Question

On June 1, 20--, J. Smith opened Smith Funeral Home. Smith's accountant listed the following chart of accounts: Chart of Accounts Cash J. Smith, Drawing

On June 1, 20--, J. Smith opened Smith Funeral Home. Smith's accountant listed the following chart of accounts: Chart of Accounts Cash J. Smith, Drawing Supplies Business Service Revenue Prepaid insurance Wages expense Equipment Rent expense Furniture & Fixtures Utilities expense Accounts Payable Miscellaneous expense J. Smith, Capital

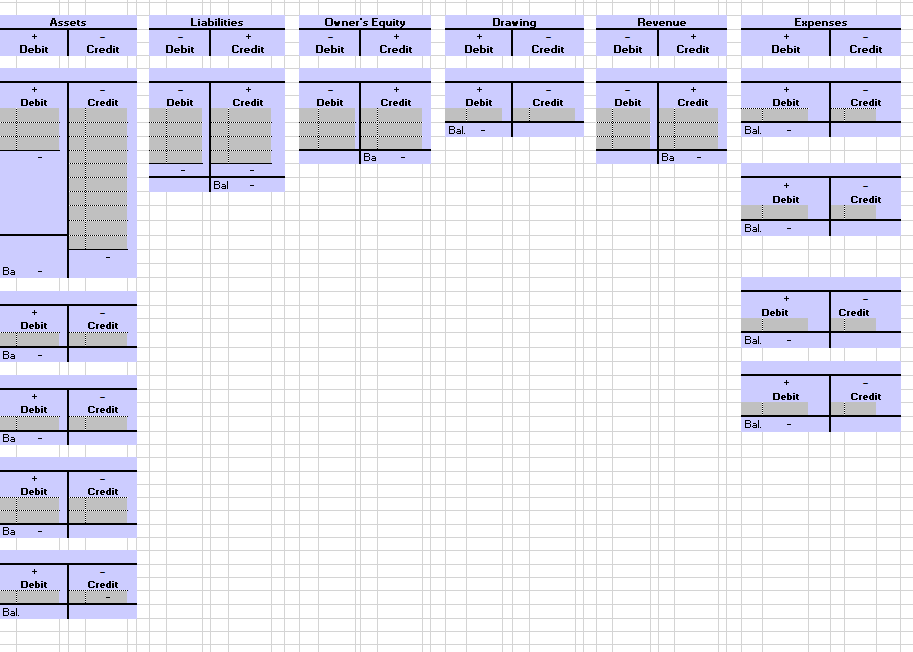

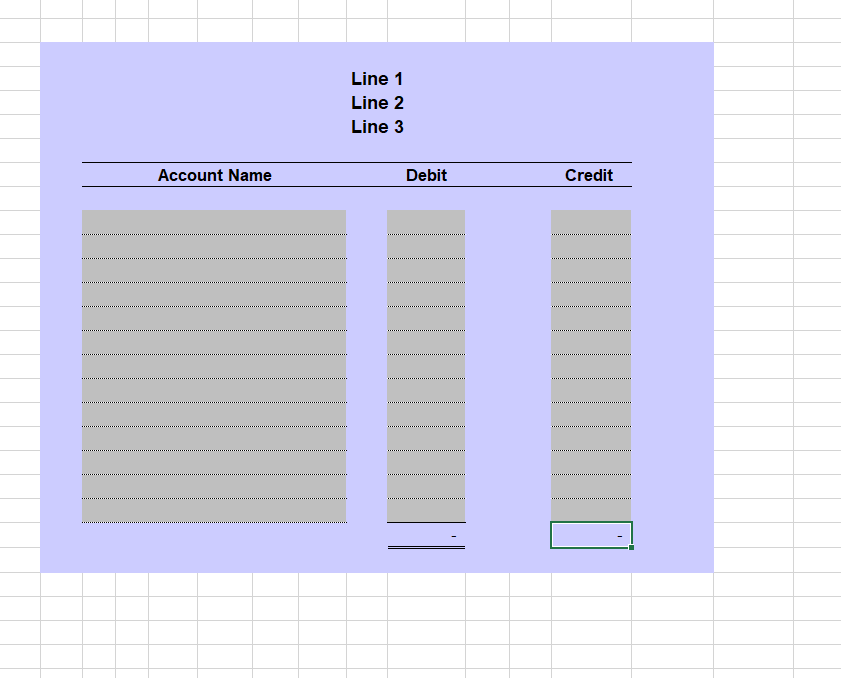

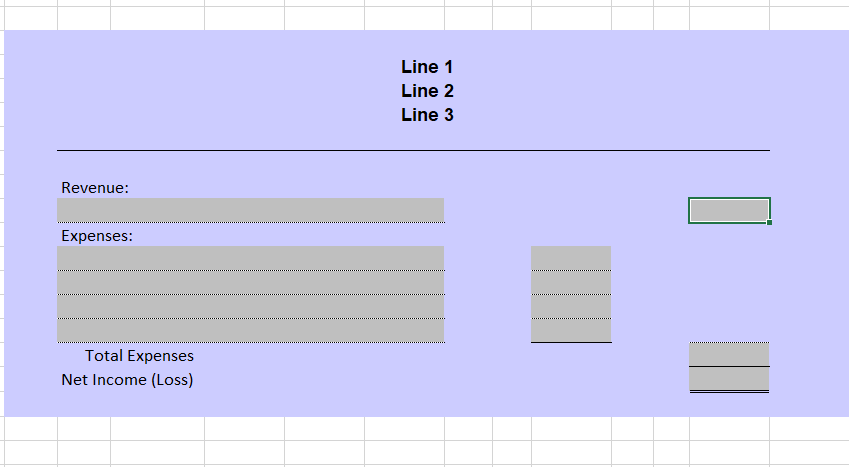

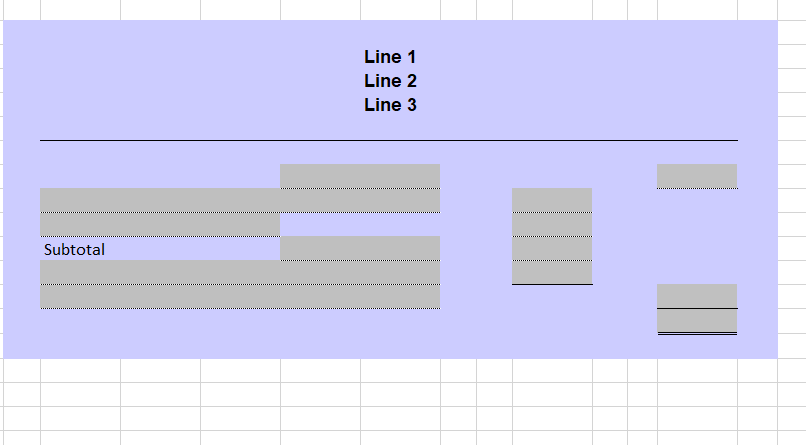

The following transactions were completed during June: a. Smith deposited $50,000 in a bank account on June 1 in the name of the business. b. Bought tables and chairs for the chapel and fellowship hall, cash, $850. c. Paid the rent for the current month, $1500. d. Bought an embalming machine and visitation equipment from Dodge, $12,800; paid $4000 cash and put the balance on account. e. Bought prep room supplies on account from the Kelco Co., $650. f. Sold a direct cremation service to a client family for cash, $2170. g. Bought insurance for one year, $1600. h. Paid on account to Dodge, $500. i. Received and paid the electric bill, $289. j. Paid on account to Kelco, $650. k. Provided a funeral service to a family for cash, $8820. l. Received and paid the bill for the F.H. establishment permit, $200. m. Paid wages to an employee, $1450. n. Smith withdrew cash for personal use, $1100. Required accounting tasks: 1. Label all accounts (using the Chart of Accounts) and record the owner's name in the Capital and Drawing T accounts. 