated accordingly. In part 1, you must fill out the journal sheet ONLY. Leave the other sheets blank. They will not be graded. In part 2, you fill out the other sheets. The journal sheet will not be graded again in part 2. 4. You must start the project in Microsoft Excel only (Windows or macOS). Other spreadsheet software (e.g., Numbers, LibreOffice, Excel Online, etc.) or operating systems such as Chrome OS, IOS, Android, or other distributions of Linux will not work properly. 5. Use blue cells only. Gray and white cells are locked to avoid unintentional mistakes and submission errors. If a dropdown menu is available, DO NOT TYPE. Instead, choose the item from the menu. In grading, the priority goes to the accuracy of account names first, and then of the amounts. 6. Round DOWN all decimals. 7. DO NOT rename or delete any sheets; otherwise, your submission could not be graded. 8. Before submitting your work, DO rename this file to match the name of your MS Word file. If not, your submission could not be graded. (e.g., if your MS Word file is named "v01_ABCD", rename this Excel file to "v01_ABCD") 9. Do not change the format of this file. Only files with xlsx extensions will be graded. Do not save your project with different ejitensions. Submit only this very file. Do not copy the content and paste it into a different file. coMARow storx Thirinat \begin{tabular}{|l|l} \hline \multicolumn{2}{|c|}{ accome ruxprasie } \\ \hline & \\ \hline \end{tabular} ??? Trial Balances Income Statement Revenues Expenses Total expenses ??? Retained Earnings Statement RETAINED EARNINGS, JAN 01 Add: Current assets Total current assets Property, plant, and equipment TOTAL ASSETS Current liabilities Total current liabilities Long-term liabilities Stockholders' equity On Jun 30, 2022, the end of its most recent fiscal year, Mcopah@2 And Tate Company's post-ciosing trial halance was as follows: The company underwent a major expansion in Jul. New staff was hired and more financing was obtained. Mcomahen And Tate Company conducted the following transactions during Jul 2022, and adjusts its accounts monthly. Jul 01 Purchased equipment, paying \$6,270 cash and signing a 2-year note payable for $20,080. The equipment has a 8-year useful life. The note has a 9% interest rate, with interest payable on the first day of each following month. Jul 02 Issued 21,800 shares of common stock for $54,500 cash. Jul 03 Paid $4,650 cash for a 12 -month Insurance policy effective Jul 01. Jul 10 Collected $2,250 cash on account from bex Face. This client was billed in June when Msmahsa And Tate Company performed the service. Jul 14 Paid $1,100 cash for a utility bill. This was related to June utilities that were accrued at the end of June. Jul 20 Performed services worth $23,350 on account and biled customers. Adjustment data: 1. Adjustment of prepaid insurance. 2. Equipment depreciation, $274 per month. 3. Accrual of interest on note payable. 4. Estimated utilities expense for July, $1,800 (invoice will be received next month). 5. Income tax for luly. $3,750 will be paid next month. The chart of accounts for Mosmabse And Tate Company contains the following accounts: Cash, Accounts Receivable, Suppiles, Prepaid Insurance, Prepaid Rent, Equipment, Accumulated DepreciationEquipment, Accounts Payable, Notes Payabie, interest Payable, Income Taxes Payable, Salaries and Wages Payabie, Unearned Service Revenue, Comman Stock, Retained Earnings, Income, Surnmany. Service Revenue, Supplies Expense, Depreciation Expense, Insurance Expense, Salaries and Wages Expense, Advertising Expense, Income Tax Expense, Interest Expense, Rent Expense, and Utilities Expense. - Instructions Part1. Journalize the July transactions (including adjusting entries). Part2-a. Enter the opening balances in the ledger accounts (Use T-accounts). Part2-b. Post only non-adjustment transactions to the ledger accounts. Part2-c. Prepare the pre-adjustment trial balance at Jul 31,2022. Part2-d. Post adjusting entries for the month ending Jul 31, 2022. Part2-e. Prepare the adjusted trial balance. Part2-f. Prepare an income statement and a retained earnings statement for July and a balance sheet at Jul 31, 2022. (Net income $16,989, Total assets $127,769 ) Submit your answers in the Excel file provided separately. DS version: ds230217160752 This is your project submission file. Read the project details and the requirements provided in a separate MS Word file, then submit your answers in various sheets of this file. DO NOT share this file and its accompanying MS Word file with ANYONE! Sharing the content of this project with anybody, regardless of the reason, is a violation of the University Student Code of Conduct as well as copyright infringement and the student will be treated accordingly. In part 1, you must fill out the journal sheet ONLY. Leave the other sheets blank. They will not be graded. In part 2, you fill out the other sheets. The journal sheet will not be graded again in part 2. 4. You must start the project in Microsoft Excel only (Windows or macOS). Other spreadsheet software (e.g., Numbers, LibreOffice, Excel Online, etc.) or operating systems such as Chrome OS, IOS, Android, or other distributions of Linux will not work properly. 5. Use blue cells only. Gray and white cells are locked to avoid unintentional mistakes and submission errors. If a dropdown menu is available, DO NOT TYPE. Instead, choose the item from the menu. In grading, the priority goes to the accuracy of account names first, and then of the amounts. 6. Round DOWN all decimals. 7. DO NOT rename or delete any sheets; otherwise, your submission could not be graded. 8. Before submitting your work, DO rename this file to match the name of your MS Word file. If not, your submission could not be graded. (e.g., if your MS Word file is named "v01_ABCD", rename this Excel file to "v01_ABCD") 9. Do not change the format of this file. Only files with xlsx extensions will be graded. Do not save your project with different ejitensions. Submit only this very file. Do not copy the content and paste it into a different file. coMARow storx Thirinat \begin{tabular}{|l|l} \hline \multicolumn{2}{|c|}{ accome ruxprasie } \\ \hline & \\ \hline \end{tabular} ??? Trial Balances Income Statement Revenues Expenses Total expenses ??? Retained Earnings Statement RETAINED EARNINGS, JAN 01 Add: Current assets Total current assets Property, plant, and equipment TOTAL ASSETS Current liabilities Total current liabilities Long-term liabilities Stockholders' equity