Question

On June 1, 20 17 the Diamond Bottle Company sold $400,000 in long-term bonds to the Silver Jewelry Company. The bonds will mature in 10

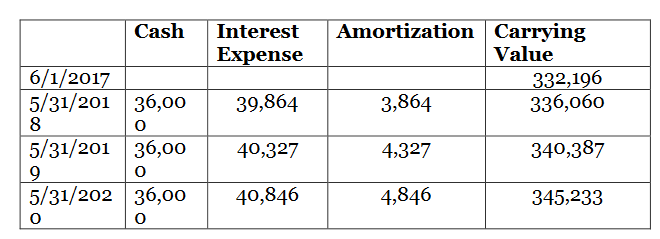

On June 1, 20 17 the Diamond Bottle Company sold $400,000 in long-term bonds to the Silver Jewelry Company. The bonds will mature in 10 years and have a stated interest rate of 9%. The market rate at time of issuance was 12%. Therefore, the bonds sold for $332,196. The bonds pay interest annually on May 31 of each year. The bonds are to be accounted for under the effective interest method. Below is a partial bond amortization schedule.

8. Diamond Bottle company's year end is 12/31. What amount of interest expense should Diamond Bottle Company report at the end of December 31, 2017?

If Diamond Bottle Company buys back the bonds at 101 plus accrued interest on December 31, 2019.

9. What is the amount of total cash paid out when the bonds are recalled?

10. What is the gain/loss reported on the retirement of bonds? (be sure to include the $ amount and note gain or loss).

_____________________________

Cash Interest Amortization Carrying Expense Value 6/1/2017 5/31/201 36,0039,864 8 332,196 5/31/20136,0040,327 Cy 5/31/202 36,0040,846 3,864 4,327 4,846 336,060 340,387 345,233Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started