2. Record the transactions in the T accounts. Write the letter of each entry to identify the transaction. 3. Foot the T accounts and show the balances. 4. A trial balance for the first month of business. 5. An income statement for the first month of business. 6. A statement of owner's equity for the first month of business.

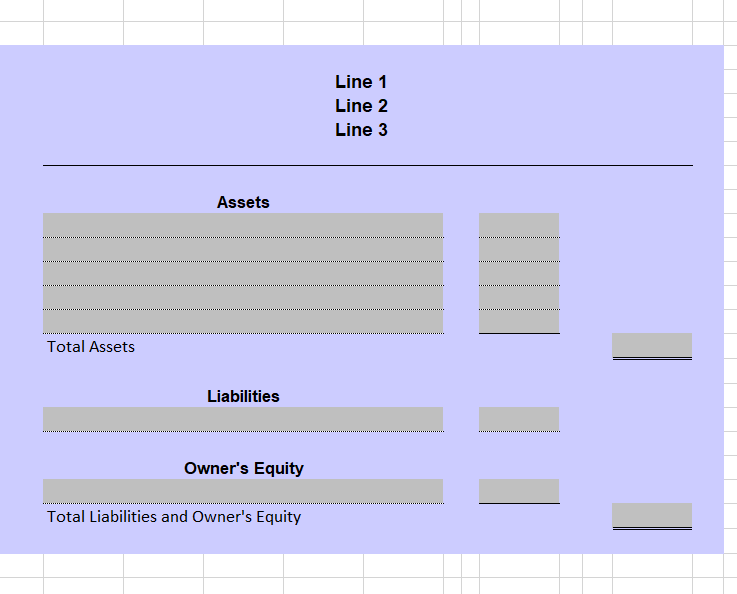

7. A balance sheet for the first month of business. 8. Use the appropriate headings/dates for the three major financial statements. Use the Excel spreadsheet template that is included with the assignment. There should be five (5) documents included in the assignment: 1. T account page 2. Trial balance 3. Income statement 4. Statement of Owner's Equity 5. Balance sheet Use the tab function at the bottom of the spreadsheet so each document is on a separate tab.

T Acct Ledger

Ba Ba + Debit Assets Credit Debit Liabilities Owner's Equity + Credit Debit + Credit Debit Drawing Expenses Revenue + + Credit Debit Credit Debit Credit + + + Debit Credit Debit Credit Debit Credit + Debit Credit Debit Credit Debit Credit Bal. - Bal. Debit Credit + Debit Credit Ba Ba + Debit Credit + Debit Credit Bal. Bal Ba Ba Bal. + Debit Credit + Credit Bal. Debit + Debit Credit Bal.

Step by Step Solution

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer 1 Journal Entrie...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started